The Future of Sustainability Policy

Sustainable Material Regulations: Bans and Taxes Likely to Spread while EPRs Lag Behind

Policy and regulations hold a unique place as drivers of corporate sustainability practices, which creates a clear need for corporations to understand and predict future regulatory states – both to prepare existing businesses and to explore the potential for new business opportunities under these regulatory schemes.

Furthermore, policy foresight will only become more important in the future as more and more of what innovation teams are tasked with is system transition, according to a new analysis from Lux Research.

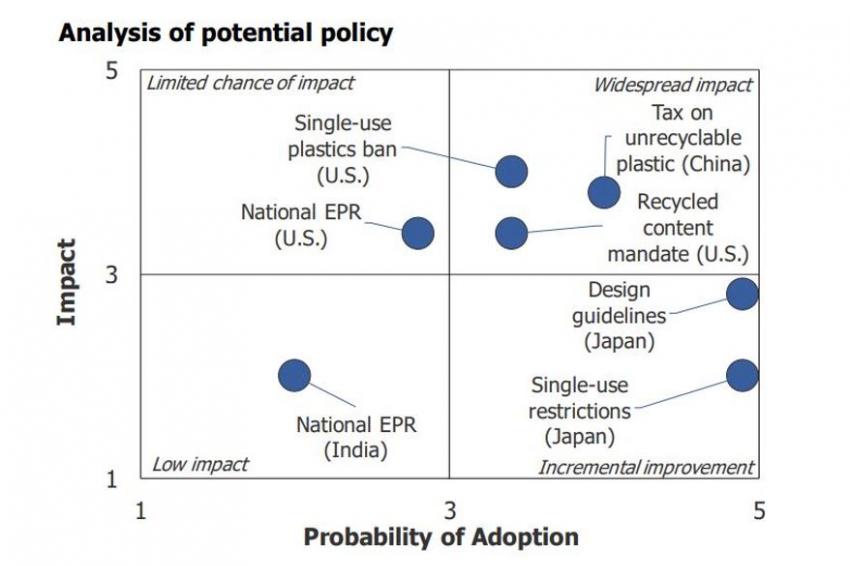

The new report "Predicting Policy for Sustainable Materials" provides an analysis of past regulatory practices and a qualitative framework to assess policies based on impact and probability of adoption. Lux evaluated seven policies on the factors of anticipated cost, ease of adoption, international reputation, and impact to gauge how likely a regulation is to spread.

“The evolution of the regulatory landscape is not a simple thing to forecast, as political and economic factors play a huge role in determining outcomes,” said Anthony Schiavo, Research Director at Lux Research and lead author of the report. “This challenge is further complicated by both murky understanding of the science on the part of the legislators who are typically responsible for major regulations and the wide range of possible outcomes that could be viewed as ‘sustainable’.”

According to the report, the biggest, most likely impacts globally are expected to come from bans on single-use plastics and taxes on unrecyclable plastics. Extended producer responsibility (EPR) policy, though potentially the single most impactful approach to sustainability, will struggle to gain traction outside the EU, as implementation remains a major barrier. In the US, national-level recycled content mandates and single-use plastic bans are most likely; a national EPR scheme faces major uncertainty in terms of adoption, although it would be impactful. Companies should instead look to state-level adoption of EPR as the most likely outcome.

China, unsurprisingly, emerges as the nation to watch. A tax on unrecycled plastics is likely and would have major knock-on effects for the entire industry, predicts Lux Research. Just as China’s ban on single-use plastics is fueling growth in bioplastics, a future tax could fuel growth in plastic alternatives.

An executive summary of the report is available here.