The Shale Gas Game

Part 2: What does it Imply for Downstream Players?

In Part 1, Stratley thoroughly reviewed the available global resources and elaborated on expected shale gas production developments in China and Europe. The main thing we learned was that the shale gas boom will remain predominantly focused on the USA for roughly the next decade and that, in the long term, significant commercial production activities are also expected to evolve in China and selected European countries. This means that, in the near future, the USA will keep its competitive gas cost advantage compared to other large economic regions. While this insight appears to be straightforward, the implications on many chemical companies have not yet been investigated. In the following, we aim to create awareness of the complex interdependencies between shale gas development and the downstream business of chemical companies and possible strategic issues involved.

What Shale Gas-Driven Changes Can Be Expected in the Global Alkene Supply?

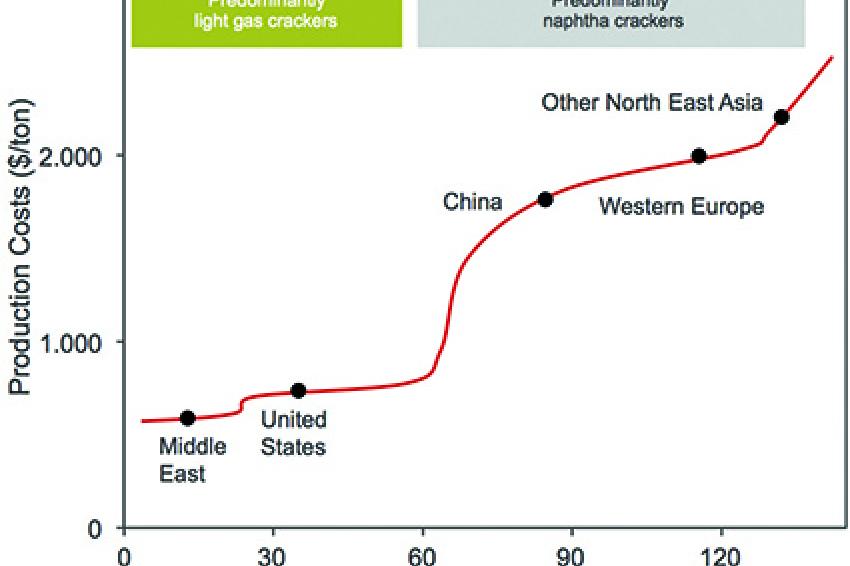

Cracker operators and investors in the US have presumably done a thorough assessment of the resource range and assumed that there will be enough of an additional ethane and propane supply from US shale gas for the coming decades. Thus, the cheap supply of natural gas liquids and especially of ethane has enabled US ethane cracker operators to supply ethylene at prices in a very competitive global position (Fig. 1).

Consequently, US flexi-crackers have been switching to ethane in recent years and new ethane crackers are under construction. This will lead to an increased supply of ethylene in the next several years and, at the same time, to a stagnating trend in butadiene and to a declining trend in propylene and BTX supply from crackers in the US (Fig. 2). The trends can be derived by considering changes in naphtha and ethane cracking capacities and their typical output of alkenes.

New projects to produce propylene on purpose by the dehydrogenation of propane, such as announced by Dow Chemicals, are expected to compensate for the regional shortage of propylene. However, butadiene and BTX production from crackers will presumably remain short in the US in the mid-term.

Similar shale gas-induced projects are not expected to occur in the other two large economic regions, China and Europe, in the foreseeable future. In China, the shale gas resources are presumably mostly dry, and competitive production technologies have to be installed. In Europe, only few governments are supportive and, similar to China, technology is still in its infancy.

Hence, naphtha crackers will remain predominant in those regions. In China, large new naphtha cracker capacities are being built so that the propylene, butadiene and BTX supply from crackers is expected to increase globally by 2% per year until 2017.

Based on new capacity announcements and our analysis, chemical companies in the US will face favorable ethylene price conditions. Overall, propylene supply in the US will presumably remain healthy. The butadiene and BTX supplies from crackers show a stagnating or declining trend in the US. However, supply and price indications beyond cracker production capacities for butadiene and BTX are very difficult due to a complex set of supply and demand market drivers beyond cracker capacities. The butadiene price, in particular, has been very volatile since 2007, and we have observed an increasing butadiene market supply shortage in the US. Experts indicate that new US cracker capacities will not considerably ease the US butadiene shortage on the market. One reason is, for example, that a significant percentage of the cracker output is not fractionized due to currently poor underlying economics. Furthermore, on-purpose production of butadiene does not appear to be profitable with established technologies. An analysis of butadiene and BTX market drivers is required for a comprehensive assessment.

In contrast to the US, new naphtha cracker capacities in China will increase C3+ alkene supply, although below GDP growth rate. In Europe, alkene production from crackers will remain stagnant or show a declining tendency.

Which Strategic Issues Might Evolve Beyond The Obvious?

Generally, the evolving shale gas supply concerns a multitude of stakeholders, such as upstream, midstream and downstream companies and their suppliers and customers, the energy industry, the transportation sector, politicians, associations, environmental protection organizations, scientific researchers and others. In this paper, we focus on the downstream chemical industry and aim to create awareness for opportunities and threats by raising selected questions.

The obvious opportunities such as energy supply, raw material sourcing, competitive advantages of the production of ethylene and its derivatives in the US, or new sales channels for fracking chemicals and water treatment are assumed to already be on the agenda of the responsible managers of the chemical industry. However, there are also implications of shale gas on chemical players beyond the effects commonly discussed in shale gas-related articles. The list below shows just some of the issues which we feel will have an indirect impact and will, for a number of players, almost certainly necessitate a strategic rethink:

- What are the region-specific implications for aromatic chemicals, and will planned investments need to be re-evaluated?

- In what way do supply/price changes in propane, butane, propylene and butadiene justify innovative investments such as research for new catalyst and dehydrogenation technologies?

- Which new production routes based on ethylene as a platform chemical are economically feasible?

- Will 'methane to olefins' become competitive?

- What effect will changes in alkene derivatives prices have on suppliers of additives (e.g. co-monomers for polyethylene)?

There are no straightforward answers to these questions. To address the questions adequately, profound expertise in both the shale gas business and the chemical industry is a prerequisite. This is a challenging requirement, as typical upstream companies do not focus on downstream drivers and vice versa.

Furthermore, deriving strategic implications for concerned players requires a customized evaluation considering the player's product portfolio, regional sites, strategy and other specifics of the company and related markets. We recommend chemical companies evaluate corresponding opportunities and threats to their own business and, where applicable, also for their suppliers' and customers' portfolio.

A specialized consultancy can be an important partner when it comes to designing and implementing a customized strategic concept. Closely monitoring developments in the shale gas and associated industry, we at Stratley are well positioned to support chemical companies in turning potential shale gas-related threats into attractive new opportunities.

Contact

Stratley AG

Spichernhöfe Spichernstraße 6A

50672 Köln

Germany

+49 221 977 655 0