Back in the Game

American Chemistry Reemerges as a Growth Industry

Poised For Growth - American Chemistry rang in the New Year with some cheer. Despite the challenges, the industry managed to post gains in 2013. American Chemistry is now poised for growth and the outlook for 2014 and beyond is bright due in large part to a major shift in competiveness for American producers (thank you, shale gas).

Of course, this optimism is against the backdrop of the U.S. economy which has been stuck in a slow growth pattern. It's been hard to gain any momentum with so many speed bumps along the way: weakness in manufacturing, cuts in government spending and periods of tense uncertainty, a cautious consumer, and softness in demand at home and externally. As Americans put another rough year behind them maybe now it's time to consider some of the hopeful signs moving into 2014.

Improved Prospects

Many of the key end-use markets for chemistry have recovered. The housing market looks like it's finally gearing up - housing prices have begun to appreciate, credit conditions are easing and though mortgage rates rose, they remain historically low and the sticker shock seems to have already worn off. The employment situation is getting better and expected to continue improving over the next several years. Improved employment (and income) prospects, better availability of credit, and pent-up demand will foster growth in light vehicle sales and they are expected to rise in 2014.

After a strong post-recession rebound, the U.S. manufacturing sector, which represents the primary customer base for chemistry, is pulling out of a soft patch. Growth slowed in 2013 largely due to the sequester and to weakness in major export markets. Forward momentum will depend upon demand for consumer goods, which ultimately drives factory output. In addition, the surge in unconventional oil and gas development is creating both demand-side (e.g., pipe mills, oilfield machinery) and supply-side (e.g., chemicals, fertilizers, direct iron reduction) opportunities. The latest consensus is that the U.S. GDP grew between 1.7-1.9% in 2013 and will further expand 2.5% in 2014.

Accelerated Growth

The lackluster recovery in the U.S. and a slowdown in global manufacturing have clearly been a drag on U.S. chemistry, but the industry managed to end 2013 on an upswing. U.S. chemical production grew 1.6% in 2013 and is expected to accelerate to 2.5% growth in 2014. Improvements in customer industries and in emerging markets and an enhanced competitive position with regard to feedstock costs will support U.S. chemical industry production going forward.

Strength is expected in plastic resins and organic chemistry as export markets revive. Production of specialty chemicals will be driven by strong demand from end-use markets; most notably light vehicles and housing. Strong 2013 gains are expected in consumer products as well, but these gains will moderate in 2014 and 2015. Demand for agricultural chemicals (and their supply from the U.S.) will revive. During the second half of the decade, U.S. chemistry growth is expected to expand at a pace (over 4% per year on average) exceeding that of the overall U.S. economy.

Pharmaceuticals will eventually emerge as a growth segment in 2015. Gains in chemical industry production volumes and stable capacity suggest that improving operating rates will have improved in 2013. And, with strengthening production volumes, capacity utilization could improve even further in 2014 and beyond.

Chemical Investment

Much of the optimism for American Chemistry relates to the fact that the U.S. has emerged as the venue for chemical investment. With the development of shale gas and the surge in natural gas liquids supply, the U.S. has moved from being a high-cost producer of key petrochemicals and resins to among the lowest-cost producers globally. This shift in competitiveness is boosting export demand and driving significant flows of new capital investment toward the U.S. We anticipate that recently announced new capacity for chemicals will significantly expand production when those investments come online beginning in 2015. As a result, the recent pattern of smaller payrolls is reversing. The industry is expected to add high-paying jobs through the end of the decade.

The pattern of trade deficits in the chemistry is reversing as well. U.S. chemicals trade expanded in 2013 with exports growing faster than imports. The U.S. will lock into a position as a net exporter of chemicals in 2014 and the trend will only accelerate over the coming years as the advantage from shale gas boosts U.S. chemical exports. We're expecting to have posted a modest trade surplus in 2013 and to see it grow to a $7.7 billion surplus by the end of 2014. Looking at chemicals excluding pharmaceuticals trade, the U.S. net exports will grow to $46.6 billion in 2014 and a record $67.5 billion by 2018. With this type of momentum in both imports and exports of chemicals, there's no better time than now to make headway on important trade agreements such as TTIP. Eliminating costly barriers to free trade is particularly beneficial between regions such as the U.S. and E.U. where a significant portion of chemicals trade is between related parties.

Bright Outlook

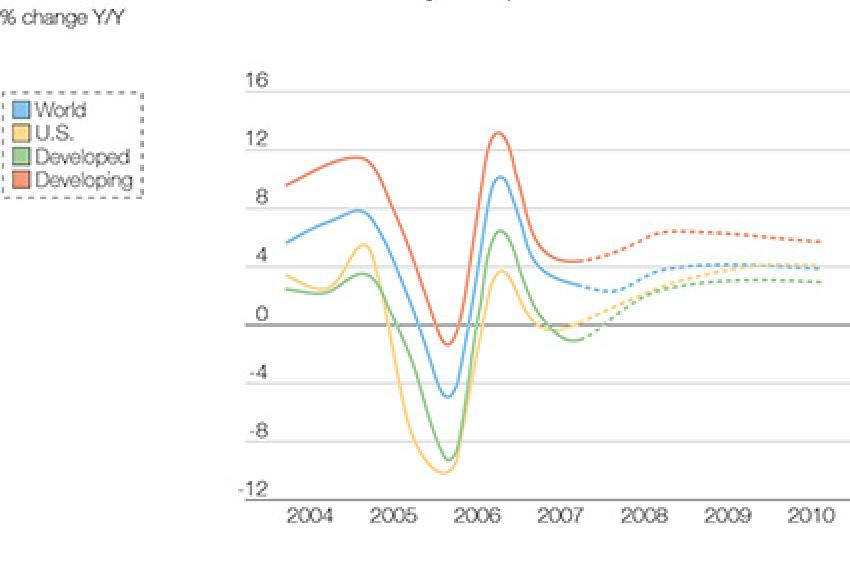

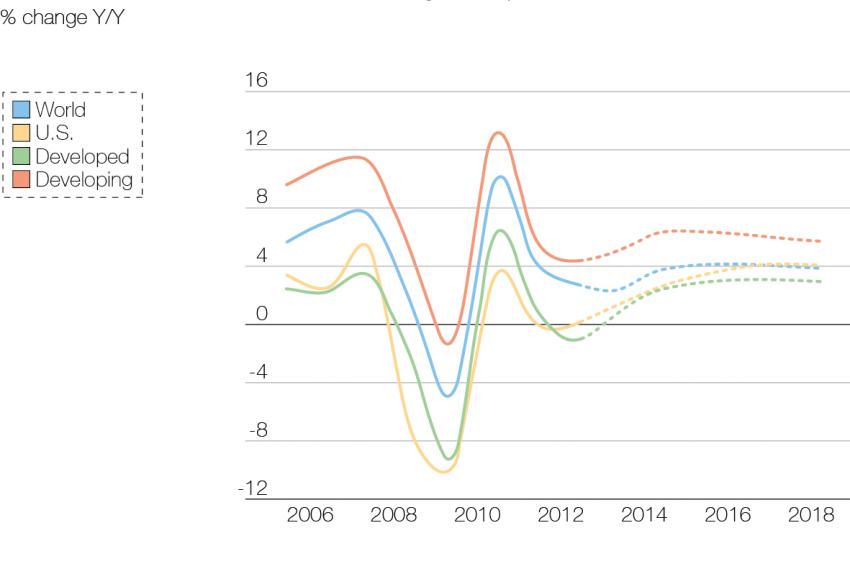

Together, American chemical producers and their partners have a bright outlook. Global chemistry is set to expand with the largest gains occurring in developing nations. Though global production likely only advanced 2.4% in 2013, as economic prospects improve, we expect to see 3.8% growth in 2014 and 4.1% in 2015. The most dynamic achievements will occur in the developing nations of Asia-Pacific, Africa & the Middle East, and Latin America. Due to competitive advantages from shale gas, growth will be strong in North America as well. Western Europe and Japan will lag. With strengthening production volumes, global capacity utilization will improve in the years to come.

Persistence through the slow recovery, innovation, and new advantages from access to shale gas leaves no question about it: American Chemistry is back in the game. In 2014 and beyond, watch to see production volumes growing, jobs returning, and net exports rising as American Chemistry reemerges as a growth industry.

Info: The American Chemistry Council prepared a year-end situation and outlook report U.S. chemical industry based on the latest data available in November 2013. A copy of this report is available from the author.

Contact

American Chemistry Council

1300 Wilson Blvd.

22209 Arlington, VA