Success in Times of Crisis

Arthur D. Little Analyzed the Global Top 70 Chemical Companies

Capital Efficiency - With the credit crunch in full force, a superficial analysis would suggest that capital intensive industries would be hit hardest. However, in the chemical industry, the robust performance of most of the capital intensive industries results in a strategic advantage in times of economic downturn. Arthur D. Little analyzed the global Top 70 chemical companies on capital intensity, capital efficiency and cash generation to investigate how companies can capitalize on their robust performances in good times to strategically reposition themselves in times of economic hardship.

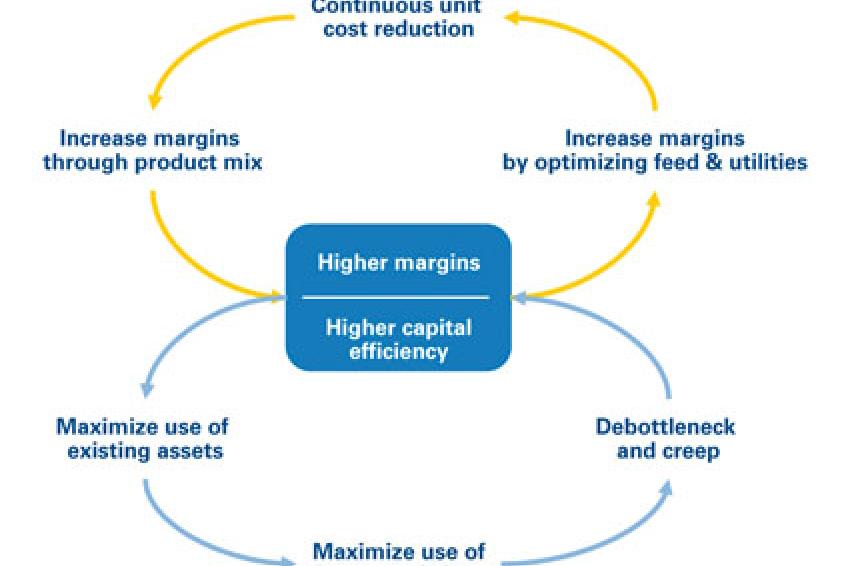

To increase the profitability of a company, executives tend to focus their efforts on the improvement of their margins. To achieve this, company executives work on the reduction of costs, optimization of feedstock use and changes in the product mix. However, what should be achieved is being jointly agile in managing margins and capital.

Businessmen know that minimizing the use of capital for a given business level will release much needed cash. Experience has taught them however, that this has to be done in coherence with shorter term business optimization which continuously adapts the product mix in order to optimize the margins (fig. 1).

Practical Problems

While this duality is theoretically obvious, it is not easy in practice to optimize margins and capital efficiency simultaneously. The reason for this is that the two processes are generally managed by different entities in the organization: product mix and margins are primarily targets of product management or market driven business lines, whilst manufacturing is in charge of asset management. As a result, in many cases not all factors that assure proper capital management are orchestrated in an efficient way.

Additionally, the typical timelines of the two processes also differ: capital decisions tend to be taken on a quarterly or annual basis whilst the product mix and margins are adapted in real time.

Arthur D. Little's study shows that the companies who managed to "co-optimize" those two processes are performing better - generating much more cash per unit of sales - in the long term compared to others with very similar capital intensity. It also concluded that those with high capital intensity seem to pay more attention to this "co-optimization" and consequently manage to extract more value.

Characteristics of Highly Capital Efficient Companies

Based on industry insights, four major characteristics of highly capital efficient companies have been identified and should be considered for a successful capital efficiency improvement program:

- 1. They improve their plants and processes over years in a professional manner. Continuous improvement programs, focusing on the efficiency of assets, results in lean production processes and higher quality. Therefore, these companies possess high-performing technology and engineering teams.

- 2. The capital efficient companies enjoy either economies of scale or the right balance between size and flexibility in their production units. The first is more important for capital intensive industries (e.g. basic chemicals), while the latter plays a larger role in application driven businesses such as speciality chemicals.

- 3. The highest performing companies apply a "no-nonsense" approach in strategic investments: they do not follow the latest fashion.

- 4. The capital efficient companies have clear and transparent capital management processes in place, enabling them to review and adapt their businesses and investments at any given moment in time to manage their cash flow. This will also facilitate the definition and follow-up of any strategic plan in the company.

The above characteristics for capital efficiency will not only improve the cash position of a company, but will also improve the solidity (debt/equity ratio) and credit rating. They will also reduce the delivery times and the implied discipline will result in many secondary benefits.

Survive And Benefit

Each of these capital efficiency elements will, next to the product mix and margins, improve the company's cash generation. Companies that have performed well in the past ten years will enjoy an interesting cash position, which is a weapon for strategic implementation: it permits the right move at the right time. Fortunately, even a global downturn is not all doom and gloom for every player, as these downturns, beside their painful effect on the capacity utilizations, are also unique opportunities for acquisitions or expansions.

In our analysis we divided the companies into three clusters. The first group of companies have outperformed over a long period of time and generated a large amount of cash. They should focus on expansion and strengthen their market position, especially in a capital intensive environment. The downturn is a perfect time to invest in future growth. The value for acquisition targets is dwindling, resulting in lower multiples to be paid. Next, the order books of engineering and construction companies are deflating, leading to a reduced cost of plant construction and an excellent service offering.

The second group of companies are called "the optimizers" and include companies that have performed very well over the last ten years. They need to continue the optimization of their business: the improvements of the variable margins should be combined with a reduction of fixed costs and continuous attention needs to be paid to the improvement of efficient use of capital.

The third group consists of the application-driven companies which are less capital intensive but have a rather healthy cash flow. They will have to focus on margin optimization. By optimizing their margins, companies will make money available which will enable them to take advantage from the down cycle and expand or strengthen their market position. Fortunately, the application-driven companies will be favored by the burst of the raw material bubble, leading to a substantial decrease in their raw material cost.

However, to make such a margin management program really successful and differentiate themselves from close competitors, they need to segment their offering between innovative specialties and more commoditized products. Complexity reduction along the process chain and management is the name of the game.

Unfortunately, not all companies were able to generate a decent cash flow and some will be forced to fix their profitability whilst working on both product mix and margins and an increase in capital efficiency. In order to secure their existence, management should take stringent actions such as:

Redefining their strategies and focusing on their core strengths;

Differentiating their process chains and services according to innovative specialties and commoditized products;

Creating a sustainable complexity management with holistic process chain optimizations

Implementing a stringent operations management process with production network and cost optimizations;

Focusing on feedstock and raw material management including backward integration;

Adopting straight forward business models, organizations, services and overhead costs to a differentiated environment.

By taking these rigorous actions, top-level management will be able to fight the current downturn, avoid the life-threatening dangers and thus become stronger.