Asia’s Future Bioplastics Hub

Thailand Has All the Trappings to Become a Global Player

Boom Region - In 2011, the markets for bio-based materials are continuing to develop dynamically (with annual growth rates of 15-30 %). It is estimated that a global production capacity for bio-based products of 700,000-800,000 tons per year was established by end of 2010. Within these scenarios Asia is going to develop as a key region for bioplastics - Asia is predicted to serve 25 % of the world demand for bio-based materials in 2020.

General Situation for Bio-Based Materials in Asia

Many countries in Asia are currently intensifying their efforts to push bio-based products into their economies in search of biomass-resource oriented, sustainable solutions.

For Asian countries, a suitable waste management solution is mandatory to avoid future environmental burdens for the societies: Asia is home to 60 % of the world population, creating demands for food and materials, including end-of-life options for a high level of lifestyle. The initial driving factor for introducing bio-based plastics into the domestic Asian markets is still the biodegradability aspect. In many Asian countries like India, China, Malaysia or Bhutan, conventional plastic bag bans or fees have been set in place in 2010/2011. Thailand doesn't charge for plastic bags in supermarkets: 350 million plastic bags are disposed in Thailand every day, requesting proper waste management for such materials including the handling of (wet) organic wastes (because shopping bags are often used as waste bags). Food waste contributes up to 60 % to the total local municipal waste in Asian countries. In 2010 many new investments with a focus on Asia were initiated, which are expected to be going to be realized in the upcoming years:

- Purac is currently building a 75,000 tons per year lactide plant in Thailand, which expected to be operational in Q4 of 2011.

- Singapore-based Indorama Ventures and Purac are in discussions to set up a polylactic acid (PLA) manufacturing facility in Thailand.

- Braskem's bio-based polyethylene (PE) plant, producing PE from sugar cane bioethanol with a 200,000 tons nominal production capacity, went operative in Brazil in October 2010. Toyota is intending to act as resin distributor for Braskem and announced further collaboration with local producers to utilize bioethanol from Brazil, targeting to produce bio-PET.

- PTT, the leading Thai oil and gas company, bought stakes of the U.S.-based biotech company Myriant, intending to collaborate on succinic acid research and production.

- PTT and Mitsubishi Chemicals announced they will form a joint venture in Thailand to produce polybutylenesuccinate (PBS). The bio-based succinic acid for PBS will most likely come from a future production facility in Thailand, based on Bioamber/Mitsubishi technology.

- Naturworks LLC has chosen Southeast-Asia as site for a potential second PLA plant.

- Italian leading starch-bio plastic producer Novamont extended its distribution network in Asia by selecting Thai bag producer Tantawan as local partner.

- International companies such as BASF or Uhde Inventa Fischer are interested in further engagements in terms of bio-based/biodegradable products for this region.

The announced activities would add further 400,000-500,000 tons of bio-based resins to the projected bioplastic production capacity in the Asian region. The main application for bioplastics in Asia is still seen in the packaging sector, with 40-50 % market share.

Thailand - a Potential Bioplastic Hub in Southeast Asia?

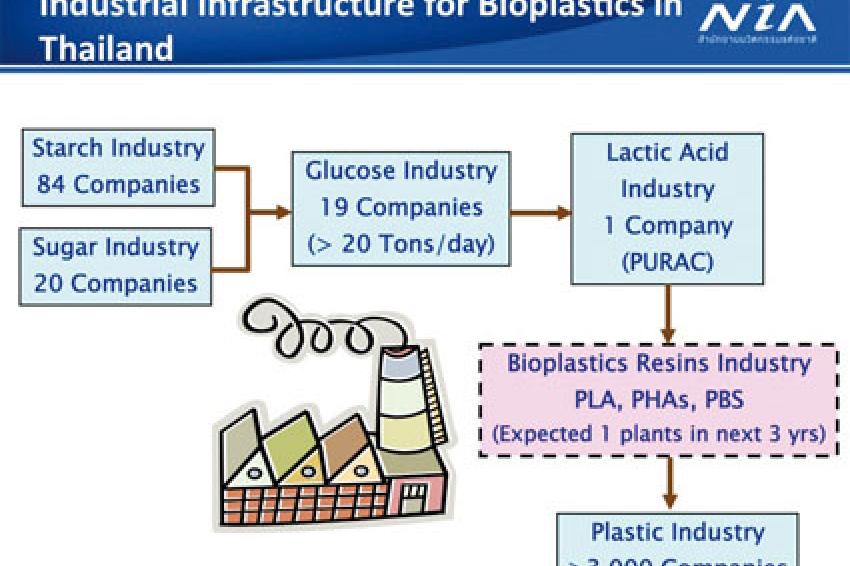

Thailand's main advantages to become the future bioplastic hub in Southeast Asia are evident: The country boasts abundant sugar- and starch-based feedstock at competitive prices. A versatile fermentation industry for organic acids e.g. for lactic acid (Purac), glutamic acid (Akinomoto), citric acid (Worldbest) or for bioethanol is already in place. A well-developed chemical industry is also able to support the production of bio-based materials like PLA, PBS or bio-based PET (Indorama). The plastic industry in Thailand is well-established with more than 3,000 companies.

Thailand's location in Asia, in particular its proximity to China, is also of strategic importance. China is seen as having the largest future customer potential. Also, Japan as one of the most developed bio-based countries in Asia, has long-term relationships with Thailand. Thailand is one of few countries in the world that has introduced policy measures for bioplastics to support sustainable bio-based innovations for future of the country. These policy measures are created along a National Roadmap for bioplastics, which was endorsed by the Thai government in 2008. The implementation of this roadmap was assigned to the National Innovation Agency (NIA) at the same time. The main targets of these measures include:

- to realize sufficient supply of biomass for raw materials for the production of bio-based plastics;

- to stimulate and promote technology development for bio-based plastics and national and/or international;

- to build up new innovative industries and businesses; and

- to establish a supportive infrastructure along the value chain for bio-based plastics, including government policies and end-of-life strategies.

The enhancement of the roadmap from 2011 to 2015 is extending the activities by financial supporting the implementation and operation of a bio resin pilot plant with a capacity between 1,000-10,000 tons/year as well. The main resins in focus for pilot or commercial plants are lactic acid/PLA and succinic acid/PBS.

Benefits of Thailand as an Industrial Location

Incentives provided by the Thai Board of Investments (BOI) include a cooperate tax holiday of eight years (following a 50 % reduction of tax for the next five years), reduction on import tax on raw materials and machinery and the access to domestic feedstock at export (parity) price level.

The domestic market for bioplastics in Thailand, based on volume, is currently low (estimated around 1,000 tons/year). Development of the domestic market is one of the main reasons for the pilot plant strategy of the Thai government. The market volume for bio resins in Thailand could be optimistically estimated between 15,000-40,000 tons in the next 10 years. The NIA has supported and funded many innovation projects during the first years of operation including policy building and waste management projects trials. As important result of the activities, the awareness for bioplastics has significantly grown at industry, retailer and consumer level. Thailand is therefore expected to develop as the future alternative hub for global bioethanol/bio-based resin production, complementary to Brazil.

However, raw materials costs represent 40-60 % (and more) of the production costs for certain bioplastics like PLA or PBS. A concern for bioplastic producing companies is to be able to produce these bioplastics in an economically feasible way.

Other Factors

The price for fossil crude oil has reached high levels of more than $110/barrel at the beginning of 2011 and is predicted to further increase to $150/barrel by the middle of the year. Unfortunately, the sugar and starch fermentation industry has been strongly hit by deceases and climate effects (droughts) in 2010 as well, which has caused high prices for these commodities and has equalized the market push effect of the high oil price at present. However, if Thailand is able to achieve all of the planned measures, the country's future vision to be the bioplastic hub of Southeast-Asia is within reach.

Contact

National Innovation Agency

73/1 Rama VI Road

10400 Bangkok

Thailand

+66 2 6446000

+66 2 6448444