Chemical Companies are Continuing to Seek Growth Opportunities

The Valence Group has analyzed chemical segments from the standpoint of stock price movements

Mergers & Acquisitions - Almost 35% of chemicals M&A transactions currently involve Asia or the Middle East. With this forecast to increase, a wider group of buyers are evaluating a broader range of chemical sub-sectors for potential acquisitions. Consequently, knowing the dynamics and specific market developments across all sub-sectors has become more important.

As part of this sub-sector theme, the Valence Group has analyzed chemical segments from the standpoint of stock price movements in the Valence Indices, via the analysis of more than 230 chemical product/application segments, and finally from the perspective of regional M&A transactions.

Valence Indices

The Valence Indices comprise 33 chemical sub-sector stock price indices that were launched earlier this year. These indices show remarkable sensitivity to the end markets they serve or the broader economy. For example, as noted in our July Newsletter, the Basic Chemical & Commodity Polymers index is a highly sensitive and lead indicator of overall economic activity.

The indices' performance over the last 12 months is shown in Figure 1. It shows the huge variation in sub-sector stock price movements, with some being more than double the S&P 500 and well above the aggregate Valence Global Chemical Index (VGCI). In particular, the Paints & Coatings index has risen by ca. 35% in the last year and this is mirrored by other related indices such as Coatings Materials & Additives, Adhesives & Sealants and also Additives. All these sub-sectors have been driven higher by a thawing of the US housing sector. Although these indices are global, with companies from all regions represented, the US constituents are benefitting most from the increasing activity in the US commercial and residential housing sector. Companies such as Sherwin-Williams, PPG and Valspar have all seen share prices rise by up to 100% in the last year, and this has pulled the index higher, despite lower housing sector activity in other geographic regions.

Surprisingly, sub-sectors which are more closely linked to the general economy have not fared as well. Elastomers & Rubber, Electronic Materials and Basic Chemicals & Commodity Polymers have all underperformed the VGCI and S&P 500 in the last 12 months as the global economy has slowed. These sub-sectors, being at the start of the supply chain for packaging, auto, electronics and consumer goods, are highly sensitive to economic activity and often lead indicators of global (or regional) macroeconomic factors. Although these sub-sectors are showing slow economic growth, there has been an uptick in prices recently, indicating that 2012 Q4 may be stronger than many believe. The sub-sector indices show that there is a decoupling of US housing, which is growing (albeit from a very low base) relative to the broader economy, which remains subdued.

Paints & Coatings have also been aided by lower or stagnant pigment raw material pricing. For example, titanium dioxide pricing has eased recently and, although still at healthy levels, is no longer rising. As would be expected, the Pigments sub-sector index has therefore underperformed, having dropped almost 15% in the last 12 months and nearly 30% in the last six months alone.

Worthy of note has also been the recent rise in the Agrochemicals index as the share prices of larger companies such as Syngenta, Monsanto and Nufarm have risen by as much as 60% in the last year. Much of this rise has been in 2012. The index is potentially set to go higher as the industry fundamentals of increasing crop prices and continued high demand could combine with more sector M&A activity, as demonstrated by the recent transactions by Dow Chemical (Cal/West Seeds), BASF (Becker Underwood) and Syngenta (Devgen and Pasteuria Bioscience). With Asian buyers and companies increasingly focused on seed and biopesticide-related acquisitions and partnerships, the sector dynamics will likely propel the index further upwards. Even the moribund Pharma/Agrochemical Intermediates index appears to have been dragged up by the Agrochemicals index.

Chemial Industry - M&A Segment Mapping

Chemical companies are continuing to seek growth opportunities for their businesses either through related "bolt-on" opportunities or increasingly by the creation of a "new leg". In addition, Asian buyers and traditional private equity firms are also actively seeking investments in a broader range of chemical sectors outside of their traditional focus. In both cases, some level of screening of the vast range of chemical products or functional segments is a vital first step to define target chemical sectors.

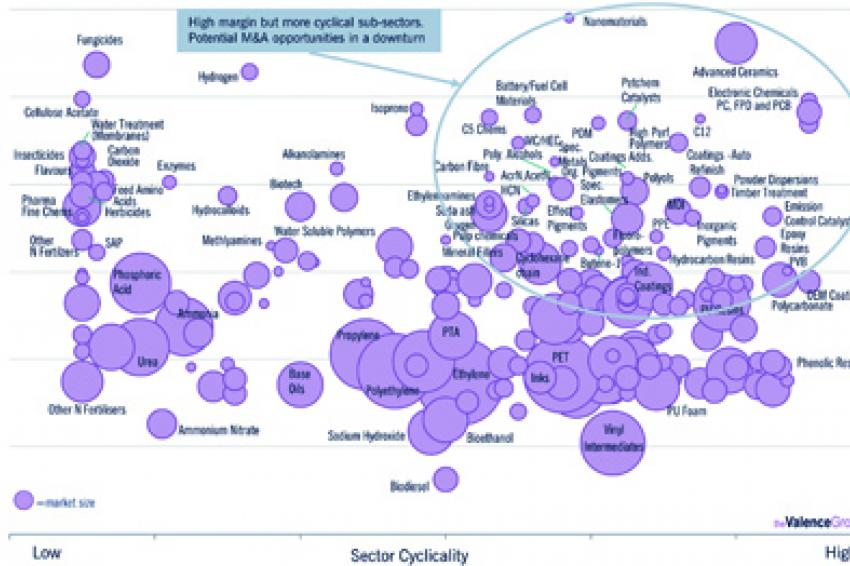

To support this M&A screening process, more than 230 chemical product/application sectors have been analyzed in order to generate a map of the chemical industry from the standpoint of business characteristics and overall attractiveness. Each sector is measured by financial performance, market dynamics, competitive intensity, supply/demand outlook, cyclicality and technology barriers to give a balanced and detailed assessment of the chemical business environment. This knowledge base can then be examined from various perspectives to show which sectors meet specific acquisition criteria.

As an example of this analysis, Figure 1 shows the mapping of chemical products/applications by level of historical cyclicality and profitability. Cyclicality is defined primarily by the blend of end markets served, and profitability is calculated by averaging margins over an economic cycle. Highlighted in Figure 1 is the area of high profitability and cyclicality, where under current slower growth conditions, margins might be expected to be depressed, thus creating opportunities for investment and acquisition. Surprisingly, up to 60-70 sectors fit these criteria, including product areas such as electronic chemicals, advanced ceramics and even some catalysts. Conversely, low cyclicality product/application areas could also be targeted if less earnings volatility was preferred. Areas as diverse as hydrocolloids, base oils, superabsorbent polymers and cellulose acetate would fall into this latter category.

Sector Spotlight - Natural-Based Chemicals

A growing and active M&A sector is related to chemicals derived from natural feedstocks, including vegetable oils such as palm, coconut, soy and castor oils. While food still remains the dominant end use, chemicals should contribute to above average growth rates for these materials.

Major drivers for this growth include increasing customer pull for products based on renewable materials, rising oil prices, and specific chemical functionality, often provided only by natural feedstocks. Applications such as bio-polymers, oil field chemicals, coatings, adhesives and lubricants are encouraging the use of natural feedstocks and derivatives beyond their traditional use in soaps and detergents.

This growth is expected to spur further M&A activity. For example, M&A is being used by specialty chemical and polymer producers seeking to broaden their synthetic-based product lines with natural analogs. Lubrizol's acquisition of Merquinsa, a Spanish producer of synthetic and bio-based polyurethanes, and Arkema's acquisition of Chinese castor-oil producer Casda/HiPro Polymers fall into this category. Indeed, many major nylon producers have introduced castor-oil based long-chain nylons into their overall portfolio because of their unique properties and sustainability appeal.

With multiple and varied underpinning forces driving the need to expand across natural-based chemicals, global M&A activity across the sector should fuel significant growth.

Chemicals M&A Analysis

Overall value of M&A activity this year is expected to be comparable with 2010 but down on the high levels seen in 2011. Clearly companies remain committed to M&A and large deals have been completed in the last few months. Furthermore, some of the larger deal activity recently has been led by financial sponsors, specifically DuPont Performance Coatings (Carlyle) and Cytec Coating Resins (Advent). Chemical companies, on the other hand, have predominantly been sellers of the larger businesses although there have been some notable exceptions, such as Cabot's acquisition of Norit, Ecolab's acquisition of Champion Technologies and the recent agrochemical transactions referred to earlier.

Despite continued financial uncertainty in Europe and volatile stock markets, the vast majority of chemical companies have maintained relatively high levels of profitability. This has resulted in strong balance sheets with low debt levels and sufficient financial strength to fund large acquisitions. However, with the demand side showing signs of sluggishness, companies are evaluating acquisitions more carefully, although still keen to invest across the spectrum, especially in non-transformational transactions.

In particular, the increasing M&A activity by Asian and Middle Eastern companies will be a further driver for chemical acquisitions. Indeed, as shown in Figure 2, over the last five years ca.35% of all chemicals M&A originated in/from Asia and the Middle East, and indeed 15% of all chemical acquisitions were outbound M&A from these regions.

This is a huge increase from 10 years ago when activity in these regions was nascent. With ambitious growth plans in China, strengthening of the Yen and continuing high oil prices, M&A involving the Middle East and Asia is likely to reach 50% of all chemicals M&A within the next 5-10 years.

Of course, Europe and the US still account for more than 60% of all transactions and an even higher proportion when viewed by volume. While Middle Eastern acquisitions in established markets have tended to be larger deals driven by the need to build scale and presence (e.g. IPIC or SABIC acquisitions), European and US transactions are more varied, tending to be linked to realigning portfolios or business positions. Asian activity shows more of a mix but with considerable outbound activity. These partially reinforcing reasons will maintain the impetus for chemicals M&A.

The rise of low cost shale gas in the US will also be a strong pull for investment from all regions. The increased competitiveness of the US chemical industry from low cost energy, advantaged feedstocks and improved manufacturing productivity, has become perhaps the most important structural change in the last 10 years. This is already fueling M&A both in the US and from abroad (e.g. TPC proposed acquisition by Innospec, Indorama's acquisition of Old World Industries and the PPG chloralkali/Georgia Gulf merger). As more shale gas reserves are brought on stream, both investment and M&A activity should further increase in the US.

www.valencegroup.com

Contact

The Valence Group

101 Albany House

London, W1B 3BL

United Kingdom