The World Of Biosimilars

Disruptive Challenge or Unmissable Opportunity?

Doubled-Edged Sword - The emergence of biosimilars has caused very large ripples in the biopharma pond, and has recently been called the most "disruptive technology" of the decade. True to a point, but dynamic change for some is usually accompanied by significant opportunity for others. This is the "double-edged sword" paradox of the biosimilars market.

In simple terms, biosimilars are the biotech industry's version of chemical generics. However, due to challenges of proving equivalence, biosimilars are considered only therapeutically similar to the originator product.

The Size of the Biosimilar Prize

According to Datamonitor analysis, the global biologics market (excluding vaccines) reached $116 billion in 2010, and is predicted to reach $145 billion by 2016. A strong driver of this growth has been the continued, robust uptake of monoclonal antibodies (mAbs). However, over the next five years, a wave of patent expiries in the biologics market will expose approximately $65 billion worth of biologics sales to biosimilar competition.

While this represents a significant opportunity for biosimilar players, success is not guaranteed. Commercial success of biosimilars has, and will, vary by product and therapy area. Attitudes and perceptions of physicians and nurses, how influential the payer is, the influence of manufacturing capacity, and the importance of a device to the delivery of the product are all potential key influences on biosimilar success.

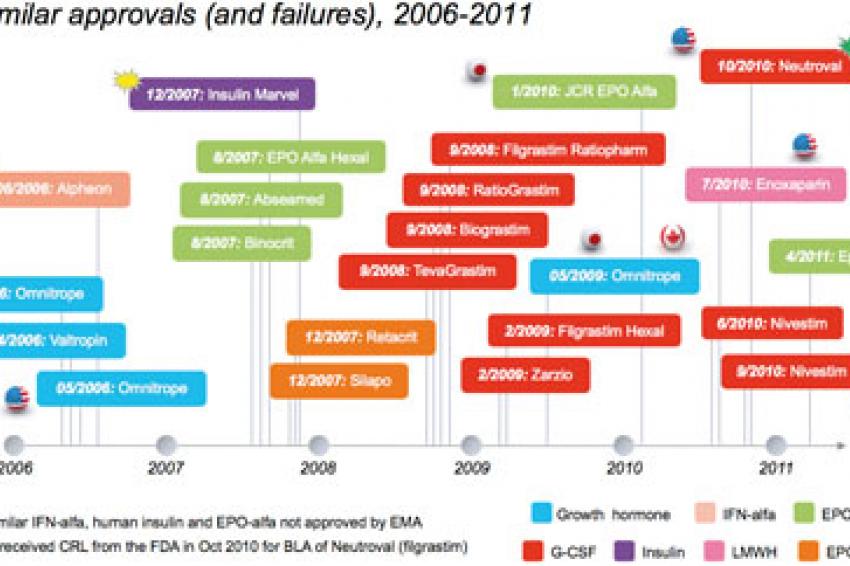

Biosimilar Approvals (and Failures!) to Date

Across the EU, Japan, Canada and Australia, there have been 18 biosimilar approvals across three classes of biologic products; human growth hormone, epoetin (EPO) and filgrastim (fig. 1). In addition to the approvals, there have been three notable failures:

Alpheon: In June 2006, Biopartners failed to receive EMA approval for biosimilar interferon-alfa-2a (Alpheon), due to quality, stability and lack of adequate biosimilarity to the reference product, Roche's Roferon-A.

Marvel Insulin: In Dec 2007, Marvel Lifesciences of India withdrew its EMA biosimilar marketing authorization (MAA) application for three biosimilar human insulin products (a basal, bolus and mix version). Despite the withdrawal, the EMA clearly states in a Q&A document that approval would not have been given due to concerns of biosimilarity and product quality.

Epostim: In April 2011, Reliance GeneMedix withdrew a MAA for Epostim (EOP-alfa) due to the company's inability to provide additional data. Interestingly, the commercial success of biosimilars has varied significantly. For example, after nearly five years on the market, Omnitrope, a biosimilar human growth hormone marketed by Sandoz, has struggled to get more than 5% volume market share in Germany (as of August 2010). In contrast, uptake of biosimilar EPO and filgrastim in Germany has been strong, with biosimilar EPO capturing about 30% volume market share of the class, and over 60% volume market share of the reference product.

Challenge Vs. Opportunity ... or Both?

In the context of the wider biologics market, there are a number of companies that are directly or indirectly affected by biosimilars, and for a range of different reasons:

Innovative biopharma currently market biologics products and are at risk of losing market share to biosimilars, and are interested understanding how they can effectively (and ethically) compete and manage their portfolios.

Opportunity seekers include biosimilar/generics players seeking to develop and commercialize biosimilars, or interested investors seeking to leverage internal capabilities and reputation to get a foothold in the biologics market, realize that the biosimilars market is a low-risk strategy for gaining entry into the biologics market.

Hybrids, formed of biopharma companies with at risk portfolios, but also interested in using internal capabilities to develop biosimilars, potentially for emerging markets, hybrid companies are emerging. A good example of this business model is Merck & Co, which has invested $1.5 billion in establishing Merck BioVentures, its biosimilars business unit.

In the face of a new threat within the biologics market, various innovator companies have reacted very differently to biosimilars. Some reactions have been based on sound commercial logic, while others have attempted to call into question the safety and efficacy of biosimilars. This speculation has attempted to give physicians and other key stakeholders pause for thought before using biosimilars, but backfired in May 2008 when the European Commission was forced to put out a statement defending the its position on biosimilars, calling all stakeholders to stick to the facts and not question the EC's integrity. Other responses include litigation to keep biosimilars off substitution lists in Europe.

Based on the fact that biosimilars cannot be automatically substituted for branded biologics, particularly in Europe where several countries have actually banned it (e.g. France and Spain), biosimilar companies have needed to create compelling marketing messages and imagery for their products. For example, Hospira's marketing campaign for Retacrit (EPO-zeta), a biosimilar version of J&J's Epogen, uses the image of a zebra. The perceived logic is that no two zebras are identical, with each animal having a unique stripe pattern that other zebras are able to differentiate between. Additionally, due to the INN that Retacrit was given (i.e. EPO-zeta), it is believed that a zebra could be associated with zeta, thereby creating a verbal and graphic link between the two.

From a "hybrid" business model perspective, many more innovator companies are expected to employ a similar strategy to Merck and invest in the biosimilars market. Companies that have already mentioned that gaining access to the biosimilars market would be favorable to the business include AstraZeneca, Amgen, Biogen Idec and Pfizer. Pfizer's recent biosimilar insulin deal with India's Biocon provides proof that Pfizer are serious about exploiting opportunities within the market.

What About The Future?

Despite much progress being made in the biosimilars market, much is left to learn and understand about this rapidly evolving sector. There will be legislative developments and refinements. In the U.S., the FDA has yet to release clear biosimilar development guidance, with the first guidance documents expected to emerge during late 2011. In Europe, draft legislation related to the development of mAbs has been published, and refinements and amendments to current legislation are planned.

Off the back of this legislative activity, more biosimilar approvals are expected, both in classes where there biosimilar products are currently approved, and in other classes. Biosimilar versions of leading mAbs are in clinical development in Europe, including rituximab (Rituxan; Roche) and adalimumab (Humira; Abbott). Additionally, biosimilar versions of human and modern insulin are also expected to be launched in Europe.

Finally, there will be increased deal activity. As companies seek to gain access to the biosimilars market, an increase in the number of partnerships, collaborations, joint ventures and acquisitions are likely to be seen. These deals will enable companies to leverage pipelines, reputations and geographical reach, thereby driving overall commercial success of biosimilars in the future.

Contact

Datamonitor Group

119 Farringdon Road

London EC1R 3DA

+44/20/75519000

+4487/01324874