A Rose in the Bud

Arthur D. Little Anticipates Opportunities in Industrial Biotechnology

The Graduate has one of the most memorable lines in movie history. "There's a great future in plastics," the protagonist Ben is advised, and it's a piece of advice that turned out to be prescient. Driven by steady improvements in cost, quality and choice in the petrochemical industry, plastics have become ubiquitous for packaging, containers, fabrics, coatings and other customer durables. Petrochemicals also deliver the key ingredients for cosmetics, personal care and many of our food and pharmaceutical products.

Today, a new prediction is made. Bioplastics and - more generally - chemicals derived from biological raw materials like wood and straw are being touted as the next big thing for the chemical industry and its customers. The technology that will make this possible, industrial biotechnology, abbreviated as IB, is regarded by many as a potential game-changer. This possibility is not just of interest for the chemical industry itself; all the main chemical-using sectors such as food and drink, pulp and paper, textiles, automotive, aerospace and packaging would be impacted. There would be considerable opportunity and change in upstream supply as well, since bio-feedstocks may include dedicated crops and by-products like straw and wood, as well as domestic and industrial waste.

Among the more attractive benefits of this technology for both companies and consumers are the new and different functionalities of biological feedstocks. They can offer innovative and better products and may, in addition, reduce environmental impacts. Indeed, IB advocates boast about lower net carbon emissions (since growing the feedstock would absorb carbon dioxide from the atmosphere) and reduced waste volumes (as many of the bio-derived products would be biodegradable) compared to those of normal petrochemicals. On the political-economic side, a bio-economy would rely less on oil imports from parts of the world deemed relatively unstable.

Bioplastics and chemicals derived from biological raw materials are being hailed as the next big thing for the chemical industry, a development that could have a huge impact on both that industry and the many others that depend on it.

This technology has its critics, but its proponents believe it has the potential to introduce all kinds of new products and reduce dependence on oil. Here the authors look at potential business models for this small but growing technology. They single out three possible futures and estimate how this promising new area could develop over the coming years.

While the world is indeed running short on resources and high on greenhouse gases, a sizeable group of critics suggest that the expectations are exaggerated. They argue that IB remains of little importance for chemical production overall, especially where IB products are more expensive than alternatives, and that industry should not exploit valuable farmland that can be used to grow food and animal feed. In addition, they highlight the fact that the petrochemical industry is not a key contributor to climate change - of all the crude oil that is produced, only about 5% is used by the petrochemical industry. It uses that oil very efficiently, converting it into useful products first and eventually into energy when it is burned in incinerators, thus providing double use.

Clearly, the debate between advocates and critics of IB shows that something is at stake. It puts IB firmly on the agenda for many executives across the chemical industry, its suppliers and all those industries that ultimately derive their products from chemical raw materials. In this article, we will discuss the key issues faced by executives with regard to IB:

• What are we talking about? What is the current contribution of IB to the chemical industry, in size and types

of products?

• How can IB develop? What is the future development path, and what are the key determinants?

• What would it mean to business? How can companies in the chemical as well as chemical-using industries benefit from these developments?

The Nature and Size of The Bio-Chemicals Market

As with so many emerging technologies, considerable uncertainty exists about the size and indeed the composition of the IB-enabled bio-chemicals market. To allow a good understanding of the opportunities, it is important to distinguish between the three different IB technology platforms by which bio-chemicals can be derived: through dedicated production, derived from biofuels, and in planta. Moreover, as in the traditional petrochemical industry, it is necessary to distinguish between high- and low-volume chemicals. Table 1 summarizes the key features of the six resulting segments and provides commercial and technological examples.

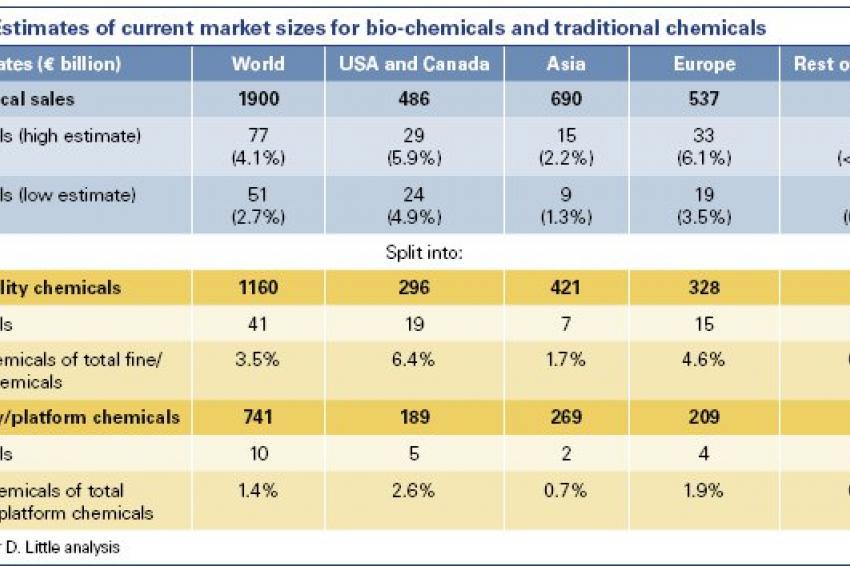

Using these definitions, we estimate the current size of the bio-chemicals market to be €51-77 billion, or 3-4% of total global chemical sales — remarkably small given the enthusiasm, publicity and optimistic growth projections made over the last decade. It is also worth noting that a very significant portion of the total estimated sales of €51-77 billion comes from high-value pharmaceuticals, i.e. the share of bio-chemicals in the non-pharmaceutical and commodity segments of the industry is even smaller.

Three Possible Futures for Industrial Biotechnology

As the application of biotechnology to the chemicals industry is a relatively new endeavor, considerable uncertainty remains concerning the direction and extent of future development, an issue critical for raw material providers,

manufacturers and users alike. To provide a more visible and quantitative basis for decision-making by future producers and users, and to explore opportunities, we have assessed the drivers for IB and developed and modeled scenarios for the future growth of the IB market. . This has yielded three distinctly different, possible futures for IB, which we have quantified in order to provide companies with an order-of-magnitude understanding about "the size of the prize."

• Future 1 - Green Bloom: This is the most optimistic potential future for industrial biotechnology. By 2025 many

different technologies that we are talking about today have been commercialized, making it possible to grow and

exploit for biofuel production agricultural feedstocks that do not compete with food crops. On the one hand, bioethanol can now be produced from switch grass and wood, as well as waste products like straw. On the other hand, algae are increasingly being used to produce biodiesel at sea, avoiding competition with land-based food production completely. The plentiful production of biofuel has resulted in the development of a thriving bio-chemical industry. The situation may in fact be compared to the petrochemical boom of the early 1900s - large-scale production of cheap fuel for a world demanding transport allows chemical companies to piggyback and valorise part of the fuel into more useful chemicals. As a result, IB is becoming increasingly important for speciality and fine chemicals due to on-going technology development. This new bio-chemical industry is focused on feedstocks that avoid competition with food crops where there are high costs due to oil-based fertilizers and political sensitivities.

• Future 2 - Stuck: In this potential future for IB, even by 2025 the anticipated technology breakthroughs that would have enabled large-scale biofuel production have remained elusive for a variety of reasons: limited success in biofuel R&D, strong fluctuations in oil and food crops prices which have reduced incentives for companies to do research or make long-term investments, and societal resistance due to biofeedstocks being seen to compete with other land uses. In addition, societal resistance to genetically modified organisms (GMOs) limits the extent to which available technology can be used. As a result, IB products are technologically unfeasible or prohibitively expensive, causing a lack of demand and/or incentives for businesses to consider biotechnology options. The only segment experiencing growth concerns the direct production of fine and speciality chemicals, a technology that was already viable before the year 2000 and that simply continues to expand where it makes business sense.

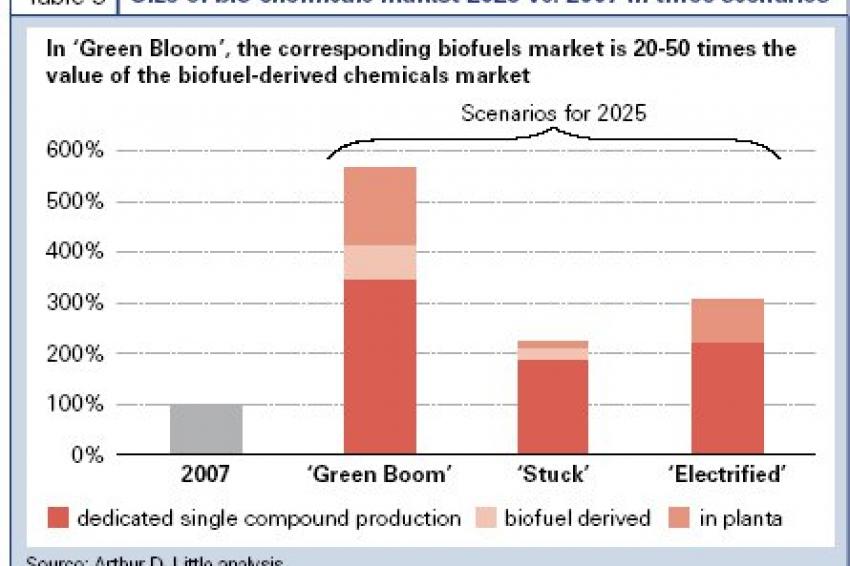

• Future 3 - Electrified: In this possible future, electric cars are breaking through on a large scale, driven by government policies and technological advances. As a result, a real or anticipated drop in demand for oil leads to structurally low prices. Low crude oil and thus naphtha prices render the existing petrochemical products highly competitive and prevent the growth of IB processes and products unless there is a clear cost or functional advantage. At present, we cannot be sure which of these three futures is more or less likely to occur. Too much depends on highly uncertain, difficult-to-predict technology breakthroughs in a wide number of areas: biofuel production; genetic modification of plants; battery technology for electric cars, and solar and wind energy to produce electricity for transport cheaply but without emissions. It will be clear that the size of the IB sector, and the different methods of production, will vary significantly in each of these futures. Our model shows - in order-of-magnitude terms - by 2025 a variation in size of between €175 billion and €420 billion, or a chemical production market share of 7-17% (Table 3). We have used the long time frame to 2025 because some critical drivers, while taking a long time to materialize, will require consideration by companies today.

"Stuck," our most conservative scenario, predicts at least a doubling of IB market sales within the next 15 years, still outpacing the growth of the chemical industry as a whole because of on-going growth in high-value chemicals. Under "Green Bloom," our most optimistic scenario, by 2025 IB sales will grow at least fivefold and contribute 15-20% of chemical industry sales because of technology breakthrough combined with high oil prices, although it must also be expected that, by then, growth will be starting to level off. The "Electrified" scenario shows that even when IB is highly disadvantaged on the cost side, on-going developments in dedicated as well as in plant-based production of specialities will allow for significant growth.

In summary, we are confident that IB will continue to grow and outpace general chemical industry growth. That said, we do not expect to witness in this timeframe a wholesale transformation of the industry. A sector that has relied for nearly all of its feedstock on traditional petrochemistry will more or less gradually shift towards becoming one that has other options. It will on a case-by-case basis choose to exploit alternative feedstock. In terms of overall size, it is too early to tell whether IB could either represent merely an attractive business opportunity, as in the "Stuck" and "Electrified" futures, or represent an outright boom as in the "Green Bloom" scenario.

Opportunities for Innovators across the Industrial Biotechnology Value Chain

Even though we're not expecting a wholesale transformation of the chemical industry, the market that is developing is sizeable, with plenty of opportunity for innovative companies across the value chain to get a slice of the IB pie. Table 4 provides an overview of five specific areas of opportunity that we see for producers, users or suppliers.

1. Make less expensive, more effective and greener end-products

Ultimately, the enthusiasm of the chemical-using industries (for example in food, cosmetics and electronics) to exploit some of the unique features of bio-chemicals will drive much of the nascent bio-chemicals industry. Bio-chemicals can lead to differentiated products and increased profitability in three ways.

First, IB may allow existing products to be produced at a lower cost. Technologies such as biocatalysis and fermentation are sometimes used to make existing chemical products more simply, and using less energy. Ultimately, such like-for-like replacements may be used in agrochemicals or in food applications and meet end-user requirements for driving down costs. For example, when oil prices were high, Braskem, the Brazilian petrochemical player, was able to produce cost-competitively polyethylene derived from bioethanol produced from sugar cane. But such examples of IB-derived chemicals being cheaper than their petrochemically derived analogues will be the exception rather than the rule (that is, as long as oil prices stay in the lower to medium range).

Second, IB technology will allow companies to achieve unique effects in products that are not achievable through traditional processes. For example, cosmetics and personal care company Croda International's subsidiary Sederma has developed a unique range of biochemical "active ingredients" that are more effective in "adjusting" dry or oily skin, wrinkle reduction, skin firming and protection from causes of skin damage, among other benefits. Also more consumer-facing companies, such as The Boots Centre for Innovation, try to develop new markets through the development of pioneering products and technologies.

Third, there will be opportunities created by IB through the marketing of "green" or nature-based products. Bio-based products can potentially be marketed as renewable and offering reduced climate impacts. An intriguing example concerns Genencor's teaming-up with Goodyear to produce bio-isoprene, the key ingredient of natural rubber used to manufacture tires. The tires obtained in this manner would be partially renewable, and/or have a lower climate impact.

A key success factor for the growth of IB markets where "green attributes" are being marketed is societal acceptance - especially in relation to:

(a) Competition of biomass production for IB with production of food and animal feed. If food and/or feed supply is scarce due to significant increases in demand or limits in supply caused by, for example, drought conditions, using limited agricultural land to produce crops for industrial applications will be difficult to justify. Breakthroughs in technologies that can exploit feedstocks that do not compete with food and feed, such as switch grass that can be grown on marginal land or algae grown at sea, can help avoid this challenge.

(b) Developments in genetic modification (GM) technology. GM organisms (GMOs) can, for example, help to improve feedstock productivity and therefore deal with scarcity issues and/or land-use conflicts. While public acceptability of the use of GMOs in industrial applications could have significant implications for the IB market, the issue is unlikely to be as sensitive as within the food and drink sector. Furthermore, strong historical negative societal reaction in Europe to genetically modified plants should not be a major hurdle to allowing in planta to take off in the Americas or Asia. For example, the U.S.-based company Metabolix has been developing technology to produce polyhydroxyalkanoates (PHA, a material that can be used to make a variety of plastics) directly from switch grass, a high-yield plant that can grow on marginal land and does therefore not compete with other land uses.

2. Exploit direct production know-how, develop new chemical building blocks

For the chemical industry itself, the main opportunities will lie first of all in exploiting direct production. Considerable experience has been obtained with biocatalysis and fermentation, and an increasing number of chemicals may be available more cheaply or more sustainably using these technologies.

The most exciting opportunities may come from the development of entirely new building blocks, or platform chemicals, which are not readily obtained from traditional petrochemical feedstock. An example is 1,3-propanediol, pursued by, for example, DuPont and Tate & Lyle. This material can be obtained from glycerol as well as by direct fermentation and has great potential for a variety of derived products and materials that cannot otherwise be accessed cost-effectively.

An interesting challenge is presenting itself with respect to reducing greenhouse gas (GHG) emissions, the stated objective of many governments, which is translating into pressure on the chemical industry to develop low-carbon ways of doing business. While it is indeed true in many (but not all) cases that bio-chemicals will emit less greenhouse gases over their life cycle, it is also true that the chemical industry is not a key contributor to GHG emission. Overall from a societal perspective, money spent in the chemical industry to reduce emissions may therefore have less of an impact than money spent in other areas, notably transportation, electricity production and livestock breeding.

Of course, this may not be convincing logic in the political arena and hence companies must take into account the scenario of direct government intervention in their markets, enforcing the use of bio-chemical alternatives where these exist. Clearly, the mere threat may cause many companies to look for such alternatives. In this respect, carbon pricing may be expected to have only a minor impact. For most chemicals, a carbon tax of, say, €50 per ton would increase production costs only marginally, generally far less than 10% of total costs, especially for higher-value chemicals.

While such "surcharges" can certainly distort competition when applied one-sidedly, they are not enough to tilt the balance decisively away from petrochemical processes towards IB.

3. Valorizing the co-products of biofuels

Sales of biofuel-derived chemicals are expected to develop only when a commercially viable biofuel industry, independent of subsidy and incentives, takes shape. In this sense, biofuel-derived chemicals should very much follow a growth path of "fuels first, chemicals next." In this situation, attractively priced biodiesel by-products offer opportunities for biorefineries to valorize by-products. Just as today's petrochemical industry became viable in the early 20th century once oil-derived fuels were put on the market in large amounts, a biofuel-derived chemical industry can only become viable when biofuels are produced in large amounts and competitively. Indeed, many pilot plants for biofuel production are already in operation, including those established by large companies such as Dow Chemical and DuPont Danisco but also including smaller start-ups such as Aurora Biofuels, which has produced biofuel from algae at its pilot plant. Once these technologies are commercially viable and more widely available, IB opportunities, particularly for biofuel-derived chemicals, will become increasingly tangible.

Nevertheless, this route will be interesting when production of biofuels and their feedstocks are competitive with, or preferably more cost-effective than, crude oil-derived fuels and when competition between biofuel and food/feed crops is avoided. This is a situation we only foresee under the most optimistic conditions. There are also examples today of co-production in other sectors. The pulp and paper industry, for instance, has been using the lignin from the black liquor residues produced in the production of pulp to manufacture polymers for use in binding, dispersion agents, stabilizers and other materials.

4. Build a value chain to convert plants into chemicals

Deriving chemicals from plants is not new. For many decades, rubber trees have been providing the key raw material for many rubber products, and a variety of oils can be obtained from different oil crops such as jojoba, linseed and sunflowers. What would be new would be the ability to deliberately encourage certain chemicals in plants and to set up the corresponding agricultural and harvesting operations to bring these new products to market. For certain medium-value chemicals, if expressed at 5-10% of plant weight, a viable growing and harvesting operation could be set up, with the plant waste used to generate electricity for the surrounding area.

Clearly, this would result in the development of a part of the chemical industry that would be structurally different from the current petrochemical industry. While the latter is based on the scale and efficiency of the oil refining industry, the former would need to be significantly smaller and more widely distributed in order to cost-efficiently source biomass from surrounding lands (unless significant feedstock imports were involved). We can thus envisage a network of medium-sized plants, coupled with small-scale electricity production, located close to the biomass feedstock. This could involve strategic alliances of smaller businesses providing the biotechnology working together with large agricultural firms or even individual farmers. Integrators would also play an important role in ensuring a seamless link between the production of biomass feedstocks and the processes. Alternatively large industrial conglomerates such as Dow may be able to cover the full-value chain.

5. Grow the feedstocks for a nascent bio-chemical industry

The capacity of local supply chains sets the ultimate upper limit to sourcing feedstocks within domestic markets. For example, when evaluating the potential of straw energy, Ely power station in the UK assessed that the most significant barrier was not transport costs but logistics: The amount of straw that could be collected and delivered to the power plant was the primary constraint resulting in the actual size of the plant being less than the optimum. The alternative is sourcing feedstocks internationally, which raises a number of challenges such as minimising competition with food crops and making use of waste biomass where economically feasible. Also, it may make more sense to set up conversion plants in the country of origin and ship the resulting biofuel and chemicals, rather than shipping the bulky biomass itself for conversion. There are a number of companies looking to exploit these opportunities. For instance, Green Biologics has developed fermentation technologies allowing for the conversion of biomass from organic waste streams to biofuels and chemicals. Regulation surrounding sourcing biomass feedstocks is in a state of flux. Companies need to develop a robust and flexible methodology for assessing the sustainability of biomass feedstocks and taking into account the needs of government and local stakeholders who may be influenced by such operations. For instance, Ensus Group is building a refinery producing high-protein animal feed, of which some is further refined into biofuels; while it relies on UK agricultural land for feedstock, it will reduce European demand for soy meal imports from South America.

Insights For The Executive

Industrial biotechnology is a big deal, but its scale to date remains small. Dramatic displacement of petrochemicals by bio-chemicals produced through industrial biotechnology is not widely expected unless there is significant technology development and, for high-volume chemicals, high oil prices.

Nevertheless, there is ample opportunity for innovative companies, whether suppliers, producers or users, to find their place in the value chain. But this is not without risk or uncertainty, as our analysis of different development paths shows. The most successful companies will be those that understand some of the fundamental differences between IB-based business models and the traditional petrochemical industry. Chemical companies that want to benefit from IB developments need to consider many new aspects compared to their existing business models, but the key to success is that they deliver products that are either more cost-competitive or that provide new functionality or consumer benefits. It is risky in this endeavor to depend on government interventions for the business to succeed, since politics are fickle and more broad-based measures such as carbon pricing would only have a minor impact on the final cost of most chemicals.

Implications for Chemical-using Industries

Industrial biotechnology is not just a new form of production being pioneered by the chemical industry. The technology opens up numerous opportunities for new product attributes that in future could be offered at the same price as existing products. Many companies have established centers of innovation to understand opportunities more clearly. As pressures increase to manage the full impact of your products - whether it is waste minimization, embedded carbon or water consumption - IB will be an important alternative to understand.

The movie on industrial biotechnology is still to be made. Like Ben in The Graduate, we may be a little worried about what the future will bring in terms of bio-chemicals. It will certainly pay off to keep an eye on what bio-chemicals can do for us.