Untapped Potential

Market Entry into India Requires a Long-term Strategy

As attractive chemical market India has not yet established itself in the minds of European entrepreneurs. “Too difficult” some argue. Nevertheless, experts know that the work is worthwhile because India has a lot of untapped potential. The chances thereby offered for European companies are big, especially now, since the government in Mumbai offers the needed support and is quite open towards foreign investors.

India counts as one of the most attractive markets worldwide. Although the growth rate has reduced in the past few years to 5,5% per year, India has not lost its attractiveness, insiders know. It is a country of high dynamic: with a population of 1,3 billion people India is after China the most populated country. The growth can be seen through the growing middle-class, which includes 25 million households. According to McKinsey the middle-class will grow to 500 million people by 2025. Concerning consumption, for example motorcycles, tractors, trucks and mobile connections etc. India is part of the top 3 of these markets worldwide. In contrast the per-capita consumption of cars, synthetics and agrochemicals even in comparison to other developing countries is low. In these categories India is still a sleeping giant.

India: on the Fast Lane of Asia

The Government and the business community have realized the need to act and are letting experts show them important fields of action. At a conference, organized by the Indian Chemical Council together with the Department of Chemicals and Petrochemicals, Government of India, in India with the motto “Mission Make in India” the consultants of Go East Advisors were important discussion partners and speaker. With great interest the participants followed the presentation, which puts salt in the wound of the Indian economy. Politicians and business representatives agree: there is work to be done, and it will be worth the effort. The focus on the economical growth in India is already monitored internationally with high interest. IMF and Worldbank are predicting for the coming years a rising economical growth of up to 7%. Already in 2016, according to prediction, the Indian growth will have surpassed China. The positive development will have an impact on the private consumption. The demand for cars, refrigerators, but also consumption goods of the daily need will rise. Experts think, it is not too optimistic to think about a two-digit growth rate- in many sectors.

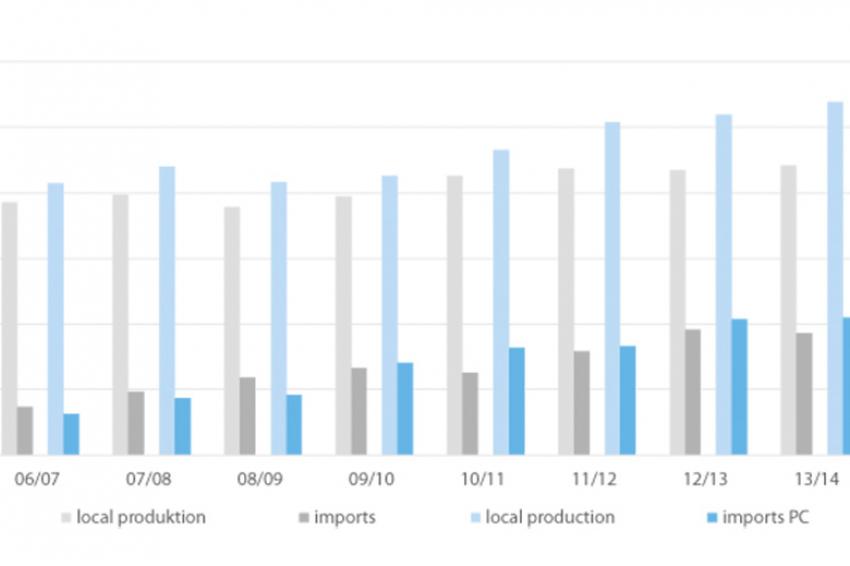

What’s missing is a solid raw- and intermediate product base for these products. And that is exactly where the chances for the chemical market lie, which will have to play a bigger role in India. The time of investors has come. This development, which is reinforced through the focus of the government, has been visible for some time. In these past few years the imports- not only in the chemical sectors- have noticeably grown, more than national production. Today one knows, that national production will not only have to replace imports; it is desperately needed, to keep the growth motor going. European companies can be a part of this development. The earlier they will start with their onsite activities, the larger the chances are of gaining an incredible market position not only in India, but additionally in the Middle East and in Africa. India can become the key to these markets; if one acts now.

Chances to a Strong Market Presence

India’s chemical industry is defined through few large and many small companies. It is missing a large middle-class with business size of over 50 million Euros. While large Indian concerns focus on the mass chemicals and the petro chemistry, the focus of the smaller and medium large companies lies with the special chemistry and agro chemical and pharmaceutical semi-finished and finished goods.

Not only in India it is known: After purely importing, the investment in the own production is the only logical consequent step in order to gain a stronger and consequently growing market presence. Whereas in other more protectionist oriented countries, foreign companies in India may invest independently without an Indian partner in the chemical industry. That SMEs can have success has been demonstrated by German and European companies.

With all the prospects of success there are many aspects to be considered. Who, for example, expects a high efficiency in the administration, will be proven wrong. Furthermore for some registration processes there aren’t many defined procedures (there isn’t e.g. a Biocide guideline). Not everything can be improvised and some things may be hindered by corruption. If one is prepared for that, it will be easier.

Own Company or Partnership?

For some investors a partnership with an in India established company or even an acquisition is more reasonable than setting up an own local company. The market offers great possibilities, as long as the European investors are well prepared. Before anything else, they should be asking themselves these questions:

- Why am I looking for a partner, instead of investing by myself?

- Does the acquired partner provide the wanted competence and/or the financial support?

- Should I look at and evaluate further possible partners?

- Do the partners have the same ideals and agendas about how the joint venture should the managed?

Furthermore there are many more topics to be questioned, starting with the amount of shares of each partner, the legal form, the management as well as the rights and responsibilities of the partners. Experience shows, that it is important, that the Top Management from both partners is striving for the Joint Ventures success and will engage itself fully in the process. When only partners from one side are pushing, the project is most likely to fail.

Whichever strategy is chosen, one should be aware of the fact that India is a developing market. The processes and procedures especially with the public authorities and administration differ massively from those of a mature market in Europe or North America. As investor one will always end up in a situation, where one will wonder if the decision to invest in India was the right one. Nevertheless set-backs should not be a discouragement. Especially in India achievements will set in long-term. Who gives up too easily, will miss to see the success of his investment.

Conclusion

As European chemical company it is not an option nowadays, to ignore the chances of the Indian market. For a middle and long-term success a clear and long-term strategy is needed, which allows for set-backs or delays. A team of experienced India experts helps to avoid risks and ensures a long-term success.