Latin America’s Growing Pharma Industry

Can the Region Still be Considered ‘Emerging’?

Adaptation and Growth - For years, pharmaceutical companies have turned to emerging markets as low cost manufacturing destinations, utilizing lower wages and, frequently, less stringent environmental, health and safety regulations.

As emerging markets capture a greater share of the global pharmaceutical market, these countries are altering and adapting their regulations to compete with the quality expectations of highly regulated markets like the EU and U.S., while addressing their own sourcing needs.

Led in large part by substantial growth in Brazil and Mexico, countries in Latin America are firmly establishing their place in the market.

Latin America has been a long sought after, though difficult to penetrate pharmaceutical market. With the market size of Latin America at $66 billion as of May 2012, many companies have developed strategies to enable access to a portion of this growing market. Part of these strategic discussions center around how to address different regulations between countries in the region and the various components required to register a product from country to country.

Reciprocity Agreements

In order to help alleviate some of those difficulties and promote trade between Latin American countries, several regulatory bodies have entered into reciprocity agreements. In January of this year, one such agreement between health authorities in Argentina, Brazil, Colombia and Cuba came into effect. This agreement allows Good Manufacturing Practices (GMP) inspection reports for the member countries to be the basis of GMP certificates in any of the other member countries, allowing regulators to expend resources elsewhere.

Several similar reciprocity agreements have been reached including one between Mexico and Chile, and a recent one involving Mexico, Chile, Colombia, and Peru. The Mexican regulatory agency, the Federal Commission for the Protection from Sanitary Risks (COFEPRIS) has also been in talks with the European Medicines Agency (EMA) regarding mutual recognition of GMP information as well, indicating a strong interest in pursuing more regulated markets.

To this point, Brazil has sought inclusion on the European Commission's "White List" as part of the Falsified Medicines directive, which was tightened in July . Inclusion on this list would allow manufactures in Brazil to be among those in select countries that do not have to submit written confirmations with their shipments of APIs into the EU, enabling easier trade between the two regions. The EU's equivalence assessment of Brazil is still ongoing; the U.S., Japan, Switzerland, and Australia have been accepted as third countries.

The Importance Of Brazil

Among Latin American countries, Brazil has the largest market share with an estimated worth of $25 billion. In addition to the required registration documents and fees; the Brazilian Health Surveillance Agency (ANVISA) requires GMP certifications for each product imported into Brazil. ANVISA has been conducting inspections of finished dose (FD) manufacturers for some time and began to require registration of active ingredient manufacturers in recent years. Currently, ANVISA is conducting inspections of companies that are manufacturing APIs on the list of priority products established by the health authority and, earlier this year, asked companies to delay certification requests for products not included on this list.

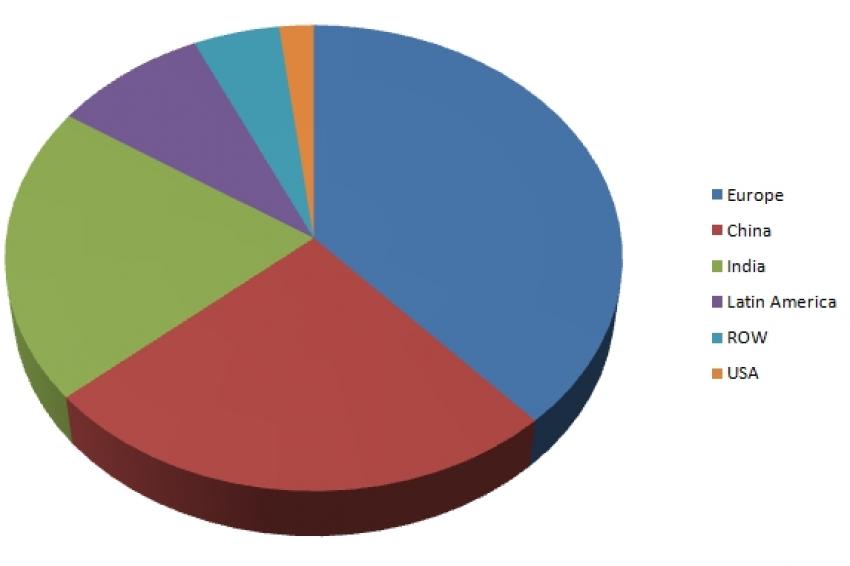

ANVISA has conducted inspections in a number of countries with almost half of successfully inspected sites being located in China and India combined, and the remainder coming from European, Latin American and rest of world sources (fig. 1). With a substantial number of API suppliers located in Europe, maintaining existing and creating new opportunities for cooperation is vital to growth in Latin America. In addition to inspecting manufacturers importing into Brazil, ANVISA requires inspections of local manufacturers of API and FD products as well. To meet increasing oversight demands, ANVISA published a list of state and local authorities that cooperate with the national authority to conduct inspections within Brazil. Similarly, COFEPRIS announced that GMP certificates from a number of regulatory authorities will be recognized in Mexico.

Is It Local?

Along with increasing quality expectations for products being imported to and exported from Latin America countries, there is greater focus being placed on growing local manufacturing. This comes as governments strive to curtail burgeoning health expenditures in the face of increasing cost of prescription medications and incidences of chronic lifestyle disease.

A number of countries are offering incentives to companies to bring production to the region as a means to cut costs through decreased reliance on imported medications. In addition to offering incentives, some countries require a local presence in order to sell medicines on the local market. The local governments have created a number of private-public partnerships (PPP) to boost local production and to bring technology transfers to regional companies.

Building up local manufacturing capabilities for specialized technologies, like biologics and cytotoxics, has become an integral part of the healthcare discussion. In recent years, a number of agreements have been made that center around increasing biologic drug manufacturing and biotech development.

Recently, the Brazilian government entered into two such agreements with biotech companies Indar and Protalix for sourcing agreements and technology transfers of insulin and taliglucerase alfa, respectively. Along with development deals between Latin America and companies outside of the market, there are a number of deals between Latin American countries. Brazil and Argentina are collaborating on biosimilar development with Libbs investing $100 million into a new plant in Sao Paolo and transferring technology from mAbxience's facilty in Buenos Aires, PharmADN.

Conclusion

As quality requirements and the cost of compliance continue to increase globally, Latin America and other emerging markets will continue to be in focus. Manufacturers continue to seek ways to decrease costs and capitalize on these rapidly growing markets, leading to greater partnership opportunities as governments strive to increase their local capabilities as a means of decreasing healthcare expenditures. Specialized manufacturing necessary for biologics, high potency, and cytotoxic medications will also drive continued deal-making and regional investment in Latin America. Foreign market players looking to expand their footprint and established players in Latin America will benefit from emerging companies seeking to further develop their manufacturing and expertise in this growing region.

Contact

Thomson Reuters

215 Commercial Str.

Portland, Maine 04101

+1 207 8719700

+1 207 8719800