Capitalizing On Precision Medicine

A Global Survey by Strategy& Shows How Pharmaceutical Firms Can Shape the Future of Healthcare

By applying a deeper understanding of diseases with richer patient data and advanced analytics, precision medicine can help physicians tailor medicines to the needs of individual patients, leading to better outcomes at potentially lower costs. A global survey by Strategy& among leaders in the pharmaceuticals industry shows that companies are aware of the promise but have yet to harness with the full potential of precision medicine.

Not only can precision medicine improve the way physicians detect, diagnose, and treat diseases, but it can also lead to more preventive healthcare. Using analytics to identify patient risks before they manifest themselves can result in considerably better outcomes, at potentially lower costs for healthcare systems. In this way, precision medicine has the potential to disrupt the entire healthcare industry, including the way pharmaceutical companies develop, manufacture, and market drugs. Few companies have been able to start capitalizing on the promise of precision medicine. Doing so requires a dramatically new set of capabilities, along with the ability to operate in an environment with regulatory uncertainty and new market entrants. The challenge is great, but the rewards are commensurate. It is up to pharmaceutical companies to act now.

Precision Medicine on the Corporate Agenda

Strategy& recently surveyed more than 100 leaders in the pharmaceuticals industry across a range of functions, therapeutic areas, and geographic markets worldwide to gauge the industry’s response to precision medicine thus far. The results clearly show that executives are wrestling with the topic. Among respondents, 92% said they regard precision medicine as an opportunity, and 84% have it on their corporate agenda.

Regarding specific therapeutic areas where precision medicine will likely be viable over the next 5 years, the top two responses were oncology, cited by 91% of respondents, and orphan diseases, cited by 53%. There are valid reasons for the industry’s interest: Precision medicine holds the potential to change the way medicine is practiced. Precision medicine upends the medical one-size-fits-all approach in favor of in-depth patient profiling and individual treatments based on both personal data and a statistical analysis and comparison of larger cohorts. According to survey respondents, the most relevant data types for precision medicine are genomics (87%), clinical trials (72%) and electronic health records (66%). By comparison, newer and less well understood types of data such as someone’s personal internet “fingerprint”, lifestyle or data about food and nutrition were found to be less relevant.

Expected Benefits along the Pharma Value Chain

For pharmaceutical companies, precision medicine represents a new approach to innovating and developing drugs, in line with the demand from governments, regulators, and payors for “real-world evidence” of a drug’s effectiveness and its value to those stakeholders. With populations in many markets aging, chronic diseases becoming more prevalent, and patient expectations increasing, governments and payors are looking for more evidence of value and positive patient outcomes. Potential benefits from precision medicine range across all aspects of the pharmaceutical value chain: research, development, market authorization, and post-product launch.

More than 75% of our survey respondents were confident that precision medicine will help reduce the roughly 10-year R&D cycle by about eight months on average, with one in three respondents saying reductions of a year or more are possible. In terms of R&D expenditure, 72% of those able to judge such spending (which was 77% of the total respondent base) predicted a reduction, averaging 17% of costs. Considering that global R&D spending for the industry is currently about $150 billion that translates into a potential annual savings of $26 billion.

External and Internal Barriers to Overcome

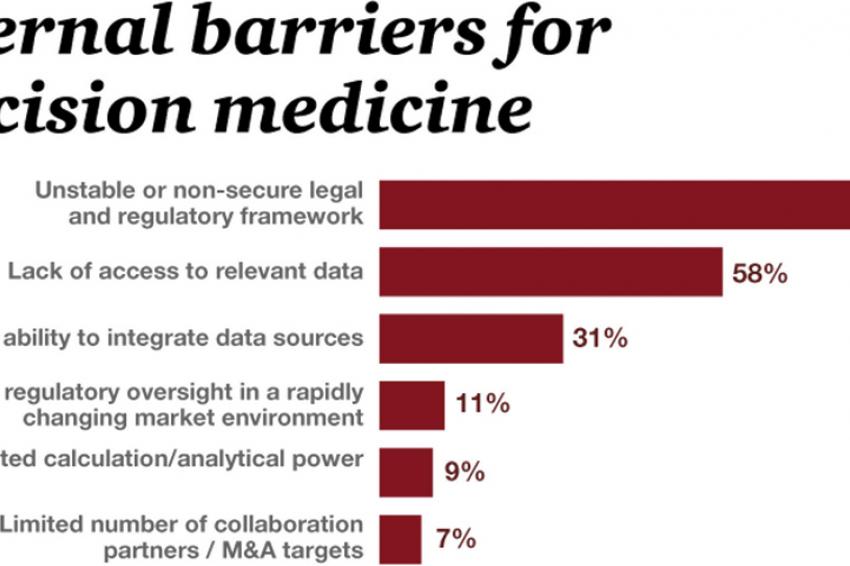

Nevertheless, respondents were well aware that they face still many hurdles until they can fully benefit from the potentials of precision medicine. 92% see the unstable or nonsecure legal and regulatory framework as the most important external barrier. But also the lack of data (58%) as well as the limited ability to integrate data sources (31%) were considered obstructive.

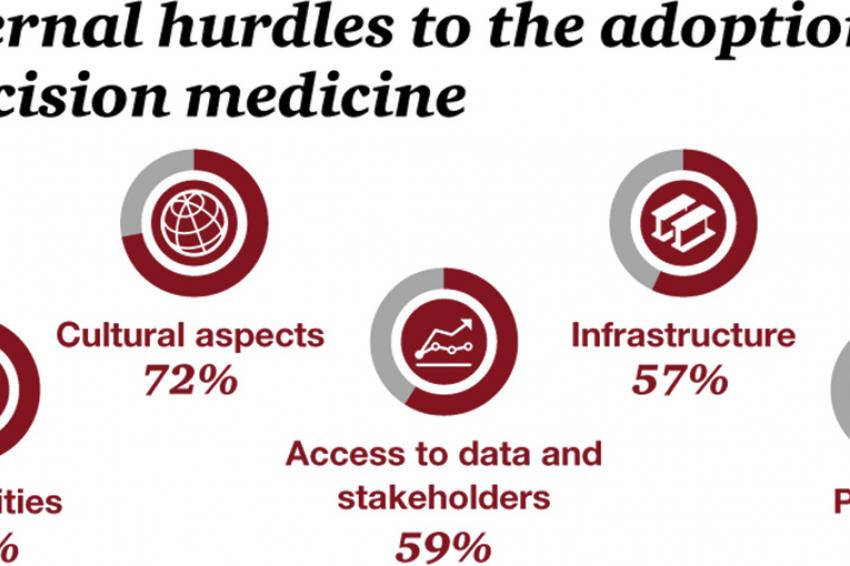

The main internal hurdle was the lack of capabilities, cited by 79% of respondents. In particular, most pharmaceutical companies don’t yet have the capabilities in place to generate the relevant data about patients, analyze and interpret that data, and apply the insights from clinical outcomes to change future drug development. Cultural aspects within the own company (72%) and the access to data and stakeholders (59%) played an important role as well.

Asked for the most viable means by which they could develop data capabilities, the majority of respondents (87%) opted for “targeted collaborations beyond pharmaceutical firms” as the way forward, followed by the hiring of external experts, cited by 65%. Building these capabilities internally, although a viable choice for some companies, is slower and not necessarily cost-effective.

Building the Right Strategic Partnerships

As a result, striking the right collaborative partnerships will be tricky. There is a flood of new market entrants working on data issues, frequently from nonmedical fields such as personal technology and consumer devices. Some of these companies specialize in specific aspects of data — such as generation, collection and integration, analytics, or interpretation and usage — yet others are integrated across the full data value chain. Companies that partner with external players need to trust that the data and analyses their partners provide are both accurate and complete. Companies will also need to sort through a range of issues such as data protection, access and usage rights, and changes in the way clinical trials are set up. In order to forge the right partnerships, companies must ask themselves “What gaps in capabilities do we need to fill?” Second, companies must decide which partners are most appropriate to fill those gaps. Because they have limited experience in this new data field, companies will need to understand the landscape before they decide on specific external partners or experts to work with. All risks will remain with the pharmaceutical player as regulators will not allow the risk to be transferred elsewhere. Once a suitable partner has been found, the next issue is establishing the right engagement model. Companies will need to trust both their new business partners and the new technologies at the same time. It will require a significant cultural overhaul, particularly given that development cycles in technology are often measured in mere weeks or months. Companies will have to transform their organizational culture and embrace a more agile startup mentality.

In sum, precision medicine represents not only a business opportunity but also a clinical opportunity. At a time of greater healthcare challenges, it is a clear means of using emerging technologies to deliver better care to patients. That, in essence, is the responsibility of pharmaceutical leaders. As one respondent in our survey put it, “Precision medicine will happen, and it’s better to be one of the shapers than a follower. Pioneering and taking risks to get on the train may afford greater opportunities than resistance or avoidance.” In other words, pharmaceutical companies can seize this opportunity — or ignore it and watch their competitors pass them by.