A Numbers Game

A Sale Isn’t Complete Until You Get Paid

The Final Score - Revenues, profits, assets, liabilities, cash flow - looking after your financial statements is sometimes sport, sometimes science and sometimes plain arithmetic. But while sales may be the trigger that sets the game in motion, the back end of the sale, collecting payment, will determine the winners and losers.

The math is the score, the science is the strategy and the game is the implementation of them. From a math perspective, we simply look at the numbers and the financial effect that sales have on them. From the scientific perspective, we can point to sales formulas or strategies designed by many companies to maximize the effectiveness of the sales process. With a focus on triggers that build stronger relationships with customers, the scientific perspective appears to be focused on orders, but with similar processes for receivables management it can be extended to the collections process as well.

But this all folds into the game aspect of sales. In making the sale you have competitors to outmaneuver, you need to have a strategy to win the business (the science), and you need to keep the intensity up to maintain good sales volume. But the game doesn't end with a purchase or sale agreement. Once you have convinced your customers that you are the best supplier, you have to get them to pay you (the math). With the majority of your customers this is no problem, but for some, cash flow or other issues put them in a defensive position where they need to be creative in managing their payments.

North American Weakness: Collecting Receivables

The Atradius Payment Practices Barometer, a survey looking at B2B payment behavior in Canada, Mexico and the United States in comparison with Europe found that, on average, 28% of receivables in North America are paid late. This has not changed much over the last year; about 26% were paid late in 2011, but the outcome of those late payments has changed. In 2012, on average, 5.3% of the receivables of B2B companies participating in the survey were written off as uncollectable, up from 4% one year earlier.

The level of uncollectable receivables in 2012 climbed in each of the three countries, growing in Canada from 2.9% to 5.2%, in Mexico from 4.3% to 5.2% and in the U.S. from 4.6% to 5.6%. In comparison, uncollectable B2B receivables in Europe averaged 3% in 2012, remaining pretty consistent with 2011.

In Mexico, the situation with regard to domestic receivables was more pronounced with 5.6% uncollectable compared with 4.1% of foreign receivables. In Canada and the U.S., foreign receivables represented a greater risk than did domestic receivables with the volume of receivables and the difference between domestic and foreign receivables greater in America. In the U.S., 5.1% of domestic and 6.6% of foreign receivables were uncollectable while the comparable numbers in Canada were 4.8% of domestic and 5.8% of foreign receivables.

So what are North American businesses doing wrong? North American economies appear to be doing better than European economies. Mexican GDP is forecast to rise 4% in 2012 and 3.6% in 2013. Although it is the slowest growing of the three, Canadian GDP is also forecast to grow 1.7% in 2012 and 2% in 2013. The U.S. economy, which many say has shown sluggish growth, continues to improve with growth forecasts of 2% in 2012 and 2.3% in 2013. In comparison, GDP growth forecasts for the Eurozone remain negative and uncertain. Expected default frequencies in 2012 have been improving in North America, but are trending in the opposite direction in Europe. There is no significant difference in average payment terms between Europe (36 days) and North America (39 days). So why are uncollectable receivables a bigger problem in North America than in Europe? Do European businesses play the game better?

Europe Excels in Science Aspects of the Game

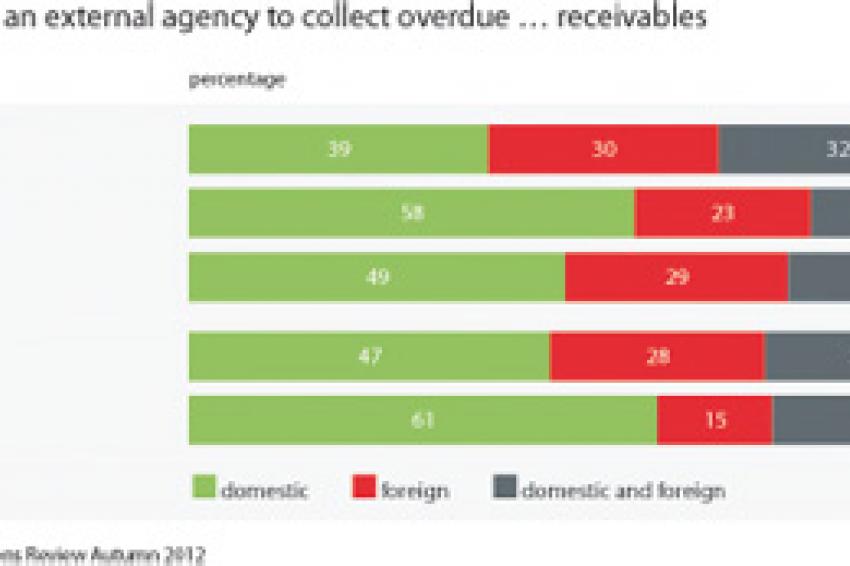

The answers may lie in the approach to receivables management. According to the Atradius Global Collections Review, a parallel study of global credit management practices, in both Europe and North America internal resources represent the bulk of the invoice collections effort. North American businesses tend to rely on internal resources to collect domestic receivables more so than European businesses. Domestic sales normally account for the bulk of receivables, but in North America external agencies are used by only 72% of the survey respondents to support collection of overdue domestic sales, largely driven up by Mexican responses. This compared with 85% of European respondents. Except for Mexico, the focus of external support is more on foreign receivables, which normally account for a smaller percentage of sales. Almost twice as many North American respondents used external support exclusively for collection of foreign receivables than did European respondents.

Within the organization, receivables management tends to be more centralized in North America than in Europe. Of North American respondents to the Atradius Global Collections Review, 75% maintained centralized receivables management operations with the rest relying on local management of receivables. In Europe, only 61% were centralized and 37% managed receivables locally. This raises the question of who is in a better position to collect outstanding invoices: a local team with direct customer knowledge or a centralized team that may be able to act more systematically. Survey results suggest the local approach is achieving greater success.

There may, however, be an additional contributor to the greater success of European respondents to the Atradius Payment Practices Barometer in collecting receivables. North American respondents tend to rely on simple MS Office functions to manage receivables. European respondents are twice as likely as North Americans to use either standard credit management software or tailored tools to manage receivables. These resources can make the entire receivables management process more efficient and seamless.

Chemicals Industry Doing Reasonably Good Job of Finishing the Sale

On average, payments in the chemicals industry take between 45 and 60 days, and payment delays have decreased since 2008. While we expect fairly steady performance, the sector is cyclical and heavily tied to the overall health and strength of the economy. Therefore, any deterioration could lead to increased payment delays and defaults. However, insolvencies have not increased in 2012, and assuming the situation in the housing and motor industries does not worsen, this should continue. Danger of a downturn persists; therefore caution remains the rule of the day. Access to financial information can be difficult, but it is essential when considering large deals. At Atradius, we are reviewing more accounts on a quarterly basis and are adding more buyers to our watch list.

In the end, maximizing the effectiveness of the receivables management process is largely a balancing act. The business needs to employ a number of factors including checking the payment default risk of buyers before the sale; regularly reminding customers about outstanding invoices coming or being due; and using the most effective internal credit management structure, tools and resources to manage the process and collect the debts.

While the bottom line may not pinpoint one specific factor that is responsible for the higher occurrence of uncollectable receivables in North America than in Europe, it is clear that the combination of multiple factors will influence the ability to complete sales and increase profitability.

The complete reports highlighting the findings of the North American edition of the 2012 Atradius Payment Practices Barometer can be found in the Publications section of www.atradius.com. The Atradius Global Collections Review can be found in the Presentations and Reports section of the Atradius Collections website at www.atradiuscollections.com.

Contact

Atradius

Opladener Str. 14

50679 Köln

Germany

+49 221/2044-7523

+49 221/2044-7836