Chemicals in the Middle East

The Drive Towards Downstream Expansion

Leveraging Feedstocks' Advantage - Behind the Arabian Gulf petrochemical and chemical industry lies three decades of exceptional growth: leveraging advantaged feedstocks, economies of scale, integration and world-leading process technology to build a vibrant, influential and highly profitable petrochemical industry that is the envy of many other regions.

With almost 30% of the world's oil reserves and 23% of all natural gas reserves, the Gulf Cooperation Council (GCC) states - made up of Saudi Arabia, Bahrain, the United Arab Emirates (UAE), Oman, Qatar and Kuwait - have benefitted from compelling cost economics and the export of low-cost petrochemical commodities to rapidly growing Asian markets.

Unlike other petrochemical producing regions, the GCC is not co-located on a major market. It is ideally situated close to either Europe or Asia but it is unique in its dependence on its supply chain. The infrastructure has been developed in a relatively short period of time during which petrochemical exports had built up dramatically.

From an embryonic beginning in 1981, the first exports of polyethylene were shipped from Qatar followed by Saudi Arabia and Bahrain in the 1980s.

The region has longstanding relationships with downstream producers in Europe, Japan and the U.S. Additionally, on the World Bank's Ease of Doing Business 2013 Index, all GCC states outrank the key emerging chemical producing countries of China, India and Brazil.

Over the decades, the GCC has developed talented petrochemical leaders. Many of these CEOs have astutely developed global positions through acquisitions and alliances, and have made the GCC a pivotal player in the global petrochemical sector.

The GCC petrochemicals production capacity reached 127.8 million tons in 2012. The petrochemical industry in the region is currently concentrated in Saudi Arabia. It is the leading petrochemical producer across the region and home to SABIC, a global top-10 chemical producer by revenue. Saudi Arabia accounted for about two-thirds of the region's production capacity with annual petrochemical output reaching 86.4 million tons in 2012.

The region is continuing its focus on developing its infrastructure, supply chain and logistics as capacity limits are being reached. A series of investments are underway throughout the region. Over the next decade, Saudi Arabia alone intends to invest more than $367 billion in developing its infrastructure including petrochemicals. After Saudi Arabia, Qatar has the next largest GCC petrochemical plans. It plans to finance more than $10 billion worth of petrochemical projects next year and up to $34 billion on projects in the five years thereafter.

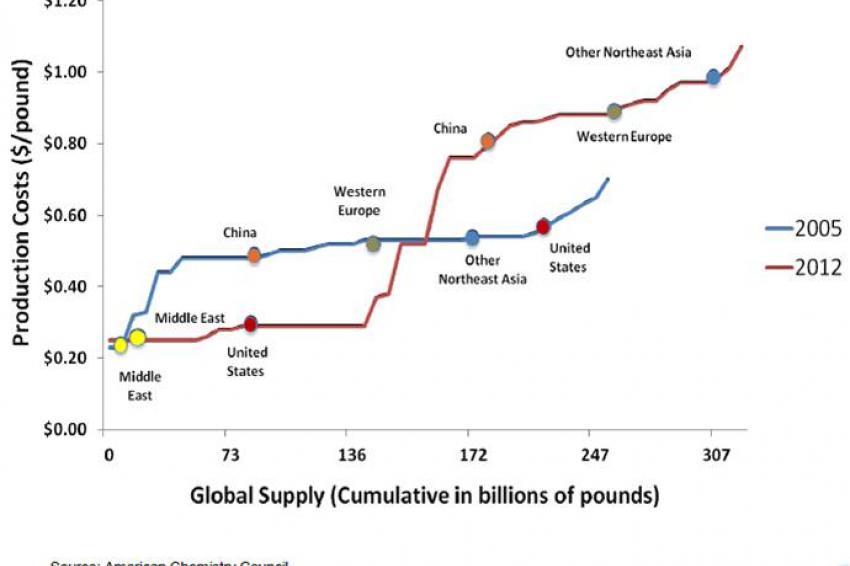

The growth of the region's petrochemical industry has been on the back of significant cost-advantageous feedstock, compared with other regions such as the U.S. and Europe. As per ICIS, Middle East crackers enjoy about 46% cost advantage relative to U.S. ethane crackers.

Moving Downstream

As per estimates by Gulf Petrochemical & Chemicals Association, the annual petrochemical production capacity in the GCC region is set to reach 191.2 million tons by 2020 (growing by 50% from 2012). Saudi Arabia, followed by Qatar and UAE will drive the growth, expected to add 40.6, 10 and 8.3 million tons respectively of additional capacity by 2020.

Gulf producers will be competing more intensively to successfully capture downstream demand in the emerging markets. Gulf producers will continue to focus on Asian markets, particularly China and India - markets driven by high demand for middle class products.

The GCC petrochemical industry is expected to face several regional and global challenges in coming years.

On the global level, shale gas discoveries in North America are reinvigorating North American petrochemical producers. In 2017, when the U.S. capacity starts coming on stream, a lot of low cost product will be supplying Asia as well. Furthermore, the development of coal-based technologies such as methanol-to-olefins (MTO) in Asia may also fundamentally influence their import needs. These new sources of supply will affect price and profitability margins. GCC producers will face a strategic dilemma - stay in Asia, competing alongside the U.S., or switch their export focus to Europe.

In a post-stimulus world, geopolitical tensions are high with greater risk of protectionism and uncertain confidence. This volatility plagues the certainty sought by financial investors. Furthermore, attempts to rein in inflation in overly stimulated economies could lead to a hard landing in some of the largest chemical markets in the world.

On the local front, the biggest threat the industry is expected to face is that of declining cost advantage due to the switch from light to mixed/heavy feed, resulting from the gas shortage. As per a report by ICIS, this can lead to a 24% disadvantage to U.S. ethane crackers. The feedstock scarcity in the Middle East region has forced the regional chemical producers to switch their strategies to focus on downstream manufacturing projects. The region will continue to expand downstream with clusters playing an increasingly important role in the manufacturing of specialty chemicals. Conversion parks will consume and add value to locally produced petrochemicals. The downstream expansion is considered to be less cyclical and is expected to provide stable returns in the long run.

The industry also is expected to face a severe shortage of skilled labor, such as professional technologists, despite the area's growing population, a large part of which is younger than 25. According to Gulf Petrochemicals and Chemicals Association (GPCA), petrochemicals account for about 6% of the total workforce in the GCC region and the region's petrochemical companies will need to approach skills shortage and strive to focus on developing a young talent base.

Historically, the industry has been commodity-focused, therefore access to advanced technology and know-how remains a challenge. Producing downstream derivative products is heavily dependent upon developing or acquiring the requisite technology and know-how.

GCC producers pursuing the downstream strategy will need to identify and gain access to key technologies, or develop them locally.

Securing Downstream Technology

The GCC chemical industry can exercise one of several options to gain the essential technology it needs for development.

- Joint ventures - Gulf producers can trade access to feedstocks for proprietary technology. An example of this is the rubber plant SABIC-Exxon Mobil joint venture announced in August 2012 for a combined investment of $3.4 billion. The JV is to develop a 400kt/y synthetic rubber manufacturing complex in Jubail, Saudi Arabia. The project is scheduled to be online by mid-2015 and is expected to deliver halobutyl rubber, ethylene propylene diene monomer (EPDM), carbon black, styrene butadiene rubber (SBR) and polybutadiene rubber.

- Technology licensing - Advanced technology can be licensed from foreign competitors, such as the SABIC agreement with Asahi Kasei and Mitsubishi Chemical to produce 200,000 mtpa of acrylonitrile.

- Buying and replicating - GCC companies could buy and replicate technology via acquisitions. The acquisition of European-based Borealis and Canadian based NOVA Chemicals by Abu Dhabi investors is an example of this strategy. More recently, in October, Oman Oil Company announced it will acquire Oxea (Germany), one of the largest global manufacturers of Oxo chemicals, from the private equity firm Advent International. With this acquisition, Oman aims to become a vertically integrated global chemical leader in the downstream industry with Oxea bringing its technology and expertise to Oman. A large part of technology and IP rests with management, so particular care must be taken to retain key management teams. An advantage GCC producers may have over their competitors in other emerging chemical markets is their legacy of deal-making in Western markets and ability to move quickly in M&A auction processes.

- Incentivize foreign investments - Special incentives (such as tax holidays and lower tax rates) could be offered by GCC states to foreign investors with leading edge technologies. These must be designed to compete with investment-attractive countries such as China.

- Developing new technology - This is the least feasible option as it takes time, which given the current rapidly changing market is simply not available.

So a new era has begun for the petrochemical producers in the region - strategic imperatives are changing, feedstocks are less accessible, refinery/petrochemical integration more essential and prevalent, added value more essential, decisions more complex and markets less certain.

But the region has enduring strengths that will secure its leadership role in the next decade - strong cash reserves, refinery/petrochemical integration, good infrastructure, feedstock advantages and proximity to both growth markets in Asia and established markets in Europe. Additionally, the region has long-standing relationships with downstream producers in Europe, Japan and the U.S. to bring the required technology to bear.

With the rapid expansion of its educated, urban youth, demographic pressures are increasingly making successful economic diversification and downstream expansion a necessity for the Gulf petrochemical industry. The challenge has been set.

Contact

KPMG AG Wirtschaftsprüfungsges.

Tersteegenstr. 19 -31

40474 Düsseldorf

Germany