Resilience Is the Strategy for Success in Volatile Markets

The Chemical Industry Has Developed Extraordinarily Well over the Past Years — Despite Numerous Crises

Stable through the Corona pandemic — the chemical industry has proven resilient even in this crisis. Between 2017 and 2021, the return for shareholders developed exceptionally well. By contrast, the first months of 2022 have been more difficult. The war in Ukraine, fluctuating prices for energy and raw materials, disrupted supply chains and inflation have taken their toll; demand in key customer groups such as the automotive industry has slumped. Nevertheless, even in these difficult times, the industry has outperformed others. For example, the total shareholder return (TSR) of the chemical industry has decreased half as much as the general stock market. This gives hope, as in the past the chemical sector has often been a trend barometer for general economic growth.

For its annual report, „Value Creation in Chemicals 2022 — Building Resilience as the Crisis Unfolds,“ strategy consultancy Boston Consulting Group examined the value performance of 351 of the world‘s leading chemical companies between 2017 and 2021.

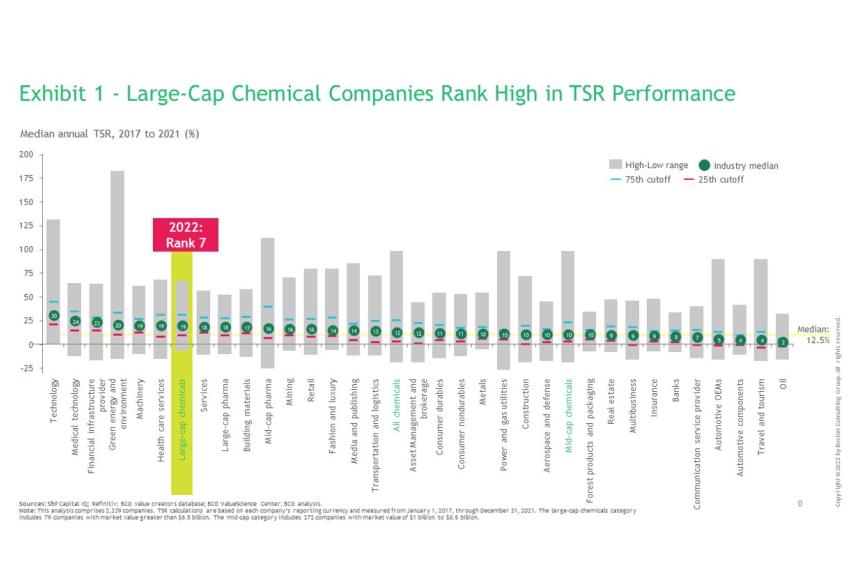

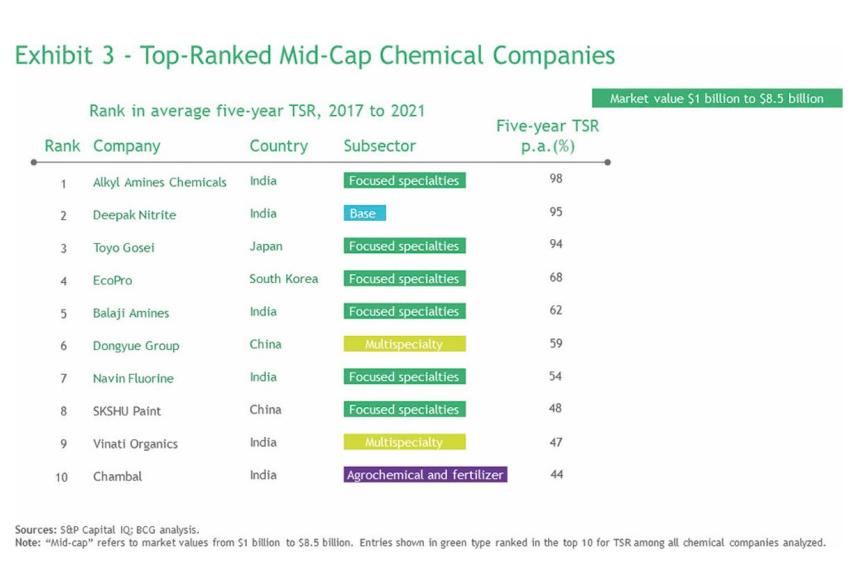

The 79 large-cap companies studied, i.e., companies with a market capitalization of more than $8.5 billion, are among the top ten of the 33 industries with the highest median TSR over the 5-year period. TSR takes into account the change in share price and other factors that affect shareholders‘ net worth over a given period, for example dividends. Compared with the last ranking, the largest chemical companies have risen from 16th to 7th place. The median annual TSR has increased from 11% to 19%. The 272 mid-cap companies with a market capitalization of more than $1 billion are also 3.5 percentage points above average, with a median TSR of 16%, putting them in 11th place. Among these companies are many comparatively young companies from India and China. They are growing rapidly, achieving a high TSR performance. They not only serve their home markets, they are also positioning themselves very quickly in regional markets.

All 351 companies surveyed achieved a median TSR of 12% – 4 percentage points higher than between 2015 and 2019. Even the downturn in the first half of 2022, which was mainly caused by war-related energy shortages, affected the chemical sector less than others. For example, the median (average) annual TSR did fall by 13% in the first half of 2022. However, public companies across all industries lost twice as much in the same period.

Focused Specialties on the Rise

In the latest ranking, companies from China and India dominate the top places. Of the ten large-cap companies, four are headquartered in China and mainly serve the domestic market — with the exception of Wanhua Chemical Group (rank 6). China‘s largest MDI producer has gradually expanded its market share and now dominates the global MDI market. Zhejiang Huayou Cobalt (ranked 7th), also from China, and South Korea‘s Posco Chemtech (ranked 1st) are benefiting from the electrification of the automotive industry as suppliers and producers of precursors for lithium batteries.

Demand for focused specialties rose sharply, particularly in markets affected by decarbonization and digitalization. Makers of semiconductors, electronic vehicles, and batteries have become increasingly important customers for Asian chemical players. The strategy of expanding the company‘s own portfolio into adjacent business areas was also successful. Zhejiang Satellite (ranked 10th), for example, expanded its petrochemical production capacities to offer a broader range of carbon-based products.

US specialty chemicals manufacturer Entegris (rank 4) has become a leading supplier to the semiconductor and high-tech industries through inorganic growth. The Dutch IMCD (rank 8) is one of the world‘s largest distribution companies for specialty chemicals.

One example of outstanding TSR performance is India‘s SRF (ranked 3rd), a multispecialty company that is successively expanding its portfolio in the specialty chemicals segment. With a five-year TSR of 52% annually, the company ranked third among the top ten large caps. SRF is one of the largest refrigerant manufacturers in India. The complete back-integration of production in this area has led to significant cost advantages. In addition, SFR has tapped into the large Indian domestic market in the agrochemicals and pharmaceuticals sectors

India Becomes the New China

Indian companies dominate the top ten mid-caps. Six out of ten companies come from there. The location benefits from supply bottlenecks in China which led to a market shift towards Indian companies. The domestic market for paints, refrigerants, pharmaceuticals, and industrial chemicals is also growing extremely rapidly. The prospects are good, especially since India itself has not had a significant chemical industry to date. Development is also being driven by the import of cheap Russian oil.

Dongyue Group ranks 6th among mid-caps and is also the highest ranked Chinese chemical company with an average TSR of 59%. Dongyue is among the major suppliers of polyvinylidene fluoride, which is used in lithium batteries. It also has businesses in fluoropolymers, organic silicones and refrigerants. In the first half of 2021 alone, sales growth was 178%.

“11 of the top 20 large-cap and mid-cap companies

come from the focused specialties subsector.”

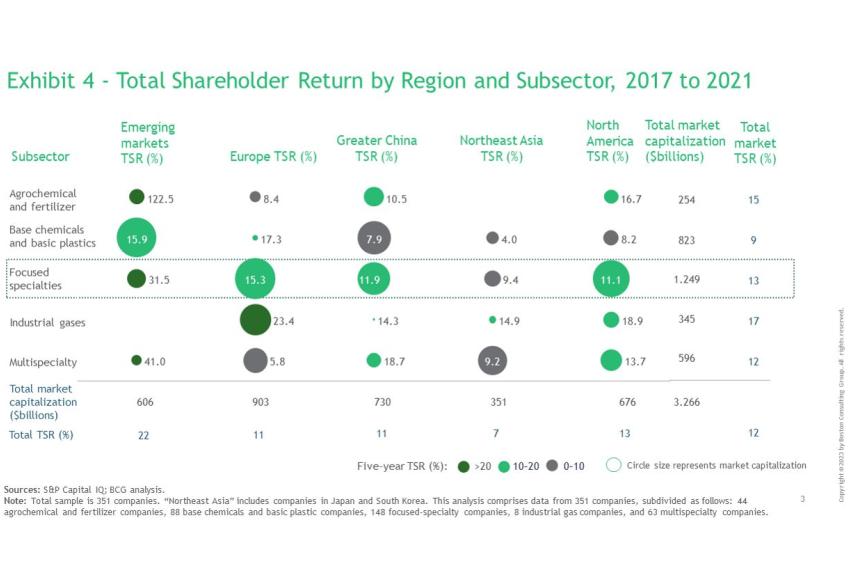

Looking at the TSR development of the chemical industry by subsector, a long-standing trend is confirmed: 11 of the top 20 large-cap and mid-cap companies come from the focused specialties subsector. This subsector achieves the best performance across all regions. The industrial gases subsector also continues the successful trend of recent years, with TSR rising from 13% to 17% compared with the last survey period. Multispecialties are also proving comparatively resistant to crises because they are mainly large companies. In volatile markets, they have advantages due to their diversification.

A key success factor for TSR performance is also the business model, as companies with a technology-based model have shown themselves to be particularly strong. They have proprietary intellectual capital, in-house research, and patents.

This group includes several suppliers of high-performance polymers, enzymes and catalysts for industrial processes, as well as companies specialized in the production of electronic chemicals used in the manufacture of semiconductors. In many cases, innovations like these are difficult to replicate or reproduce.

Building Resilience

“Every crisis offers a great opportunity for companies

to reposition themselves and create

competitive advantages.“

First and foremost, resilience means being able to adapt quickly to changing circumstances. Pandemic, Ukraine war and inflation — every crisis is over at some point, but the world is a different place afterwards. And every crisis offers a great opportunity for companies to reposition themselves and create competitive advantages. The successful companies in the industry conquered the crisis their own way, so there are no patent remedies. But there are strategies that have proven particularly effective. These include, first of all, an open analysis of possible scenarios for supply and demand. The goal is not to predict the future, but to identify measures that will make the company more resistant. In addition, it is important to implement measures that are necessary in the short term, such as pricing or cost optimization, quickly and expeditiously in order to increase the scope for action.

Besides changes in cost structures and assets, resilience requires new ways of working and faster decision-making processes. On this basis, chemical companies can develop a medium- and long-term plan to improve resilience. Existing weaknesses must be eliminated now to be prepared for the future — this includes the supply chain and production sites, human resources or the entire business model.

Although many companies in the industry are cautiously optimistic, the challenges are nevertheless great: they must maintain the ability to create value. In a much more volatile world, this is only possible if they are well prepared to adapt to changing conditions quickly and consistently.

Authors: Andreas Gocke, a Managing Director and Senior Partner, Boston Consulting Group, Munich, Germany

Adam Rothman, a Managing Director and Partner, Boston Consulting Group, Chicago, USA

Hubert Schönberger, a Knowledge Senior Director, Boston Consulting Group, Munich, Germany

Han Zhou, a Managing Director and Partner, Boston Consulting Group, Shanghai, China

Frederik Flock, a Partner, Boston Consulting Group, Chicago, USA

Downloads

Contact

BCG The Boston Consulting Group GmbH

Ludwigstr. 21

80539 München

Germany