The Success Story of Biosimilars

Since the Appearance of these Follow-on Drugs in 2006, They Have Increasingly Replaced Original Biopharmaceuticals

The development of biosimilars is one of the more recent success stories in the pharmaceutical industry. Since these drugs first appeared on the European market in 2006, they have increasingly replaced original biopharmaceuticals whose patents are expiring. In the process, they often achieve high market shares from a standing start. However, with their triumphant advance, biosimilars are also setting in motion the usual market mechanisms. Biopharma interest groups warn against the automatic substitution of originator drugs and argue that price wars could lead to the relocation of production.

At the end of January 2023, the best-selling Humira was also lost in the USA: The biotech group Amgen launched Amjevita, the first biosimilar to AbbVie’s number one sales driver. This also heralded the end of Humira’s 20-year dominance in the world’s largest pharmaceutical market as the biologic with the highest annual sales of all time, at more than $21 billion.

Humira, which contains the active ingredient adalimumab, is used primarily to treat severe inflammatory diseases such as rheumatoid arthritis. For almost seven years, Abbvie had tried to fend off the threat to its blockbuster therapeutic from adalimumab biosimilars in the United States by means of patent and legal disputes. While this succeeded for a long time on the other side of the Atlantic, also thanks to several settlements, Abbvie was less able to fend off the troublesome competition in Europe. The first Humira biosimilars came onto the market here four years earlier, and as of June 2023 there were already ten.

This example is representative of the rise of this still comparatively young generation of drugs. The basis for the emergence of biosimilars is original biopharmaceutical drugs, which usually have a complex molecular structure. According to the Pro Generika association, these are becoming increasingly important for our drug supply — biopharmaceuticals account for almost one-third of the German pharmaceutical market. In addition to insulins, these include corona vaccines and novel immunotherapies for the treatment of cancer for example. When the patents on these products expire after 20 years, the time has come for biosimilars. Although these successor products are just as complex in structure as the originals and also require considerable development effort, they are generally significantly less expensive than the reference product and thus help to relieve the financial burden on healthcare providers.

76 Biosimilar Approvals in the EU

According to figures from the European Union, 76 biosimilars are currently approved centrally by the European Medicines Agency (EMA). In addition to biosimilars for the arthritis product Humira, these include follow-on products for monoclonal cancer antibodies, the ophthalmic drug ranibizumab, the anemia product epoetin alfa, the rheumatism drug etanercept, the autoimmune drug infliximab, the diabetes drug insulin aspart, or the immunostimulator pegfilgrastim.

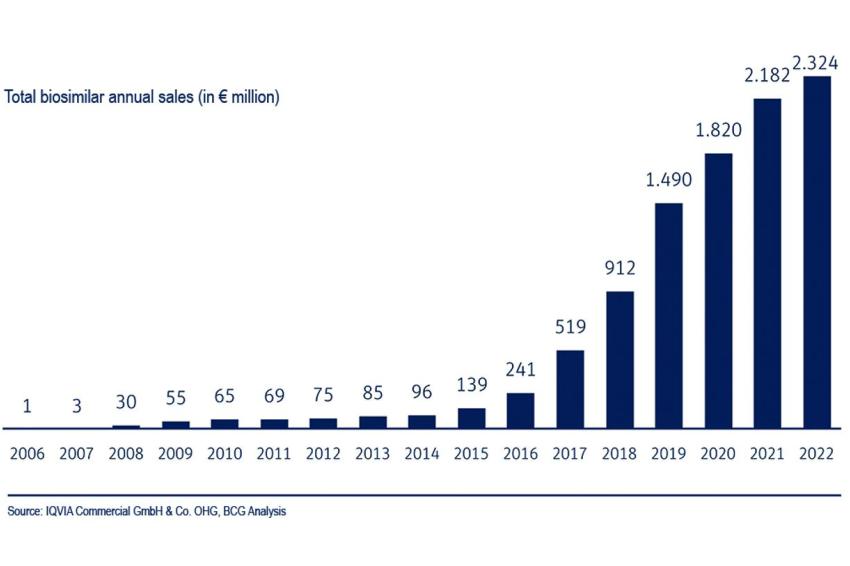

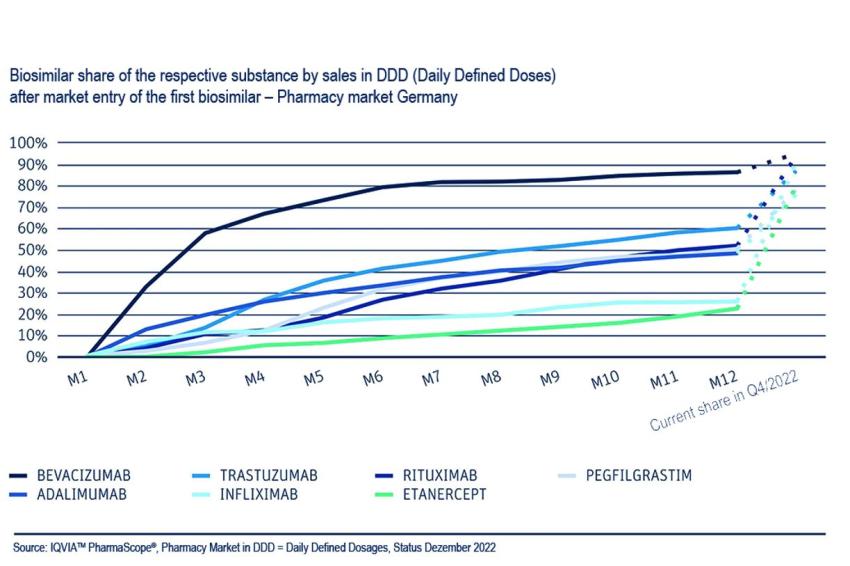

Biosimilars usually show a steep growth curve with their market launch. In Germany, for example, they achieve market shares of up to 80% in the first year. According to figures from the Boston Consulting Group (BCG) and VFA bio, the biotechnology interest group in the German Association of Research-Based Pharmaceutical Companies (VFA), their share of sales in 2022 averaged 64%, while total sales in the German market rose by 7% year-on-year to €2.3 billion in 2022. The authors also determined that biosimilars achieved a sales share of 92% in the pharmacy market at the end of 2021 in the case of the active ingredient rituximab, 90% for bevacizumab, 89% for infliximab and 85% for trastuzumab. In addition, on average three biosimilars competed with the original.

The numbers show: Competition with biosimilars is working, both in terms of the pace of market penetration and the share of prescriptions. These products are also helping to improve patient care, according to biopharma associations.

However, the success of downstream products depends on a number of factors. A decisive one, in addition to the number of biosimilar products available, is the price difference compared to the originator product. Only if this is large enough physicians will feel an incentive to prescribe the biosimilar to their patients, which in case of doubt is less well known than the original. One example: the cost of Humira biosimilars in Denmark fell by 82% from September 2018 to December 2018. In addition to price, education plays an important role. Experience shows that biosimilars only gain acceptance if physicians and patients feel they are informed in a factual and up-to-date manner.

Different Speeds

However, market penetration in Europe and the USA is proceeding at different speeds. While the United States is often ahead in innovation, the opposite is true for biosimilars, where Europe is much faster. The main reasons for this are patent disputes, which numerous pharmaceutical companies in the USA are pursuing with all their might against their competitors — as in the case of Humira.

Although the main patent for Humira’s active ingredient expired back in 2016, AbbVie was able to maintain its market exclusivity for many more years through more than 100 additional Humira patents. This resulted in patent infringement proceedings, but also in financial settlements that AbbVie reached with competitors. These included, for example, biosimilar manufacturers taking their time with market entry and paying AbbVie a royalty upon market launch.

Restraint in the USA

In addition, it is possible that the availability of biosimilars in the USA could be deliberately restricted. For example, the powerful pharmacy benefit managers can influence whether and how many Humira biosimilar options are offered in their drug lists. Many experts fear that ultimately only a few Humira biosimilars will have access to the US market and many will not even be listed. In addition, health insurers’ contracting practices could help preserve sales of more expensive brand-name drugs.

This development is also reflected at the financial level; price reductions following the market launch of biosimilars in Europe and the USA diverge significantly. Experts therefore expect that Humira biosimilars will not lead to cost savings in the USA as quickly or as significantly as in Europe.

Resistance to Automatic Substitution

But the German biosimilar market is not all sunshine either. The European Medicines Agency (EMA) and the heads of national medicines agencies (HMAs) argue that biosimilars approved in the European Union (EU) are scientifically interchangeable with originator products in pharmacies. The German Federal Institute for Drugs and Medical Devices (BfArM) supports this position. The substitution would automatically make the most favorable biosimilar subject to prescription. Originally, biotechnologically manufactured drugs were to be automatically substituted for each other in pharmacies starting in August 2022.

“Politicians must not make the same mistake as

with generics and endanger the competitiveness

of European manufacturers.”

Shortly before, this date was postponed by one year, but has since been decided by the Federal Joint Committee (G-BA), albeit with the possibility of exceptions.

However, the pharmaceutical associations and biopharma interest groups BAH, BPI, AG Pro Biosimilars and VFA are vehemently opposed to the automatic substitution of original biopharmaceuticals by biosimilars. They argue that there is no reason for automatic substitution in view of the stable financing of the statutory health insurance funds: The biosimilar market is functioning and competition is in full swing. With instructions on the prescription of biopharmaceuticals for physicians anchored in law in 2021, sufficient care has already been taken to ensure that biopharmaceuticals are prescribed economically and used safely.

This group considers automatic substitution of biopharmaceuticals to be simply “dangerous.” The lobbyists refer to a regulation anchored in the SHI Financial Stabilization Act and “warn of the negative consequences for Europe, which is currently still a robust biotech production location, and for supply security.” Politicians must not make the same mistake as with generics and endanger the competitiveness of European manufacturers through unrestrained cost containment in the SHI system, they say.

“Ultimately, this discussion shows

that biosimilars have arrived at the center

of the pharmaceutical market and patient care.”

In this context, Pro Generika points out that two thirds of generic active ingredients are now produced in Asia, especially in China and India. In biosimilar production, however, the situation is still different: More than 50% of the biosimilar active ingredients intended for the European market are still produced in Europe, 30% of them in Germany.

However, Europe’s lead in global location competition is melting, and global competition in the biosimilar market is becoming increasingly intense. Asian manufacturers in particular are expanding their expertise in biotechnological production and development: China and India have risen to become the world’s leading nations in biotech research and manufacturing in recent years, he said. The first biosimilar active ingredients are already being manufactured exclusively in China.

The argument of the opponents of substitution is that once pharmaceutical production has migrated, it is difficult to bring it back. From the point of view of the resilience of the healthcare system, the slogan is therefore clear: “If you want reshoring, you have to avoid offshoring.”

But perhaps the concern behind this outcry is that it could be made too easy for biosimilar manufacturers to replace the often financially very lucrative original products at the stroke of a pen. Who likes to give up lucrative sales? Ultimately, however, this discussion shows that biosimilars have arrived at the center of the pharmaceutical market and patient care.

Author: Thorsten Schüller, CHEManager

_________________________________________

Biosimilars — Similar, But Not Identical

Biosimilars are biological drugs that, like generics, refer to a reference drug. Unlike generics, however, biosimilars produced using biotechnology are not 100% identical to the reference drug due to the complexity of the active ingredients and the inherent variability. This is because all biologics have in common that they exhibit a slight variability in structure due to their production in living cell systems with the same amino acid sequence.

Biosimilars are therefore considered to be biotechnologically similar. To ensure the efficacy and safety of these drugs, the applicant must demonstrate that the existing variations from the reference drug are minimal and do not affect efficacy and safety. In addition, to prove “biosimilarity” with the reference drug, extensive comparative analytical and often clinical studies must be submitted.

Biosimilars exist for various antibody drugs for cancer or autoimmune diseases, among others, but also for insulins and other messenger substances. Since the first biosimilar was approved in Europe in 2006, 76 biosimilars have been centrally approved to date (as of July 3, 2023). (Sources: Bfarm/vfa)