Markets & Companies

WEF’s Global Competitiveness Index 2019

Building Shared Prosperity and Managing the Transition to a Sustainable Economy

The results of the 2019 Global Competitiveness Index (GCI) reveal that, on average, most economies continue to be far from the competitiveness “frontier” – the aggregate ideal across all factors of competitiveness. Performance is also mixed across the 12 pillars of the index. The report demonstrates that 10 years on from the financial crisis, while central banks have injected nearly $10 trillion into the global economy, productivity-enhancing investments such as new infrastructure, R&D and skills development in the current and future workforce have been suboptimal.

As monetary policies begin to run out of steam, it is crucial for economies to rely on fiscal policy, structural reforms and public incentives to allocate more resources towards the full range of factors of productivity to fully leverage the new opportunities provided by the Fourth Industrial Revolution.

Europe Denmark (10) can already rely on a stable macroeconomic environment, widespread ICT adoption, modern skills and a robust labor market. An aspect where Denmark took a slight step backward in 2019 is innovation. France (15) shows strengths in macroeconomic stability, health, infrastructure, financial system development and market size. It is an innovation hub but would benefit from a stronger entrepreneurial culture and a boost in ICT adoption. Germany (7) boasts the world‘s best innovation capability. Other strengths include infrastructure, macroeconomic stability, market size, and health. However, the level of ICT adoption is relatively low. Italy (30) has improved its financial system, access to finance to both SMEs and venture capital, ICT adoption and infrastructure. Its ability to innovate also remains competitive. Yet some bottlenecks, like high public debt, are still limiting Italy’s potential. The Netherlands (4) is the most competitive country in Europe. It receives high marks for macroeconomic stability and infrastructure quality. The country‘s innovation ecosystem benefits from a vibrant business dynamism and high innovation capability. Switzerland (5) obtains the maximum score on the macroeconomic stability pillar and a near perfect score for infrastructure. In addition, the country is one of the world’s top three innovators. However, market efficiency and business dynamism could be improved. Turkey (6) advances on ICT adoption, infrastructure and labor market pillars. On the other hand, Turkey’s progress in this area is counterbalanced by a significant deterioration of its macroeconomic environment, driven mainly by higher inflation. The strengths of the United Kingdom (9) include macroeconomic stability, infrastructure and financial system development. Business dynamism and innovation capability have weakened, and market efficiency has dropped sharply – a result of lower domestic competition and trade openness.

Eurasia The macroeconomic environment of the Russian Federation (43) has improved substantially. In addition, it has enhanced its innovation capability which is also supported by increased ICT adoption. On the other hand, insufficient access to finance is limiting the competitiveness of Russian firms.

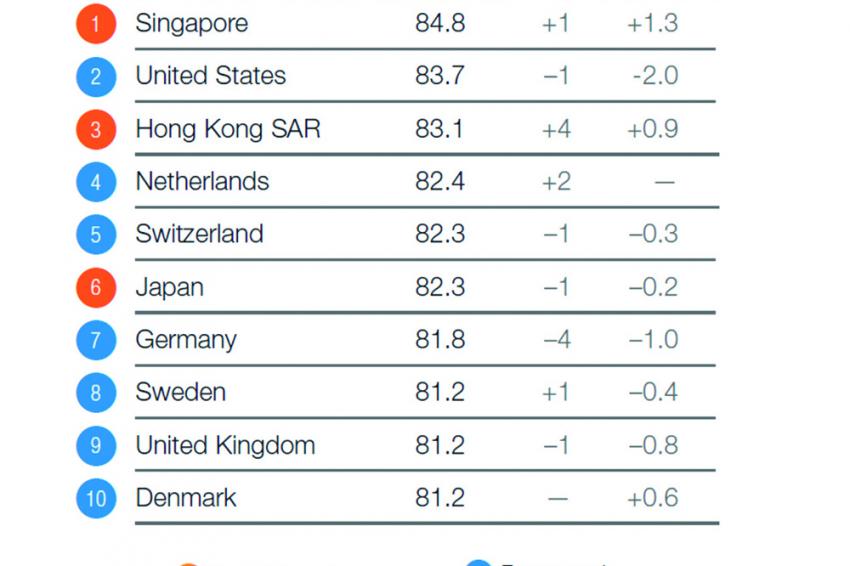

East Asia and Pacific China (28) is by far the best performer among the BRICS economies, driven by the size of its market and macroeconomic stability. In several areas, China’s performance is almost on par with OECD standards and it has been rapidly increasing its innovation capability. However, the country would benefit from a more intense competition and better allocation of resources. Australia (16) features strengths that include macroeconomic stability, skills and financial system development. Its performance is largely in line with the OECD average. Hong Kong SAR (3) is leading on four pillars: macroeconomic stability, health, financial system and product market. Furthermore, it ranks high on the infrastructure and ICT adoption pillars. Hong Kong’s biggest weakness is its limited capability to innovate. The main strengths of Indonesia (50) are its market size and macroeconomic stability. It boasts a vibrant business culture, a stable financial system and a high rate of technology adoption. Innovation capacity remains limited but is increasing. Japan (6) is one of the most technology-savvy nations in the world and its financial sector is large, deep and stable. The country also benefits from its large market size. On the downside, risk aversion and rigid corporate culture undermine Japan’s business dynamism and innovation capability. The Republic of Korea (13) leads the world in ICT adoption and macroeconomic stability, and is one of the world’s innovation hubs. The weakest aspect of Korea’s performance is market inefficiencies, due primarily to the lack of domestic competition and high trade barriers. Singapore leads this year’s GCI 4.0 rankings. The country tops the infrastructure, health, labor market and financial system pillars, and achieves a nearly perfect score for macroeconomic stability. Performance in terms of market efficiency is driven by the fact that Singapore is the most open economy in the world.

South Asia India (68) is among the low-performing BRICS countries. It ranks high on macroeconomic stability and market size, and its financial sector is relatively deep and stable. It performs well when it comes to innovation. ICT adoption is limited but has improved sharply, and product market efficiency is undermined by a lack of trade openness.

Middle East and North Africa Israel (20) is an innovation hub and spends the most of any country on R&D. It can also rely on a highly educated workforce. Market efficiency suffers from a relative lack of competition and barriers to entry. Saudi Arabia (36) continues to diversify its economy. ICT adoption and innovation capability are gradually improving. However, business dynamism is still limited by regulations that slow the entry and exit of new companies. The United Arab Emirates (25) significantly improves on the ICT adoption and skills pillars, complementing the stable macroeconomic environment, sound product market and infrastructure. Further, the financial system is well-developed.

Sub-Saharan Africa Mauritius (52), still the regional leader, is well-positioned in terms of institutional quality. It has further imroved its infrastructure and ICT adoption and is one of the most open countries in the world. However, the country‘s macroeconomic stability has slightly decreased. South Africa (60) is a regional financial hub. It has also one of the most advanced transport infrastructures in the region and is among the top countries in Africa for market size. Its competitiveness is being held back by relatively low business dynamism.

Americas Despite Argentina’s (83) recent efforts to stabilize its economy, resurging inflation and increasing deficits have led to a less stable macroeconomic context. Resolving the duality of labor market and strengthening the financial system is high on Argentina’s economic agenda. The score of Brazil (71) has been driven mainly by a significant simplification of regulations to start and close a business and by lower inflation. In addition, it also benefits from a relatively high innovation capability and from the size of its market. Canada’s (14) economy has been hit by global trade tensions. However, it remains a competitive economy with very stable macroeconomic conditions and a sound financial system. Greater investments in R&D and collaboration between companies, universities and research centers would improve Canada’s competitiveness. Chile (33) maintains a steady performance and leads the Latin America and Caribbean region. It can count on a stable macro-economic context, thanks to low inflation and low public debt, competitive and open markets and a strong financial system. Mexico’s (48) competitiveness performance is mixed, but at least it has achieved some progress on all its four lowest-ranked pillars: institutions, labor market, skills and ICT adoption. The performance of the United States (2) in several pillars is affected this year. In particular, product market, domestic competition and trade openness rank lower than in 2018. Despite an overall weaker performance, the US is still an innovation powerhouse, boasting the second-largest market, and has one of the most dynamic financial systems in the world.

As monetary policies begin to run out of steam, it is crucial for economies to rely on fiscal policy, structural reforms and public incentives to allocate more resources towards the full range of factors of productivity to fully leverage the new opportunities provided by the Fourth Industrial Revolution.

Europe Denmark (10) can already rely on a stable macroeconomic environment, widespread ICT adoption, modern skills and a robust labor market. An aspect where Denmark took a slight step backward in 2019 is innovation. France (15) shows strengths in macroeconomic stability, health, infrastructure, financial system development and market size. It is an innovation hub but would benefit from a stronger entrepreneurial culture and a boost in ICT adoption. Germany (7) boasts the world‘s best innovation capability. Other strengths include infrastructure, macroeconomic stability, market size, and health. However, the level of ICT adoption is relatively low. Italy (30) has improved its financial system, access to finance to both SMEs and venture capital, ICT adoption and infrastructure. Its ability to innovate also remains competitive. Yet some bottlenecks, like high public debt, are still limiting Italy’s potential. The Netherlands (4) is the most competitive country in Europe. It receives high marks for macroeconomic stability and infrastructure quality. The country‘s innovation ecosystem benefits from a vibrant business dynamism and high innovation capability. Switzerland (5) obtains the maximum score on the macroeconomic stability pillar and a near perfect score for infrastructure. In addition, the country is one of the world’s top three innovators. However, market efficiency and business dynamism could be improved. Turkey (6) advances on ICT adoption, infrastructure and labor market pillars. On the other hand, Turkey’s progress in this area is counterbalanced by a significant deterioration of its macroeconomic environment, driven mainly by higher inflation. The strengths of the United Kingdom (9) include macroeconomic stability, infrastructure and financial system development. Business dynamism and innovation capability have weakened, and market efficiency has dropped sharply – a result of lower domestic competition and trade openness.

Eurasia The macroeconomic environment of the Russian Federation (43) has improved substantially. In addition, it has enhanced its innovation capability which is also supported by increased ICT adoption. On the other hand, insufficient access to finance is limiting the competitiveness of Russian firms.

East Asia and Pacific China (28) is by far the best performer among the BRICS economies, driven by the size of its market and macroeconomic stability. In several areas, China’s performance is almost on par with OECD standards and it has been rapidly increasing its innovation capability. However, the country would benefit from a more intense competition and better allocation of resources. Australia (16) features strengths that include macroeconomic stability, skills and financial system development. Its performance is largely in line with the OECD average. Hong Kong SAR (3) is leading on four pillars: macroeconomic stability, health, financial system and product market. Furthermore, it ranks high on the infrastructure and ICT adoption pillars. Hong Kong’s biggest weakness is its limited capability to innovate. The main strengths of Indonesia (50) are its market size and macroeconomic stability. It boasts a vibrant business culture, a stable financial system and a high rate of technology adoption. Innovation capacity remains limited but is increasing. Japan (6) is one of the most technology-savvy nations in the world and its financial sector is large, deep and stable. The country also benefits from its large market size. On the downside, risk aversion and rigid corporate culture undermine Japan’s business dynamism and innovation capability. The Republic of Korea (13) leads the world in ICT adoption and macroeconomic stability, and is one of the world’s innovation hubs. The weakest aspect of Korea’s performance is market inefficiencies, due primarily to the lack of domestic competition and high trade barriers. Singapore leads this year’s GCI 4.0 rankings. The country tops the infrastructure, health, labor market and financial system pillars, and achieves a nearly perfect score for macroeconomic stability. Performance in terms of market efficiency is driven by the fact that Singapore is the most open economy in the world.

South Asia India (68) is among the low-performing BRICS countries. It ranks high on macroeconomic stability and market size, and its financial sector is relatively deep and stable. It performs well when it comes to innovation. ICT adoption is limited but has improved sharply, and product market efficiency is undermined by a lack of trade openness.

Middle East and North Africa Israel (20) is an innovation hub and spends the most of any country on R&D. It can also rely on a highly educated workforce. Market efficiency suffers from a relative lack of competition and barriers to entry. Saudi Arabia (36) continues to diversify its economy. ICT adoption and innovation capability are gradually improving. However, business dynamism is still limited by regulations that slow the entry and exit of new companies. The United Arab Emirates (25) significantly improves on the ICT adoption and skills pillars, complementing the stable macroeconomic environment, sound product market and infrastructure. Further, the financial system is well-developed.

Sub-Saharan Africa Mauritius (52), still the regional leader, is well-positioned in terms of institutional quality. It has further imroved its infrastructure and ICT adoption and is one of the most open countries in the world. However, the country‘s macroeconomic stability has slightly decreased. South Africa (60) is a regional financial hub. It has also one of the most advanced transport infrastructures in the region and is among the top countries in Africa for market size. Its competitiveness is being held back by relatively low business dynamism.

Americas Despite Argentina’s (83) recent efforts to stabilize its economy, resurging inflation and increasing deficits have led to a less stable macroeconomic context. Resolving the duality of labor market and strengthening the financial system is high on Argentina’s economic agenda. The score of Brazil (71) has been driven mainly by a significant simplification of regulations to start and close a business and by lower inflation. In addition, it also benefits from a relatively high innovation capability and from the size of its market. Canada’s (14) economy has been hit by global trade tensions. However, it remains a competitive economy with very stable macroeconomic conditions and a sound financial system. Greater investments in R&D and collaboration between companies, universities and research centers would improve Canada’s competitiveness. Chile (33) maintains a steady performance and leads the Latin America and Caribbean region. It can count on a stable macro-economic context, thanks to low inflation and low public debt, competitive and open markets and a strong financial system. Mexico’s (48) competitiveness performance is mixed, but at least it has achieved some progress on all its four lowest-ranked pillars: institutions, labor market, skills and ICT adoption. The performance of the United States (2) in several pillars is affected this year. In particular, product market, domestic competition and trade openness rank lower than in 2018. Despite an overall weaker performance, the US is still an innovation powerhouse, boasting the second-largest market, and has one of the most dynamic financial systems in the world.

This article is based on the Global Competitiveness Report 2019, issued by the World Economic Forum (WEF). The complete report is available at bit.ly/GCR-2019.