Portfolio Management

The Art of Making the Right Choices

Planning Ahead - We are faced with choices in most aspects of life. In the majority of cases the consequences of our choices are relatively limited and, while we may weigh up alternative attributes, we do not do so consciously. However when the choices have serious and long-term consequences, for example the future shape of the portfolio of a pharmaceutical company, a far more systematic approach is needed. My purpose here is to take an overview of the method of choice known as Portfolio Management.

The pharmaceutical industry is at a crucial stage. Potential loss of revenue from drugs on the market and currently protected by patents is estimated to amount to between €50-70 billion between 2010 and 2015. Productivity, measured by comparing cost with the number of new entities launched, is low. To quote from a recent report from Price Waterhouse Coopers "The industry is investing twice as much in R&D as it was ten years ago to produce two-fifths of the medicines it then produced."

Although there have been some improvements in this situation over the past year, the underlying factors remain the same. For example, looking across the Pharma industry, the success rate (measured as the percentage of products reaching launch) for compounds entering the first phase of development remains at about 8-10% and this number has not changed significantly despite major scientific advances in recent years.

We are working in a changing market place where focus on the patient is paramount. We will increasingly look at overall solutions, including diagnostics to ensure that drugs are administered to patients most likely to respond and least likely to suffer adverse effects. Devices to make administration simpler and improve compliance will be developed in parallel with the drugs themselves and this will in turn lead us into new alliances between pharmaceutical companies and device designers.

These new strategic directions are likely to lead to more complex and dynamic portfolios and in turn to a greater need for effective choices.

Portfolio Evaluation and Management

The function of portfolio management is clearly differentiated from project management although there are many close interactions between the two. To use a well known definition portfolio management is about doing the right projects (the definition of the word right in this context varies with circumstances). Project management, is concerned with doing the projects right (delivering the required outcome of appropriate quality on time and within budget).

Although the prioritization of projects within a portfolio is an important deliverable for portfolio management, it is not the only one. The determination of which combination of projects will deliver value in line with company strategy is a central objective, combined with the ability to look into the consequences of different scenarios.

Evaluation

Evaluation of the portfolio (and the projects within it) is in general based upon four main pillars, value, cost, risk and timing. A number of other criteria, for example strategic fit, may also be taken into account.

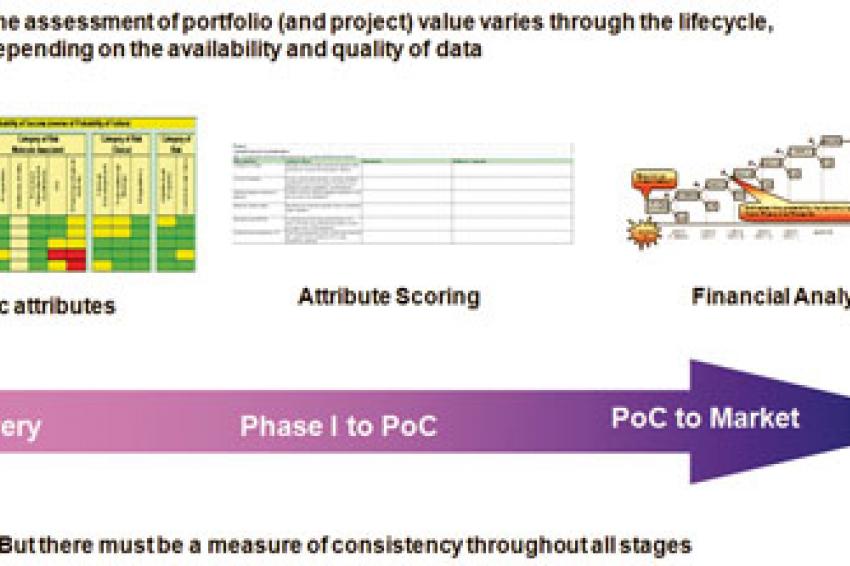

The way in which value is assigned to a project depends very much on where it sits in the project lifecycle (fig 1). In the early stages a financial evaluation is less likely to be helpful because even if the primary target disease is identified, predicting the characteristics of a specific drug some 8-10 years ahead of launch will be difficult - assessing the price which might be achieved or the competitive position even more so. In many cases, therefore, we must rely on some surrogate measure of value related to the actual or required characteristics of the drug and the market into which it will be launched.

In Discovery Research the most significant attributes will be associated with the scientific data supporting the molecule. As a method of evaluation, the attributes can simply be color coded (Green, acceptable; Yellow, possible issue; Red, warning) to give a qualitative feel for the potential of the candidate drug.

Later in development during phase 1 and up to Proof of Concept (POC) as knowledge is gained on the potential drug and the disease(s) for which it may be useful, the scientific attributes will be better defined and it will be possible to add more detail on commercial measures (size of market, potential competitive environment, time from planned launch to loss of patent exclusivity). The aim at this point is to score the attributes in some way in order to provide at least a semi-quantitative surrogate view of value.

Beyond POC, the emphasis generally moves to financial measures of which the most frequently used is Risk-adjusted net present value (RANPV). The net present value summarizes the overall project value (taking into account cost and revenue) in today's money. The RANPV also takes into account the technical risk of failure to launch by reducing the NPV in line with identified risks.

Consistency

To ensure that projects within the portfolio are treated on an equable basis it is important that all the data used are based on a consistent definition of the project objectives. In addition as the evaluation of project attributes is to some extent subjective cross-checking the data with the appropriate stakeholders in advance of the analysis avoids what should be a discussion on the relative merits of different portfolio scenarios becoming a critique of the data contained in the analysis.

Moreover, it is essential to ensure that sanity checks are in place following the analysis. For example it may be that a project which is of strategic importance but not particularly high monetary value would be excluded from the optimal portfolio based purely on the numbers generated.

Outcome

Clearly any analysis is only useful insofar as it supports decision making by the appropriate group of senior managers. Clear recommendations are needed and ideally alternative scenarios should be presented for consideration. These alternatives could include, for example, taking on more or less risk or considering the scheduling of projects to optimize delivery in particular therapeutic areas. When decisions regarding what is or is not considered to be the optimal portfolio are made they need to suggest clear courses of action and be clearly communicated.

While regular set-piece analyses form part of the strategic planning cycles of most companies, the process should allow for ad-hoc reviews to examine the effect of internal and external change on the portfolio.

Contact

UCB Pharma GmbH

Alfred-Nobel-Str. 10

40789 Monheim

Germany