M&A Activity Will Continue, No Doubt!

Chemical Distribution Mergers & Acquisitions Activity in a Post-Covid-19 Economy

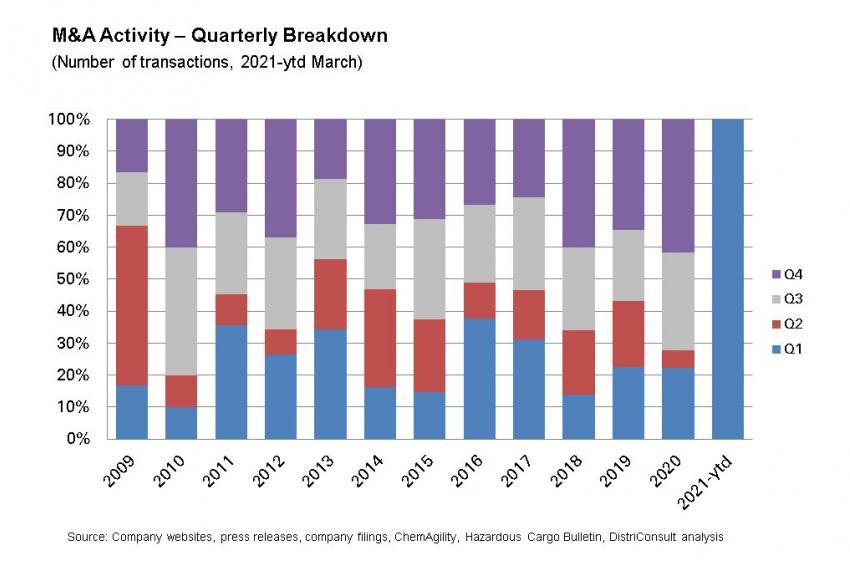

About this time last year, just when Covid-19 related lockdowns had begun to influence business and private life dramatically, everybody was anxiously looking at how mergers & acquisitions (M&A) activity in chemical distribution would develop. Looking back, one can say that the first quarter of 2020 was actually quite good with eight reported transactions. Not quite as good as Q4-2019 with 20 transactions though, and also not nearly as good as Q1 of the previous year with 13 transactions.

But 2019 had overall been the most active year since the financial crisis of 2008/09 with an almost 40% higher activity level than the previous years on average. As transactions take some time to develop, all this was no big surprise. The work had mostly been done before travel and meeting restrictions cut in, so all that was left was to let the ink dry on the contracts, have a few drinks (an activity which had to be postponed in most cases) and then send out the press releases. Then things started to change quickly and significantly.

Chemical distributor M&A activity in 2020 was the lowest in seven years. But let us be clear, this is likely to be an exception. Activity levels did drop in Q2 and Q3 of 2020 to two and 11 reported transactions respectively. But later on things started to rebound. For Q4-2020 we recorded 15 transactions, one of the highest quarterly activity levels in history. In the last three months up to end of March this year, another 17 transactions were announced, nine of these in January alone. There is the theory that some of those transaction just could not be signed by year-end and where hence pushed into 2021. And most people agree, there is doubtlessly more to come.

Drivers of M&A Activity

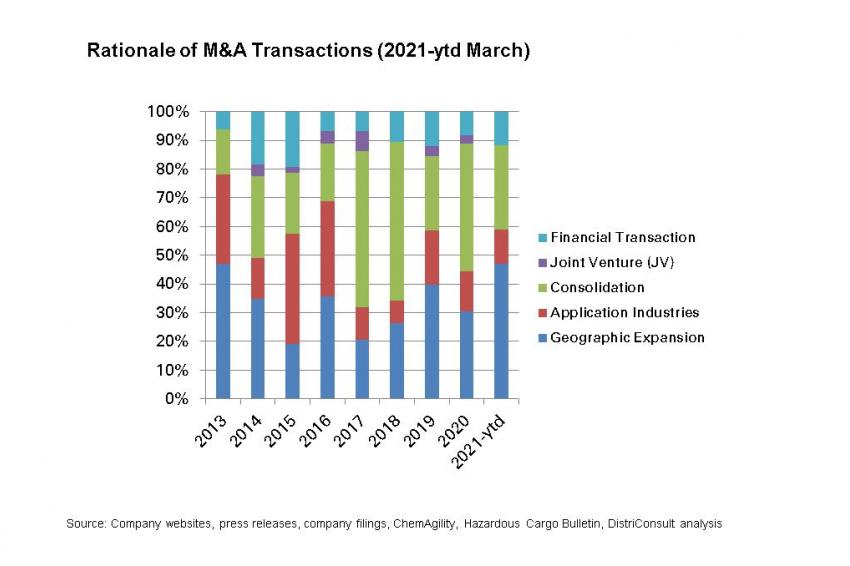

A number of developments in the chemical distribution industry do have an impact on M&A activity. The various stakeholders have vested interests here. Let us start with customers and their needs. Customers and their’ needs typically do not exert a strong influence on the level of M&A activity. The “formulator” companies that distributors sell the products to are typically interested in working with distributors that are reliable suppliers of a targeted portfolio of products fit for purpose, available locally on short notice, and marketed at a competitive price as well as attractive delivery and payment terms. Company size does not matter that much here, but other criteria such as scope, technical expertise, responsiveness or an understanding for the “small, local guy” do. So vis-à-vis distributor M&A activities the customers are sort of “neutral”. Suppliers are different though. More and more chemical producers want to work with a distribution partner that can service a whole continent, rather than working with a long list of “local champions”, a different one in each country, as it was often the case in the past. For these chemical companies a ”reduction of complexity” is high on the list of objectives. M&A projects by their preferred distributors can help here, provided the acquisition targets are carefully selected, the projects are well executed and the acquired companies are thoughtfully integrated. In this context, the size (of a distributor) matters, particularly with regards to the need to have “critical mass”.

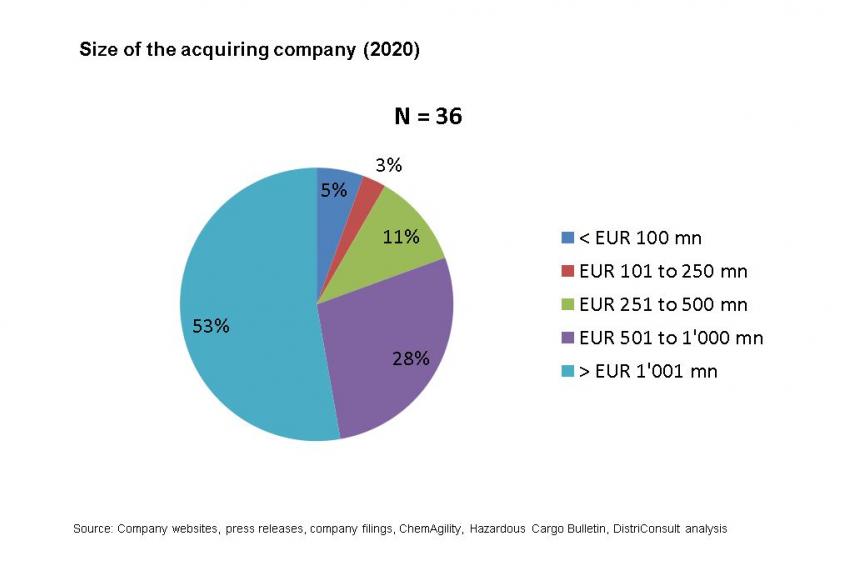

How the incumbent population of distributors in a given geography / industry market combination thinks and how the individual companies position themselves is a big factor in M&A. The larger distribution groups that are stock exchange listed (e.g. Brenntag, DKSH, IMCD and Univar) or are owned by private equity investors (e.g. Azelis) have always looked at acquisitions to enhance their growth rates, both in terms of sales and operating profits. Over the last few years, a number of mid-sized companies have taken financial investors on board (e.g. Barentz, Biesterfeld, Caldic or Oqema) and then subsequently ramped up M&A activities. Access to financing is also no issue to these two groups of companies, as there is plenty of liquidity in the market that is looking for attractive investment opportunities that are exhibiting good returns. More than half of the transactions recorded in 2020 were done by distribution companies with a turnover in excess of €1 billion.

It should be noted in this context that our statistics may not cover small, local deals that have not been published in a clearly visible fashion in the European and/or North American trade journals or on the usually consulted “reference” websites.

Add to this category a group of mid-sized privately held or even family-owned distributors that have made selective add-on acquisitions in the past. Many of these companies have some very profitable years behind them and hence are sitting on well-filled war chests. However, this last group of companies tends to be a bit more conservative when it comes to the valuation of acquisition targets.

“The “dampening effect” of Covid-19

may bring some much-needed realism back,

particularly regarding valuations.”

Although this is in general a sensible attitude to have, it has let some of the potential deals fall apart in pre-Covid times, as the rather frothy expectations of sellers regarding transaction multiples were sometimes at odds with the willingness of potential buyers to cut a deal at these levels. The “dampening effect” of Covid-19 may bring some much-needed realism back into the discussions, particularly about mutually acceptable valuations, even if it is shattering the high hopes of potential sellers

Forecasts for Valuation

Models are always an Issue

During the last 12 months, the task of performing valuations of acquisition targets did not get any easier. Although chemical distributors did generally very well in 2020, no company could really escape the effects of the various lockdowns, and economic uncertainty in general. Local logistics, at the core of any distributors’ activity, held up very well though. Aggregated across different user industries, the business of distributors typically exhibited good resilience. But going forward and predicting future developments continues to be a challenge.

Additional sources of uncertainty, such as the (petrochemicals) supply disruption triggered by the bad weather spell in the US Gulf during parts of Q1 or the general logistics imbalances need to be factored into the respective calculations. Currently there is hardly a product group in the chemicals and polymers industry, where the supply situation can be considered as stable. Shortages and supply delays or disruption are more the norm than the exception. It will take a while before growth trajectories can again be determined with sufficient reliability. Until then potential buyers will be wary not to overpay and remain “sitting on the fence” for a while. Sellers may also want to wait a bit, so they are able to show an upward trend for sales and profitability again.

The Way Forward

Over the next 12 months, our view is that M&A activity will come back to the levels seen before the pandemic. On the buyers’ side, the growth strategies put in place previously by the companies mentioned above mandate further action. Implementation is going to continue, often encouraged by suppliers. And financing is available too. Even some of the largest distributors still have some gaps to show when it comes to geographic coverage or industry (sector) participation. Those gaps are being systematically closed. Selective add-ons will therefore continue to be very interesting. There are many willing buyers, provided the target fits a given strategy and is otherwise attractive.

In this context, a comment on “distressed assets”: Not that many companies really have the resources and willingness to solve other people’s restructuring problems, although it cannot be excluded that some courageous companies will look out for such deals, to be done at a bargain price. But that would be an exception in our view.

On the sellers’ side, the situation is possibly a bit more diverse. For many owner-operators of smaller distribution companies the question of succession planning has always been around. Sometimes individuals did not want to acknowledge that and have hence left decisions open for too long. But the effects of Covid-19 on business and society in general have got people thinking. The topic has come more into focus for many owners. And some will change their approach as they may decide on doing other things in the next phase of their life after all. Small companies, who tend to pride themselves of their agility and nimbleness, generally have fewer levers to pull when it comes to diversifying risk. Being part of a larger entity, a group of companies or even a global network can bring certain benefits here. Having more “stability” may be just what a business needs in volatile times.

“Having more “stability” may be just

what a business needs in volatile times.”

As the overall industry outlook is getting a bit more predictable again, hopefully, over time recovery will morph into growth. The forecasts underlying valuation models will become more reliable too, giving both sides in a potential transaction the notion that they are getting an attractive deal at an acceptable level of risk. That will certainly help deal-making and drive further consolidation of the industry.

Author: Guenther Eberhard, managing director, DistriConsult GmbH, Waedenswil, Switzerland

Guenther Eberhard is Senior & Managing Partner at DistriConsult. He merges a thorough knowledge of the chemical industry, its technologies, structures and channels-to-market with a keen business sense and a well-developed awareness for cross-cultural issues. Before joining DistriConsult in 2009, he spent over 25 years in line and project management roles in basic and specialty chemicals manufacturing, materials technology and chemicals distribution. His education includes a master degree in Chemical Engineering from Friedrich-Alexander Universität Erlangen Nürnberg, Germany, and a master degree in Industrial Engineering from Fernuniverstät GH Hagen, Germany. He started his industry career at Dow Chemical in 1989, moved on to Swiss industry group Von Roll in 1999, and spent three years several years in Mergers & Acquisitions (M&A) advisory at KPMG before joining privately owned Swiss specialty chemical distributor Prochem in 2004.

Downloads

Contact

DistriConsult GmbH

Säntisstrasse 69C

8820 Wädenswil

Switzerland

+41 44 680 1431

+41 44 680 1432