Recycled and Carbon-neutral Precious Metals

Over the years, sustainability has evolved from an aspirational goal to an operational priority. Companies in every industry are being asked to incorporate more environmental stewardship into their operations and business practices.

Sustainability is no longer an option; customers are requiring sustainable practices from suppliers and developing scorecards to measure progress.

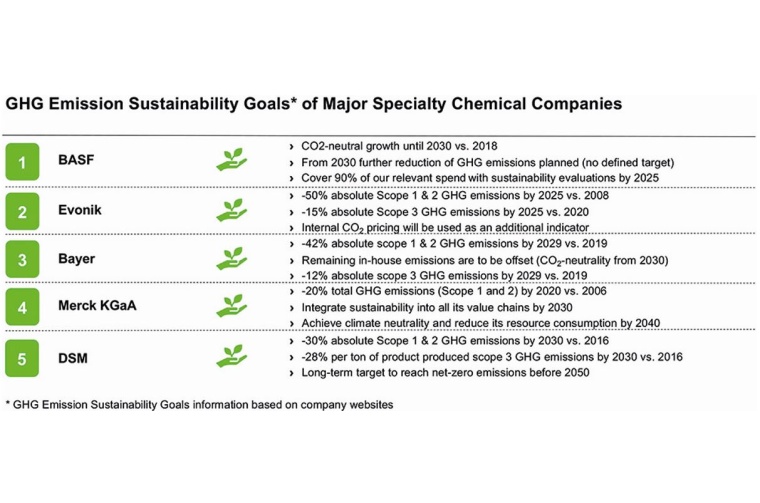

The Paris Agreement has been a driver for nations and industries around the world to address reducing CO2 emissions. Today, the chemical industry is facing tightening global legislation requiring the defossilization of all chemical value chains. In response to these global mandates, all major pharma and fine-chemical producers have committed to challenging CO2 reduction targets.

Another important consideration goes beyond meeting an industry mandate: it’s the law of supply and demand. Precious metals, by their very definition, are precious because of their limited, finite quantities on the earth. The combination of increased demand and potential scarcity can cause recycled precious metals to become more expensive. Implementing a sustainability strategy today can be a buffer that can help protect companies if precious metals become scarce or prices increase in the future.

Many of the processes to produce fine chemicals and pharma products are catalyzed by precious metals, both in homogeneous and heterogeneous form. Due to the currently high-average CO2 footprint, there is opportunity to reduce this footprint. Both primary producers and recyclers of precious metals are working diligently towards carbon neutrality. Precious metals from secondary sources may serve as a good intermediate step, offering a reduction of more than 85% carbon footprint compared to primary sources.

Precious Metals in the Value Chain of Fine Chemicals and Pharma Products

In 2019, both industry segments fine chemicals and pharma together demanded 28.9 t of platinum, 16.9 t of palladium and 2 t of rhodium. Based on these figures, the overall precious metals related carbon emission within the fine chemistry and pharma area equals approximately 1.3 million t of CO2 p.a., which is less than 1% of the overall scope 1, 2 and 3 emissions of this industry segment.

These figures show that the impact of de-fossilization of precious metal value chains on the overall fine chemicals and pharma industry is small but still remains a significant single driver that can be tackled relatively easy and fast. Thus, it is an important factor on the way to reach the CO2 commitments of all major players in the market and ultimately a zero-carbon footprint.

Defossilization of the Complete Precious Metal Value Chain

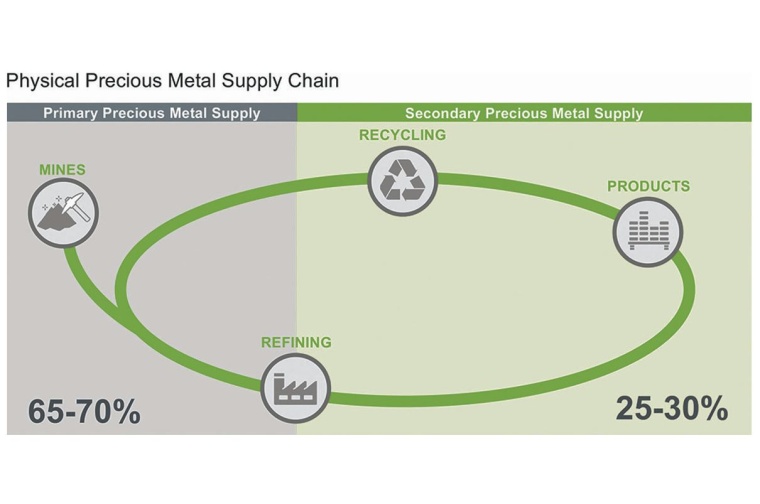

The overall precious metal value chain is rather complex as it is a mixture of primary and secondary sources that are typically combined in the refining step. By this means mining concentrates and waste streams are mixed during the purification of the precious metals.

Looking at the carbon footprint, the majority of the CO2 equivalents emitted accrue during the mining step itself. The reason is the low concentration of platinum group metals (PGMs) in a typical ore (2–6 g/t) leading to energy-intensive processes for mining, extraction and concentration. The other factor that further increases the carbon footprint is energy mix in South Africa, the major producing country of PGMs. Nearly 90% power used for producing comes from hard coal. The following refining of the precious metal concentrates only adds a minor part to the overall carbon footprint.

Thus, the biggest lever towards a complete defossilization of the precious metal value chain is the reduction of CO2 equivalents within mining operations. For this reason, basically all South African mining companies are working towards more sustainable operations. These measures include the usage of renewable energy sources such as solar, fuel cell powered trucks and generating power from waste heat recovery during the smelting operations within the concentration step.

However, this is not a quick fix. It will take time and significant investments to reach a reduction of carbon emissions to a reasonable level or even zero.

“Some fine chemical and pharma companies

already started to look into long-term supply

contracts of secondary material.”

Precious Metals from Secondary Sources — a Quick Fix

A much faster alternative to optimize the carbon footprint is using precious metals from secondary sources only. That exhibit only 15% or less of the CO2 footprint compared to primary production. As 25–30% of the annual precious metal supply is already coming from secondary sources, sufficient amounts for the fine chemicals and pharma sector are readily available.

The automobile industry is the largest user of precious metals. As it continues to strive for more carbon efficient products, it is expected that precious metals from secondary sources will get scarce; as a consequence, premiums are expected to increase in the coming years. On top of that global CO2 tax will further drive premiums for low carbon alternatives. Despite the expected higher premiums for secondary-only metals in the coming years, they remain an available alternative to reduce the carbon footprint by 85% or more. In order to mitigate supply risks early on, some of the fine chemical and pharma companies already started to look into long-term supply contracts of secondary material to secure long-term supply.

Sustainability is Possible for Pharma and Fine Chemical Companies

All major fine chemical and pharma companies are working towards challenging carbon reduction targets. Precious metals account for approximately 1.3 million tons of CO2 equivalents annually of the scope 3 emissions within the fine chemistry and pharma value chain.

The major driver for the CO2emissions is mining operations. In order to defossilize the production of precious metals, all major mining companies are working towards CO2 reduction. However, this takes time and significant investments. An already available alternative are precious metals from secondary sources, which exhibit only 15% or less of the carbon footprint. Taking these steps now are not just good sustainability practices, it is also a smart way for companies to minimize risk and uncertainty.

Author: Robin Kolvenbach, Head of Innovation Chemicals & Product Chemicals, Heraeus Precious Metals, Hanau, Germany

most read

Ratcliffe: Chemical Industry in Europe at a Tipping Point

Ineos CEO Ineos calls on European politicians to save the chemical industry.

Merck Acquires Chromatography Business from JSR Life Sciences

Merck to acquire the chromatography business of JSR Life Sciences, a leading provider of CDMO services, preclinical and translational clinical research, and bioprocessing solutions.

VCI Welcomes US-EU Customs Deal

The German Chemical Industry Association (VCI) welcomes the fact that Ursula von der Leyen, President of the European Commission, and US President Donald Trump have averted the danger of a trade war for the time being.

Novo Nordisk to Cut 9,000 Jobs Globally in Major Restructuring

Novo Nordisk announced a global workforce reduction of approximately 9,000 positions to streamline operations and reinvest DKK 8 billion (€1 billion) in growth opportunities for diabetes and obesity treatments.

Dow to Shut Down Three Upstream European Assets

Building on the April 2025 announcement, Dow will take actions across its three operating segments to support European profitability, resulting in the closure of sites in Germany and the UK.