Transition to Circular Economy: No Time to Stand Still

To Succeed in the Circular Economy, Chemical Companies Must Quickly Build Alliances

The collection and processing of growing chemical product waste streams increases the need for companies to reorient and integrate new business areas. The shift requires intensive cooperation along the value chain and across industries. There is little doubt that the chemical industry plays an essential role in establishing the circular economy model and closing loops. The time is now for chemical companies to (re-)define their role as non-traditional opportunities and players emerge.

Collaboration is key to addressing the challenges. There are models already taking shape which demonstrate how chemical companies can have a bigger impact and grow at the same time.

Serious Targets, Serious Opportunities

The circular economy is here to stay, with exciting opportunities for the chemical industry to stand out. In the long run, demand will increase; global brand owners have made pledges to their customers and need to make good on promises in the not-too-distant future which will require enormous volumes of recycled materials.

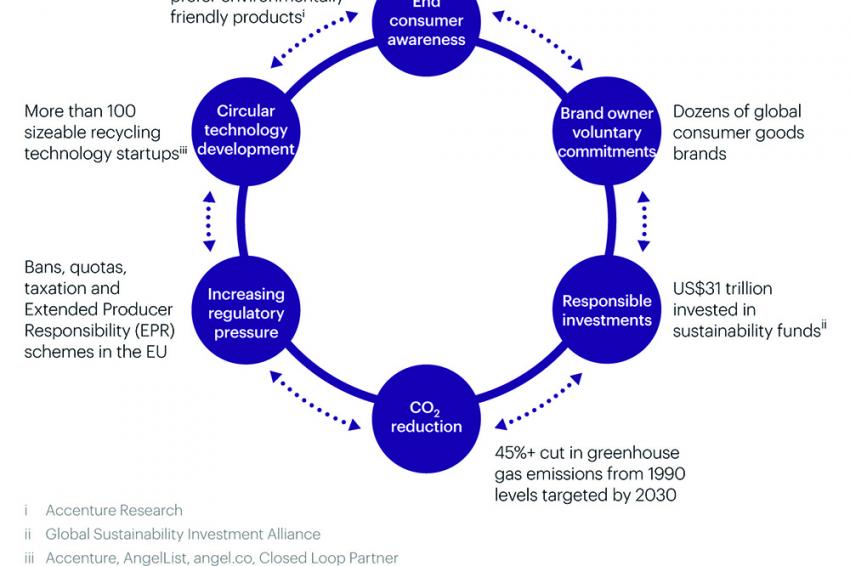

The recently published research report “Winning in the Circular Economy” evaluates the potential for the chemical industry and backs up why brands are making bold moves: 81% of consumers expect to buy more environmentally friendly products in the next 5 years. Targets for reducing greenhouse gas emissions and replacing fossil resources are serious, in Europe and around the globe. Investor preferences are following suit: access to capital will become increasingly costly for companies who fail to put serious sustainability measures in place and enable circularity downstream. For an overview of the circular economy drivers cf. fig. 1.

The business case is here, too. While, compared to fossil materials, scale will always remain a challenge for secondary raw materials, there are already chemical waste streams like polyethylene terephthalate (PET) with clear break-even economics. For several further plastic waste streams, such as polystyrene (PS), low‐density polyethylene (LDPE) and polypropylene (PP), there also appears to be good potential based on how market prices for secondary raw materials compare to their virgin alternatives.

The downstream enablement for circularity bears further sizeable volume and value potential. In the EU, about 51.2 million t of plastics were consumed in 2018, but only 29.1 million t of plastic waste were collected that year. In the absence of disruptions, Accenture expects plastics consumption to grow to 60.5 million t by 2030. Over the long-term, demand will be growing, and incremental demand driven by downstream enablement for circularity means that one can expect additional volume as a result.

“The transition to the circular economy

triggers a wide range of challenges

that the industry needs to address.”

Considering all chemical products — not just plastics — and integrating numerous assumptions, Accenture expects consumption to grow from 139 million t in 2018 to 180 million t in 2030 (fig. 2), along with an increase in average unit value from €1,770 per ton to €1,960 per ton. By 2030, circular economy-driven incremental growth represents a €50 billion value upside potential.

No doubt, the transition to the circular economy triggers a wide range of challenges that the industry needs to address. For companies this means re-evaluating target product portfolios and adjusting business strategies to build trust with consumers and capture new opportunities, shifting capital investments from linear to circular material assets, developing and reorganizing for circular capabilities across the organization and testing new business models.

“Circular value chains open opportunities for

chemical producers to

go beyond making and selling molecules.”

What is abundantly clear is that companies won’t be able to achieve this alone — partnering across the traditional value chain will be crucial. And here is where things get interesting: with collaboration at its core, circular value chains open opportunities for chemical producers to go beyond making and selling molecules. If ever there was an exciting time for the chemical industry, it’s now.

Above All, Forge Alliances

While the end-state of the circular value chain remains open-ended, none of today’s players have the capabilities and experience needed to meet what is required on their own. It’s important for companies to embed their collaboration approach into their circularity strategy and quickly build cross-value chain pilots. As the industry landscape changes and chemical companies define their roles, different value chain collaboration models are emerging.

Collaboration Model 1:

Chemical company and waste manager cooperation

Some chemical and waste management companies have started to establish joint frameworks and infrastructure for economical recycling processes. The waste managers contribute a sufficient and reliable waste supply with the needed composition and quality for economical recycling processes. In this model, the chemical companies provide the necessary knowledge for the manufacturing technology to use the recyclate or to set up and develop a chemical recycling process. For example, one of the largest plastics, chemicals and refining companies in the world and a global leader in sustainable resource management have founded a 50:50 joint venture for a premium mechanical recycling facility in the Netherlands with capacities of 25,000 t/y of polypropylene (PP) and 35,000 t/y of high‐density polyethylene (HDPE); their objective is to expand to 100,000 t/y in 2020. In this way, the resource management company aims to expand its recyclate production to 600,000 t/y. The chemical company profits from the recycling process, which otherwise would threaten its offer of virgin feedstock-based plastics and is in position to ensure high quality of recyclate for its customers.

Collaboration Model 2:

Chemical company and waste manager partnership, joined by a chemical recycling technology provider

Some chemical companies are taking their relationships with waste management companies a step further with joint development agreements which bring in new technology providers for chemical recycling. For example, a global styrenics supplier is working with start-ups to test chemical recycling solutions for PS, each company adding their expertise to the process. Within one joint development agreement, they are using the manufacturing of the styrenics supplier to process styrene monomers. Those were yielded by a patented chemical recycling technology belonging to a company producing chemicals from recycled plastics.

A similar agreement has been made with another company in the field of plastic recycling. This company provides styrene monomers to the styrenics supplier in order to polymerize food-grade PS for food packaging. Two U.S.-based facilities with capacities of 50-150 t/d of PS are being planned.

Collaboration Model 3:

Cooperation between chemical company, converter, brand owner and waste manager

This emerging type of cooperation brings together expertise in material properties, product manufacturing and product requirements. The established supplier relationships in the value chain continue to exist, the shift is the inclusion of a waste manager as a raw material supplier. For example, in a joint development project several companies from different industries such as consumer goods, packaging producers, chemicals and recycling are working together and testing a process to recover complex, multi-layer packaging to gain virgin feedstock-like materials for pack-aging. In a pilot test, recycled LDPE was used for flexible detergent packaging.

Collaboration Model 4:

Direct chemical company and brand owner collaboration

Here, the chemical company’s material property design and production capabilities are combined with the application requirements and product manufacturing of the brand owner. For example, a chemicals company and a sportswear manufacturer have been working together for several years on the European Commission-supported Sport Infinity Project with the objective of developing a textile-reinforced composite for infinite recycling loops. The material itself — which is shredded after use and mixed with virgin material and fiber from alternative waste streams — is reprocessed into a new shoe. There is a similar arrangement between a chemical manufacturer and a computer technology company where recycled carbon fibers with specific material properties are used as the composite materials for making computers.

Collaboration Model 5:

Direct cooperation of a start-up and waste manager with a brand owner

In this model, the traditional chemical producer is bypassed and the cooperation between large brand owners and start-ups forms a new competition for established players. For example, a global beverage company is helping to finance a chemical recycling start-up to build its first 10,000-t/y-recycling-plant for colored and contaminated PET. The start-up also works with a consumer goods manufacturer to supply food-grade recycled PET (rPET) with plans to build a recycling facility.

Conclusion

Most chemical companies are now recognizing the importance of adapting to the circular economy as they are partly pivoting and partly being pushed in this direction. Companies cannot do this in isolation and will need to be decisive on their role and how to put this in place. The opportunities for value-chain collaboration for specific combinations of an end-of-life material as well as the suitable recycling technology and application for the resulting recyclate are nascent. It is important that companies find their sweet spots quickly. Those who stand still too long may find themselves standing alone.