Preparing for Sustainability-Driven Growth

Chemical Companies Must Take Steps Now to Capitalize on a $200 Billion Opportunity

However, the industry may struggle to keep up with this demand, creating an obstacle to growth. To capitalize on this opportunity, chemical companies can take several key steps now to ensure that they have access to the resources, technologies and knowledge they will need to meet this rising challenge.

The increasing focus on sustainability is prompting change in the chemical industry, and chemical companies are responding. According to our research, over the last five years there has been a fivefold increase in the number of sustainability-related project and product announcements made by chemical companies and their customers, as companies work to adapt to and thrive in this new environment.

At the same time, however, increased regulation around sustainability sets a high bar and drives up costs. This has prompted many in the industry to ask a basic question: Can chemical companies really make money and find significant value as they shift to sustainable products and processes?

The answer is yes, they can. Over the next five years, sustainability-related offerings will account for nearly one-third of industry growth, according to Accenture research, creating a potential $200 billion opportunity for chemical companies. Demand will grow for both sustainability-enabling products, such as materials for wind turbines and solar panels, and products involving sustainable production, including bio-based products or those made from recycled materials.

However, this growth prompts another key question: Will the chemical industry be able to keep up with burgeoning demand? It depends. To take full advantage of this opportunity, chemical companies will need to take steps to prepare themselves for a new era.

The Growing Demand for Sustainability-Related Offerings

The industry’s numerous sustainability-related announcements over the last few years have included initiatives focused on new plants and offerings, new partnerships and collaborative agreements, and operational changes in existing plants to increase efficiency and reduce greenhouse gas (GHG) emissions. While government mandates are certainly a driver for these investments, there are also sound business cases behind them.

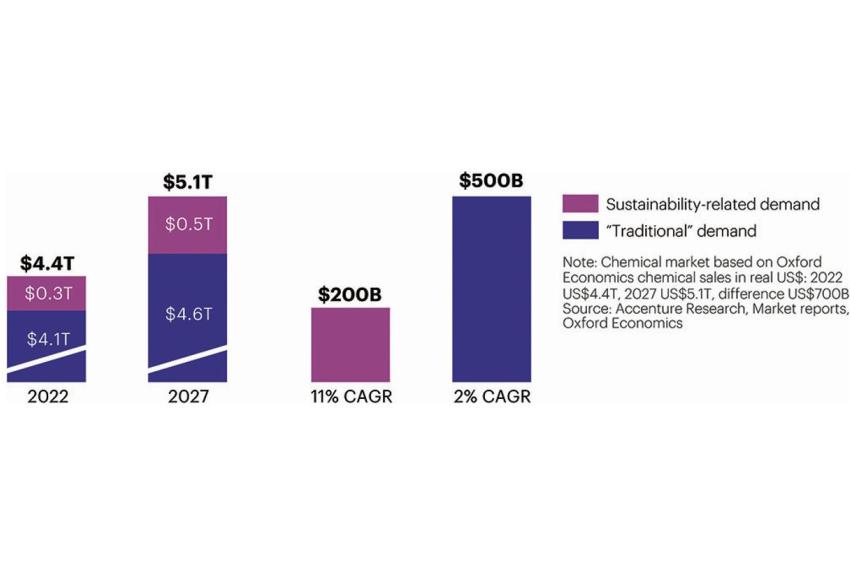

Demand for sustainability-related chemical offerings is growing rapidly. Our research indicates that the market for such offerings, which stood at approximately $300 billion in 2022, should reach about $500 billion by 2027. This translates to a compound annual growth rate of 11% through 2027, compared to a 2% rate for “traditional” industry products. Thus, sustainability-related offerings will be an especially attractive opportunity (see fig. 1).

“Demand for sustainability-related

chemical offerings is growing rapidly.”

About two thirds of this growth will come from existing products and markets related to sustainability – insulating materials for buildings, plastics for electric vehicles, polyurethane foams used in wind turbine blades, etc. To a great extent, these offerings will take advantage of existing infrastructure, and thus involve relatively low levels of investment and risk.

However, about one third of the growth will come from new markets and offerings, including new electric battery materials, carbon-capture materials and bio-based inks and coatings. Altogether, this broad mix of traditional and new offerings means that sustainability is creating growth opportunities for companies across the chemical industry.

Keeping Up With Demand

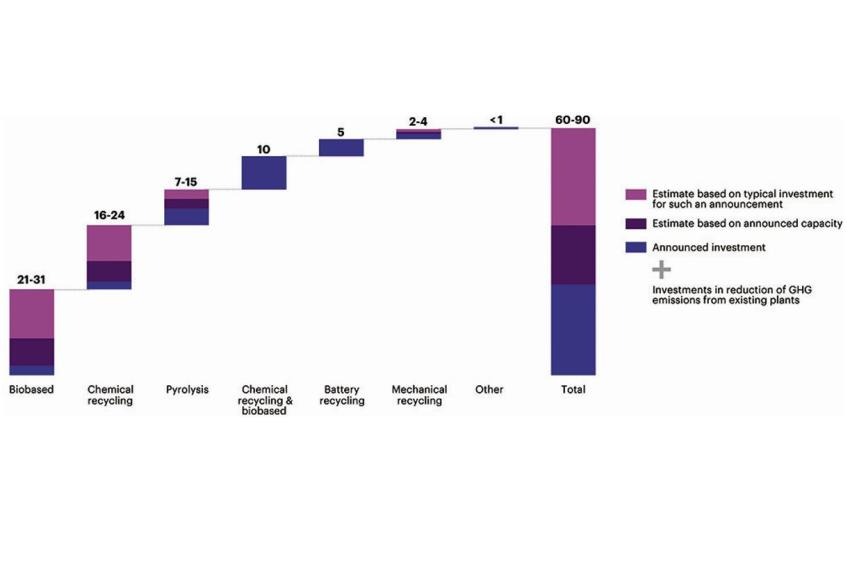

An analysis of company announcements shows that over the last five years, the chemical industry has invested an estimated $60 billion to $90 billion in new plants that produce sustainability-related products (see fig. 2).

That estimate does not include startups or investments in GHG reductions at existing plants.

These new plant investments are focused on products that are core to the industry, rather than new or niche products. They include investments in naphtha alternatives, such as chemically recycled, bio-based or mass-balanced products, mechanically and chemically recycled standard polymers and bio-based intermediates and polymers.

Despite these investments, the industry will still find it difficult to meet growing demand. Already, customers are looking for more sustainability-related offerings than the industry can supply. Some new chemical plants that are not yet up and running are reported to be sold out or nearly sold out – an unprecedented development in the industry.

High demand is likely to continue. Chemical companies’ customers from across industries have made commitments and set targets for recycled content and increased sustainability – but they are falling short in meeting those commitments. In part, this lack of progress is due to the fact that they often find it difficult to get the sustainability-related chemical industry offerings they need.

Planning For Success

Taking advantage of the growing demand for sustainability-related offerings will require more than scaled-up operations. The drive for sustainability will continue to reshape entire value chains, and chemical companies can take steps to occupy “sweet spots” in future value chains and solidify their positions in those chains.

“The drive for sustainability will continue

to reshape entire value chains.”

These steps include:

- Ensure access to sustainable feedstocks. There is a shortage of the raw materials that will be needed for sustainability-related offerings, and chemical companies may have to cast a wide net to find these key resources.

- Forge value chain partnerships. The ability to meet and exceed customer requirements for sustainability-related offerings – reliably, efficiently and at scale – will depend on close collaboration with partners across the value chain, from raw-materials suppliers to end customers.

- Secure IP and proprietary knowledge. Chemicals with sustainability-related properties will require new production processes, assets and equipment. Thus, chemical companies that focus on securing IP and proprietary knowledge will have an opportunity to gain competitive advantage.

- Develop compelling and credible sustainability narratives. Sustainability is an increasingly important driver of share price and enterprise value. That means that chemical companies should shape their sustainability-related narratives for investors and other stakeholders to build ongoing support for sustainability-related initiatives.

„The shift to sustainability plays to the chemical industry’s strengths.“

The race to occupy the chemical industry value chain’s key hot spots can be expected to accelerate – and companies that don’t act soon are likely to find themselves being left behind. Fortunately, the shift to sustainability plays to the chemical industry’s strengths – its ability to use efficient large-scale core operations to build quality products, coupled with its long history of successful, ongoing innovation. Chemical companies that draw on those strengths to reinvent themselves around sustainability will be in position to achieve significant profitable growth for decades to come.

Author: Bernd Elser, a Senior Managing Director and Global Chemicals Lead, Accenture, Frankfurt am Main, Germany