Building Momentum

American Chemical Industry Ready for Growth in 2015

In the US, where economic growth has been characterized as "slow and steady" for some time, expansion and strength in the chemical industry continues and momentum is building. In spite of weakness in key export markets and adverse winter weather, American chemistry output rose 2.0% in 2014. Growth in the chemical industry is expected to accelerate in the coming years and will be a major driver for the American economy. Unconventional oil and gas development in the US has led to an abundant domestic supply of affordable natural gas for the manufacturing industry, providing the American chemical industry, in particular, with a competitive advantage. The chemical industry uses natural gas not only for heat and power at their manufacturing plants, but also as the key raw material, or "feedstock," for chemistry products.

Chemical products are key ingredients in 96% of all manufactured goods, including cosmetics, electronic products, pharmaceuticals and plastics. Thus, the positive effects from the "shale gas revolution" are felt along the entire supply chain and have provided a boost to the manufacturing industry. Indeed, the US manufacturing industry is in full swing and we're seeing strength in end-use industries that are important for chemical producers such as light vehicles and housing. Steady improvements in the US labor market and in other factors (such as still low mortgage rates and more recently, very low prices for gasoline) are contributing to positive performance in those industries as well. Though several segments remain below their pre-recession peaks, most key end-use markets for chemistry have recovered and further improvement is expected in 2015.

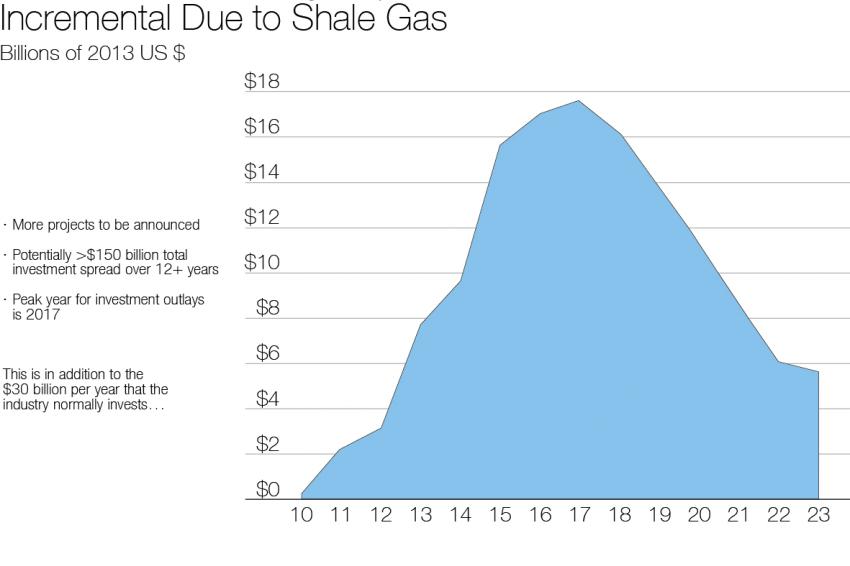

American chemistry is building momentum as a growth industry as a wave of announcements to build new chemical capacity and expand existing continues. Due to growth in shale gas production, there has been - and continues to be - a significant increase in capital investment by chemical and other manufacturing industries, driving new business and job growth. The American Chemistry Council (ACC) maintains a list of shale-related chemical projects announcements and as of December 2014, the list of chemical industry projects totals 215 projects, representing cumulative capital investments totaling $132.6 billion in the US, 60% of which represents foreign direct investment. These investments will capitalize on the profound and sustainable competitive advantage enabled by shale gas development. In addition, the industry is adding high-paying American jobs after years of trimming payrolls. Chemistry companies in the US continue to innovate, focusing on improving efficiencies as well as on new leading-edge product development. In 2014, capital spending by the chemical industry grew 11.8%. Capital expenditures are expected to by grow by another 8.8% in 2015 and to grow another 8.8% in 2016. The industry's expansion has also reversed a falling trend in employment. Employment in the chemical industry grew by 1.2% in 2014 and new jobs will be added through 2019.

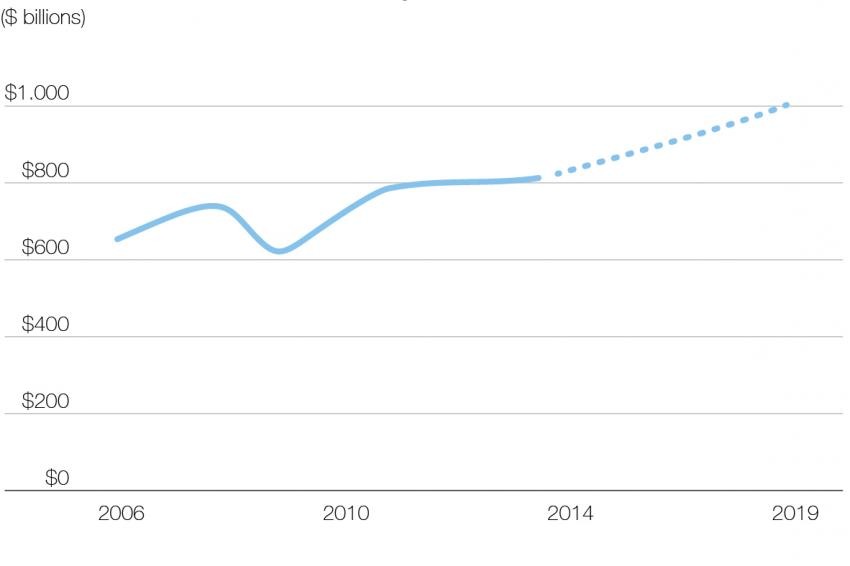

Led by consumer chemistry and specialty chemicals, US chemistry production volumes increased in 2014. With inventories having remained balanced, growing demand in 2015 will require new production. Advances in manufacturing and exports during 2015 will drive demand for basic chemicals, especially those segments in which the United States enjoys a renewed competitive advantage. Chemical output is expected to grow 3.7% in 2015, 3.9% in 2016 and by 4.8% in 2017 by which time much of the shale related investment should be online. Improving operating rates are expected in 2015, and with strengthening production volumes, capacity utilization is expected to be about 76.9% in 2015 and improve annual to reach 78.0% by the end of the decade. Growth in chemicals will be noted in rising shipments (turnover) values. Chemical shipments were $805 billion in 2014 and will grow to nearly $850 billion in 2015. By 2019, American chemistry revenues will exceed $1.0 trillion.

While strength in American manufacturing, improvement in labor markets and growth in key end-use markets have translated to solid domestic demand for chemicals, weakness in external markets have limited US chemical export sales. Despite the competitive position American chemistry owes to a comparably favorable oil-to-gas price ratio, trouble in the economies of major trading partners means that the industry likely will not post a trade surplus until 2017. This trend is expected to reverse in 2017 with the industry positioned as a net exporter over the longer-term. However, considering chemicals trade excluding pharmaceuticals, the US is a net exporter. By this measure, the industry had a trade surplus of $37 billion in 2014 reflecting a $32 billion surplus in basic chemicals. As new investments in the chemical industry come online, basic chemicals export growth will accelerate. Excluding pharmaceuticals, the surplus in chemicals trade will grow to $77.4 billion by 2019.

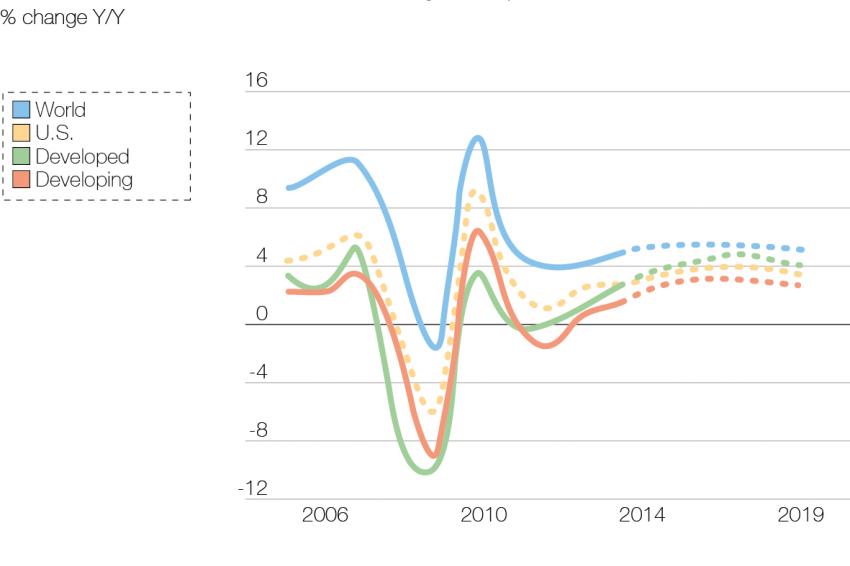

Clearly, the American business of chemistry is building momentum. Health in the domestic market and the eventual return of global economic growth will lift demand for American chemistry over the next several years. In global chemistry, economic challenges in Europe and the slowdown in China and other emerging nations clearly affected global chemistry volumes. After much promise at the start of the year, overall global production likely advanced only 2.8% in 2014, about the same as in 2013. With improving economic prospects headline growth will improve to 3.6% in 2015 and 3.9% in 2016. The most dynamic achievements will be found in the developing nations of Asia-Pacific and Africa & the Middle East. But due to competitive advantages from shale gas, growth will be strong in North America as well. With long-term structural and competitiveness challenges, Western Europe and Japan will lag as will Latin America in the short-term. With strengthening production volumes, global capacity utilization will improve in the years to come.

In December 2014 the American Chemistry Council prepared a Year End 2014 Chemical Industry Situation and Outlook based on the latest data available. A copy of this report is available from the author.

Contact

SOCMA Society of Chemical

1850 M Street NW, Suite 700

Washington, DC 20036-5810

+1 202 2968560

+1 202 2968120