Chemical Industry – Surviving or Thriving in the Next Normal?

Taking Product & Service Portfolio, Profitability, Resiliency, and Sustainability to the Next Level

Digitalization continues unabated. Even in times of the Corona pandemic, innovative customer-centric business models emerge, supply chains are entirely redesigned in a world changing from global to multipolar, new business networks and multi-discipline consortia are formed and, last but not least, sustainability more and more establishes itself as a strategic goal. All these evolutions cause challenges but also provide opportunities for chemical companies to redefine their core competencies and future strategic direction. Stefan Guertzgen talked with Thorsten Wenzel, Vice President and global head of the industry business unit Chemicals at SAP, about most recent trends and developments shaping the future of the chemical industry.

CHEManager: Mr. Wenzel, in light of recent dynamics and uncertainties which have been even exacerbated by the Corona pandemic, what keeps chemical executives up at night?

Thorsten Wenzel: In the value chain, chemical companies are the first to convert energy and natural resources into more than 70.000 different products. Located between the energy and feedstock suppliers on one side and manufacturing and consumer industries on the other side, chemical companies are facing both resource volatility and price pressure, tightened environmental regulations and challenging sustainability targets — e.g. Climate21 and circular economy. At the same time, they must adapt to changes in consumer behavior and expectations.

How do you see traditional strategies and business models being impacted?

T. Wenzel: Today, traditional strategic advantages such as proximity to customers and access to competitively priced feedstock or in-house intellectual property and technological know-how can no longer secure a sustainable competitive advantage alone. We observe a strong move beyond classical B2B-driven business models towards a more B2B2C-driven focus, frequently even in a co-innovation based “Segment of One” relationship.

“We observe a strong move beyond classical

B2B-driven business models towards

a more B2B2C-driven focus.”

As classical competitive advantages are losing their edge, and customer demand moves towards more sustainable and innovative solutions, both products, services and business must be reimagined, and corporate strategies need to be adapted. This requires chemical companies to prioritize new business models and to transform processes while ensuring sustainability, safety and integrity along the entire value chain and lifecycle of their products and services.

What main paradigm shifts are required for chemical companies to survive or even thrive in the “next normal”?

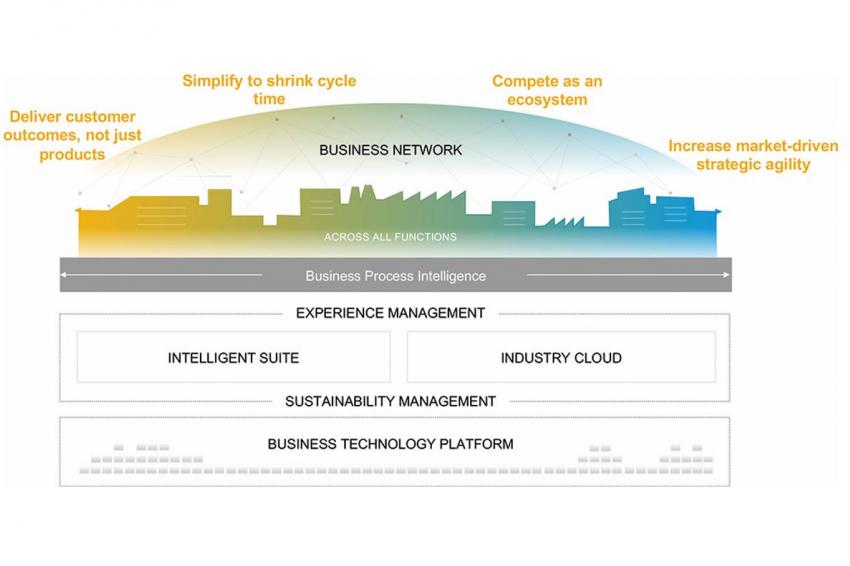

T. Wenzel: First and foremost, they start selling business outcomes instead of just products. This means connecting to and collaborating with their customers and suppliers via industry business networks (IBNs) on co-innovation and supply chains, understanding and becoming part of their value chains, and using digital technology to deliver innovative services and business outcomes instead of just selling products.

Secondly, they simplify their operations and focus on shrinking cycle times. Chemical companies run simulations and predictive models, enabling real-time sense and response, and leveraging IT and OT integration and the IoT to reduce time to market, streamline operations, maximize asset performance, and minimize rework. The manufacturing and distribution logistics area have been in focus for digital transformation for many years. We see a recent emphasis on co-innovation, research, and intellectual property management.

Thirdly, chemical companies begin competing as entire ecosystems. Collaboration is also a focus as successful chemical companies capitalize on open co-innovation, use extended manufacturing networks, go beyond the boundaries of their existing value chain, and understand their customer’s customer needs. The more chemical companies are focusing on co-innovation together with customers, the more partners are usually involved in an innovation platform approach. This frequently includes universities, research institutes, start-ups, logistics partners and other service providers.

Finally, we see them adopting strategic agility in response to market dynamics. Companies adjust their strategy and portfolio dynamically in response to market opportunities and needs, grow rapidly into new markets or segments, and capitalize on mergers, acquisitions, and spin-offs to secure continued growth. The chemical industry has outperformed most of the other industries in recent years

by number of M&A and spin-off deals, due to the tremendous need to optimize overall portfolio profitability and performance.

What role does technology and data play in terms of realizing those new paradigms?

T. Wenzel: Digital is the new norm, with technologies such as the Internet of Things (IoT), artificial intelligence (AI), machine learning (ML), robotic process automation (RPA), blockchain, the cloud, and analytics providing new opportunities for chemical producers to cut costs by automating the back office and running low-touch operations.

As a next step, chemical companies will capitalize on structured and unstructured data — both operational and experience — from common platforms and open networks to understand and rapidly respond to market needs. Ultimately, this will result in differentiating, innovative products and services, such as benchmarking or proprietary recipes, or business models that support a higher purpose, such as precision farming or circular economy.

What’s your view on the overall impact of the Corona pandemic on the chemical industry?

T. Wenzel: With regards to digital transformation and related projects, Covid-19 has been acting in many cases as an accelerator. Especially for ongoing projects, during the early days of Covid-19 the pandemic impact and related lockdown caused some delays due to the need to switch to home office and virtual environment. After that, the pace of those projects mostly picked up as before with the result that ongoing S/4HANA implementation projects, for instance, have experienced very little delay.

“With regards to digital transformation

and related projects,

Covid-19 has been acting in

many cases as an accelerator.”

What innovative business models do you see emerging?

T. Wenzel: Coming from a pure B2B-based push model in the past, as mentioned before, many chemical companies are applying B2B2C-based business models to deliver sustainable, co-developed applications, services and business outcomes instead of just products. Emerging new models will also include programs to monetize corporate knowledge, intellectual property, and data assets on new platforms, supported by extended partner ecosystems as well as intelligent technologies like e.g., machine learning.

“Predictive analysis will enable chemical companies

to anticipate downstream supply-chain disruptions

and take corrective actions in real-time.”

Customer-centric R&D will anticipate customer and consumer demand, simulate product and formulation performance, and design products that minimize environmental impact and support a circular economy. Applying digital technologies in operations will help chemical companies analyze production process variables and asset performance in real-time and simulate their impact on product quality, costs, and yield. Predictive analysis will enable chemical companies to anticipate downstream supply-chain disruptions and take corrective actions in real-time.

What chemical segments do you see leading the pack in terms of innovation?

T. Wenzel: Within the broad chemical industry portfolio we clearly see the agrochemicals & seeds segment leading the pack, and this started already more than ten years ago. With digital farming the traditional value chain has steadily moved from B2B to B2C, considering the single farmer as customer, instead of agricultural cooperatives and wholesale & distribution channels. In this environment, companies are moving towards direct sales to farmers, with product sales supported by companion product and service offerings provided by business partners.

What’s your view on the role of business networks as game changers?

T. Wenzel: Industry business networks (IBN) are cloud-based collaboration offerings that can help transform disconnected supply chains into unified, collaborative, and intelligent networks that remove barriers and centralize data. This will be one of the most strategic topics for the chemical industry in the next decade. Enterprise resource planning focuses on single corporations and companies. In the future we will see a strong emphasis on cross-company and cross industry data exchange. One recent example is Catena-X, initiated by German automotive companies working together with their suppliers and partners.

Catena-X members share the vision of a continuous data exchange for all contributors along the automotive value chain. Prominent members of the chemical industry, BASF and Henkel, are founding members and a few other chemical companies are evaluating membership now.