Global Competitiveness Index

Competitiveness Agendas to Reignite Growth

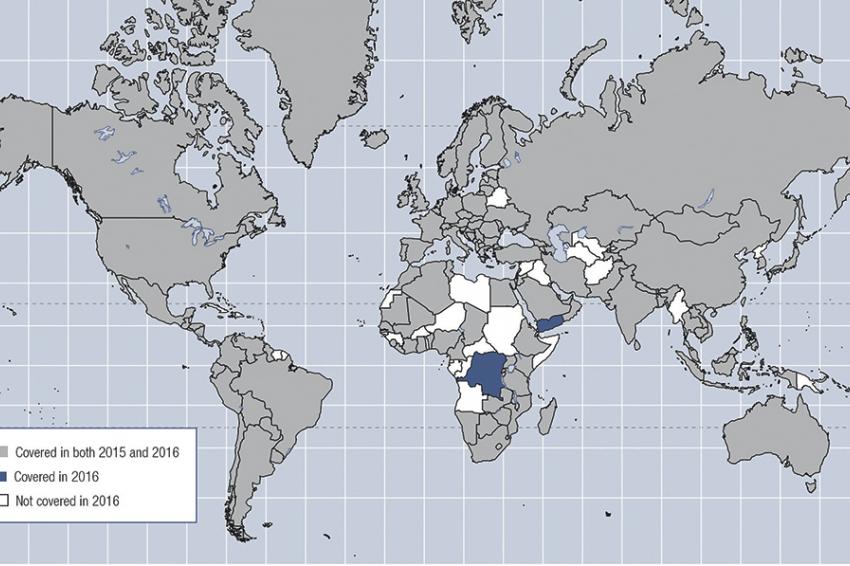

Addressing supply-side constraints to growth is of high importance, according to the Global Competitiveness Report 2016-2017. The annual report — issued by the World Economic Forum (WEF) — this year covers 138 economies and finds that income levels have recovered faster in countries with better competitive conditions even as those countries have resorted less to quantitative easing, creating less stress on their central banks. Another key finding is that more open economies are also more innovative. Therefore, falling openness — in the form of increased non-tariff barriers to trade and investment — represents a real threat to future prosperity.

According to the report’s Global Competitiveness Index (GCI), Switzerland tops the ranking for the eighth consecutive year. Singapore remains second and the United States holds its third position. The Netherlands improves its position, climbing one place to fourth. Germany (5) drops one place compared with last year’s ranking, Sweden (6) climbs three places. The United Kingdom (7), going up one place, is followed by Japan (8) and Hong Kong (9), which both drop two places. Finland climbs two places and now rounds out the top 10 of the most competitive economies in the world.

Americas

The United States ranks third for the third consecutive year, and its large domestic market represents a major source of competitiveness advantage over other advanced economies.

Since 2007, the United States has been falling behind both in absolute and relative terms in infrastructure, macroeconomic environment, and goods market efficiency. It has improved, however, on health and primary education, higher education and training, and especially technological readiness.

In the United States, innovation and business sophistication have improved. However, the business community in the United States is increasingly concerned about basic determinants of competitiveness such as infrastructure.

After almost a decade of strong growth following the global financial crisis, growth rates in Latin America have fallen and several countries are now heading into recession. The end of the commodity super-cycle resulted in a drop in export values for major commodity-exporting countries. The subsequent fall in global trade has also hit demand for manufacturing exports, further reducing the value of exports across most of the region. The result of this negative terms-of-trade shock has been a large trade deficit, producing current account deficits and government budget deficits. Despite the relative depreciation of the region’s floating currencies against the US dollar, exports have not recovered.

The top performing country in the region remains Chile (33), increasing two places in the rankings, followed by Panama (42) with an improvement of eight positions. Costa Rica falls slightly to rank 54, and Mexico (51) improves by six positions. Brazil drops one position and ranks 81 this year.

Europe

Faced with impending Brexit and geopolitical crises spilling over into the region, Europe finds itself in critical condition in many respects. Nevertheless, the region still performs above the global average in terms of competitiveness. This is driven by the performance of a group of regional champions, notably Switzerland, which leads the global rankings for the eighth consecutive year. The top 12 includes the Netherlands (4), Germany (5), Sweden (6), the United Kingdom (7), Finland (10), Norway (11), and Denmark (12).

Accelerating innovation efforts will be crucial to maintain current levels of prosperity, and Europe can expect high returns from focusing its resources on nurturing its talent. On attracting and retaining international talent, although Switzerland achieves the top global scores, the average for the region as a whole is low. The United Kingdom is currently still the most attractive EU destination for talent, yet the Brexit vote has created significant uncertainty over the conditions under which workers from EU countries will be able to participate in the UK economy in the future.

Eurasia

Eurasia’s competitiveness performance has been stable overall, although most economies in the region face challenges related to the fall in commodity prices, volatile exchange rates, recession in the Russian Federation and Ukraine, and the slowdown of the Chinese economy.

Regional competitiveness differences remain wide, with Azerbaijan (37) and the Russian Federation (43) again the top performers. Despite headwinds from the drop in oil prices that impact their macroeconomic environment, both economies improve their performance slightly, mainly driven by better and more widespread education and reforms to improve the business environment and goods market efficiency. Some progress has been made in curbing corruption, which nevertheless remains a problematic factor for doing business in both countries.

The most improved Eurasian economies are Georgia (up seven places at 59) and Tajikistan (up five at 77). Kazakhstan (53), Moldova (100), and the Kyrgyz Republic (111) decline in the rankings.

East Asia and Pacific

East Asia and Pacific is characterized by great diversity. The region’s 18 economies covered in the GCI 2016–2017 span a large part of the development ladder, from Cambodia (89) to Singapore (2), and include three of the world’s 10 largest economies: China (28), Japan (8), and Indonesia (41). The region’s emerging economies, led by China, have been supporting the modest global recovery since the global financial crisis. Today, global economic prospects look less favorable as a result of China’s slowdown, anemic growth in Japan and other advanced economies, and persistently low commodity prices undermining the growth and public finances of several economies in the region. Among emerging economies, Malaysia (25) continues to lead the region.

South Asia

South Asia continues its upward trend and competitiveness improves in most economies in the region, which is experiencing positive economic momentum, and in 2016 is set to grow more quickly than China for the first time in more than 20 years. Over the past decade, the subcontinent has focused on improving overall health and primary education levels and upgrading infrastructure, areas of particular importance for future diversification and preparedness given the resource-driven nature of the regional economies.

The region remains diverse, with a core of three heavyweight economies—India (39), Pakistan (122), and Bangladesh (106)—surrounded by smaller ones such as Bhutan (97), Nepal (98), and Sri Lanka (71).

Middle East and North Africa

The Middle East and North Africa region continues to experience significant instability in geopolitical and economic terms as spillover effects from the conflicts in Libya, Syria, and Yemen are undermining economic progress in the entire region.

Instability is also being created by the uncertain future of energy prices after recent falls, which affect the region’s countries in different ways. Oil-exporting countries — which include Algeria (87), Bahrain (48), the Islamic Republic of Iran (76), Kuwait (38), Oman (66), Qatar (18), Saudi Arabia (29), the United Arab Emirates (16), and Yemen (138) — are experiencing lower growth, higher fiscal deficits, and rising concerns about unemployment. Rising oil supplies are expected to keep prices low and limit growth expectations for the coming years. Israel (24) improves by three positions as it continues to build on its positioning as one of the most innovative economies in the world.

Sub-Saharan Africa

Sub-Saharan Africa’s competitiveness has slightly weakened year on year, mainly as a consequence of deteriorating macroeconomic environments across the region. Public finance has been put under stress by economic slowdowns among trading partners and persistently low commodity prices, which affect the commodity-exporting countries.

Improving infrastructure, technological readiness, and health and primary education continue to be sub-Saharan Africa’s main priorities as the region seeks to reap the demographic dividend by creating more employment opportunities for the millions of youth who will enter the labor market every year.

Mauritius (45) and South Africa (47) remain the region’s most competitive economies, climbing two places and one place, respectively. Five sub-Saharan Africa economies improve their GCI rankings by three to six positions: Rwanda (52), Botswana (64), Ghana (114), Tanzania (116), and Sierra Leone (132). The region’s biggest losers this year are Zambia (118), down an exceptional 22 positions, and Côte d’Ivoire (99), down eight places.

Innovation is an Important Source of Competitiveness

Many of the competitiveness challenges seen today stem from the aftermath of the financial crisis. Today, productivity and growth are not picking up in advanced economies, and the consequences of low and even negative productivity growth in many emerging economies are now evident. The great recession led many advanced economies to implement very loose monetary policy, which in turn fueled a global commodities boom that masked many of the competitiveness challenges of commodity-exporting emerging markets. Vulnerability to commodity price fluctuations in emerging economies and the promises of the Fourth Industrial Revolution underscore the importance of innovation as a source of competitiveness and economic diversification to reignite growth.

Against this background, it is clear that (1) monetary stimulus is not enough to reignite growth if economies are not competitive, (2) an increasingly important element of competitiveness is creating an enabling environment for innovation, and (3) innovation in turn goes hand in hand with openness and economic integration.