Profitable Growth in Specialty Chemicals

20.01.2015 -

The European chemical industry's share of the global market remains on a downward trajectory in continuation of the negative trend visible to observers for years. Europe's chemical industry has no choice but to act if it is to respond to the strategic and structural challenges it faces and retain its global positioning and competitiveness going forward.

In 2011, Roland Berger Strategy Consultants published a global study on trends in the chemical industry, titled "Chemicals 2030." It featured long-range trends and projections for the next 20 years. Two special editions followed: "Chemicals 2030 China Edition" and "Chemicals 2030 US Edition" focused on the market and competitive situation and on the specific challenges and circumstances in each region.

In light of the considerable interest shown in the publications by industry and media, and given the numerous significant changes that have since taken place in the market and competitive environment, Roland Berger decided to publish a new edition of the global chemicals study. It contains an updated quantitative and qualitative analysis spanning different regions and sectors highlighting how the global chemical industry is expected to evolve through 2035, and it features numerous case studies.

The motivation was unchanged from the previous study: Examine the dynamic chemical markets in detail and provide insights, scenarios and recommendations for the industry, thinking in long-range planning cycles. Based on discussions with clients, business partners and other stakeholders, a further key topic was added to the "Chemicals 2035" study: the future role and competitiveness of the European chemical industry.

Contrasting Growth Rates

Global sales of chemicals are set to almost double in the coming 20 years. Yet there is definite variation in the growth dynamics when we look at eight key/exemplary sectors of the chemical industry (petrochemicals, inorganics, commodity and engineering plastics, fertilizers, agrochemicals, paints and coatings, flavors, and fragrances). Agrochemicals and engineering plastics, for instance, exhibit the strongest growth rates in the long-range trend, whereas fertilizers will see the lowest growth over the period. The difference is even greater looking at the historic and anticipated development in the regions. Growth impulses originate mainly in China and also in Asia's emerging nations and the Middle East. Conversely, other regions such as North America and Europe exhibit comparatively low growth rates.

Europe's Shrinking Market Share

Europe's market for chemical products looks set to exhibit the weakest growth of any of the world markets in the coming years. Though the chemical industry has been able to make up for the substantial setbacks suffered in the crisis years of 2008-2009, growth has been stagnating ever since. This sluggish development has a number of underlying causes, including the weak demand from within Europe, the growing competitive intensity from Asian and American rivals, and the less favorable environment owing to the high cost of energy and raw materials. The European chemical industry's share in the global market has been in decline as a result. Having been up at around 35% in 2000, the share subsequently began to fall continuously, coming in at approximately 21% in 2012. The study forecasts a further reduction to just 13% by 2035.

The consequence of this development is that Europe's major economies, particularly Germany, are expected to export relatively smaller volumes of chemical products. This is confirmed by a recently presented study compiled by the German chemical industry association (VCI) on the receding competitiveness of the European and, in particular, the German chemical industry. The VCI study found that this loss of competitiveness in the international markets is primarily a result of the enormous discrepancies in energy and raw materials prices. These have a negative influence on a large part of the value chain, from petrochemicals to downstream processes such as polymer chemistry or paints and coatings. But factors like the relative strength of the euro and the reduced spending on research and development are also having a negative effect on the European chemical industry's ability to compete. However, the decline can still be halted provided the right conditions are put in place.

Threats From Many Sides

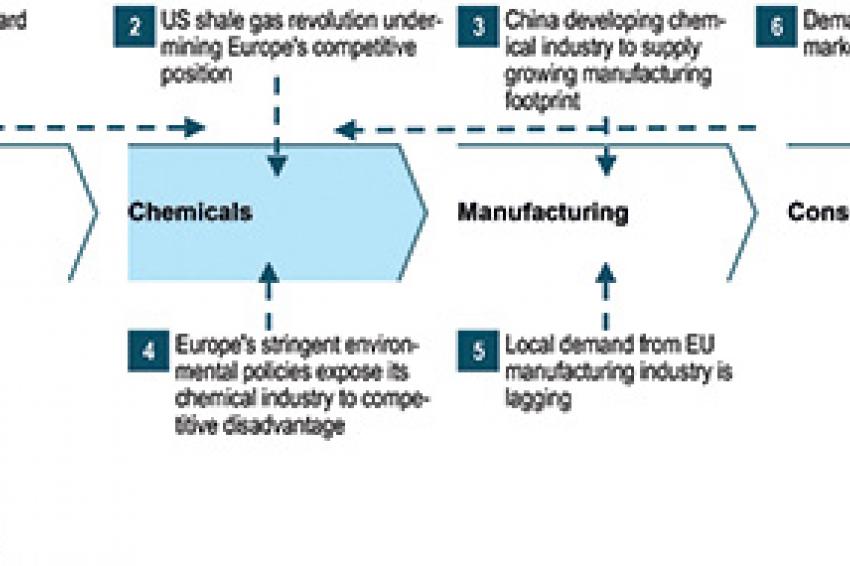

The European chemical industry needs to face six principal strategic threats (see fig.). One of them is the growing competition emerging from the Middle East as a result of companies there forward-integrating in a bid to make even more commercially efficient use of their fossil resources. A second factor is the shale gas revolution in the US, which is undermining Europe's competitive position through significantly lower raw materials and energy prices. China is expanding its chemical industry in parallel in order to meet the strong domestic demand for chemical products by local manufacturers with local plants. At the same time, stricter environmental standards and tougher restrictions within Europe (e.g., REACh, or Registration, Evaluation, Authorization and Restriction of Chemicals) are making life increasingly difficult for producers. A fifth aspect is the fact that local demand from the European manufacturing sector is in a low phase owing especially to the structural transformation from manufacturing industry to service sector. The final strategic threat is the accelerating pace of change and the shift in demand in the various end-use markets given that consumer demands and habits are changing with increasing speed these days.

Conclusion

For many decades, the European and especially the German chemical industry has managed to assert a leading role globally on the basis of superior expertise and a pronounced focus on quality and innovation. It is evident, however, that the European chemical industry is under ever-increasing pressure, and the pressure looks set to intensify. The only way for the industry to respond is to get itself even better positioned to stay competitive.

The companies are too diverse and the circumstances too complex for one all-encompassing recommendation to be made on how to survive in the global market long term. However, there are commonalities; many EU-based chemical companies have been and are currently addressing pressures in their businesses with a very similar "portfolio play" - shifting activities further into the life sciences sector. There are a lot of good arguments to do this, but it nevertheless has to be carefully investigated - if this equally makes sense to all market participants and what the effect of this development may be, e.g., for the evaluations of targets and recoverability of the respective investments.

In addition, many individually tailored single measures can help companies permanently raise their level of competitiveness. Examples would be further increasing efficiency in production, entering into a long-term cooperation to secure and source raw materials, and engaging in continuous R&D work to find answers to the big challenges of the future with innovative products and processes. After all, one thing is certain: the earlier these aspects are addressed, the more effective and efficient the efforts will be.