Renewable Hydrogen

A Growth Opportunity for the European Chemical Industry

For a successful European chemical industry, growth, competitiveness and climate neutrality are and will remain key areas of focus. While growth and competitiveness are well-established challenges for the industry, the path to climate neutrality for European chemical firms must align with the substantial European Union (EU) targets for reduced CO2 emissions.

Indeed, according to European Economic Area (EEA) data, the EU recently increased its emissions-reduction target from 40% to 55% by 2030 compared to 1990 levels, and other countries are adopting similar targets. Projections indicate that, under the existing measures, there will be an excess of 960 million tons (Mt) of CO2 emitted per year by 2030 in the EU, compared to the amount produced if the new target is achieved. Looking at the current sources, 55% of CO2 emissions originate from fuel and combustion for power and heat, 27% from transportation, 6% each from the metals and minerals industry, but just 4% comes from the chemical industry. Of that 4%, 2.2% originates from steam and heat production and 0.8% from ammonia production.

Hydrogen — a Solution Molecule

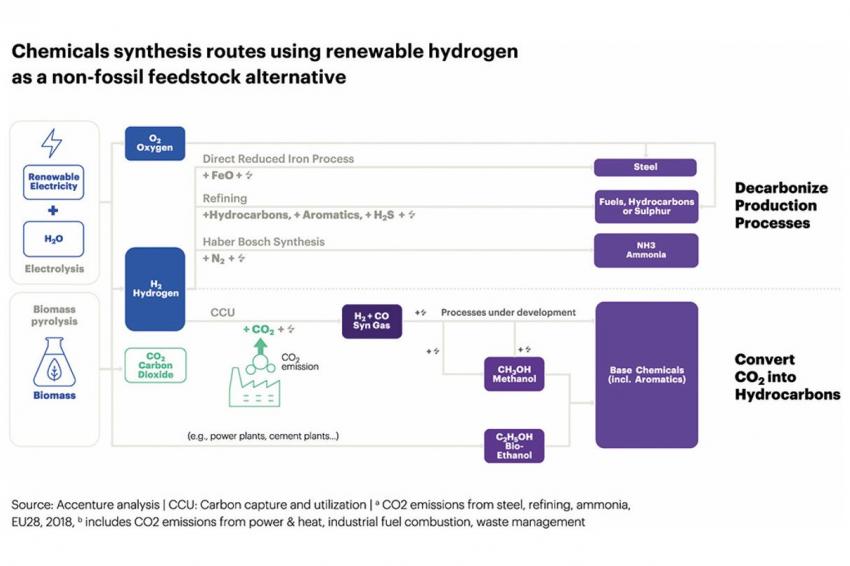

Electrification is part of the solution. However, an additional “solution molecule” is required to bolster energy storage capabilities, mitigate the volatility of wind and solar energy and, most crucially, convert CO2 back into hydrocarbons. Hydrogen’s unique properties suggest it could be the solution. Hydrogen can also be used to decarbonize production processes for iron — direct reduction of iron — or ammonia and can replace fossil fuel combustion.

Currently in Europe, a substantial amount of hydrogen production is in place. In 2018, pure hydrogen production capacity was 9.9 Mt of hydrogen per year, with 7.5 Mt from on-site captive production at about 140 plants — mainly refineries and sites for ammonia, methanol and hydrogen peroxide production. However, more than 90% of hydrogen plants use fossil fuels as feedstock.

That means at least 7.5 Mt of hydrogen production would need to be decarbonized. This would require a shift to renewable energy, or the application of carbon capture and storage (CCS) or carbon capture and utilization (CCU) technologies. However, the far greater decarbonization opportunity involves replacing the combustion of fossil fuels, and in the conversion of CO2 into syngas, which could then be used to synthesize methanol, aromatic compounds or other base chemicals such as ethylene, propylene or benzene (see fig. 1).

Cost Drivers of Renewable Hydrogen

Two drivers stand out when looking at the cost of renewable hydrogen: the cost of electricity and conversion losses in the overall system.

Our cost models show that energy accounts for 75% to 80% of the cost of renewable, electrolysis-based hydrogen, which reinforces that the key to renewable hydrogen’s future is ultimately the development of cheaper and more abundant renewable energy sources.

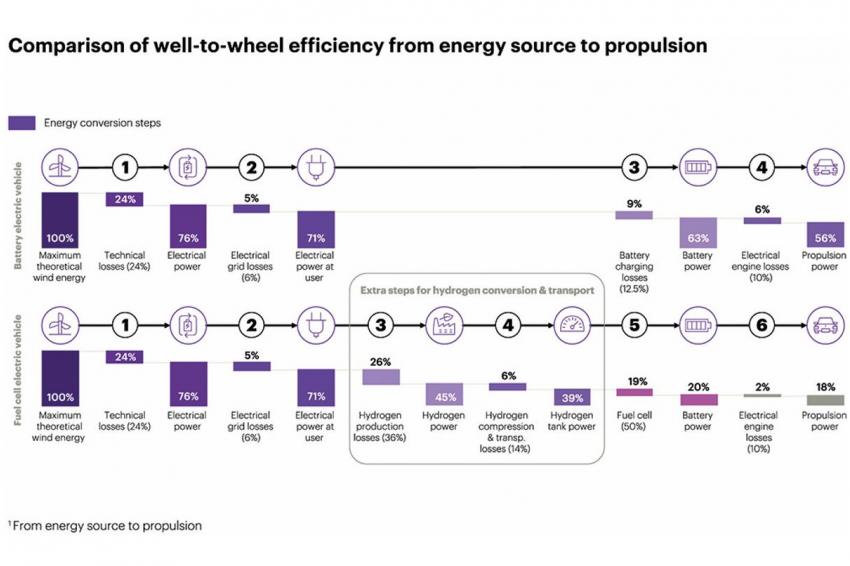

While energy cost and the use of electrolysis can often be a source of intense debate in the chemical industry, there are additional areas for improvement in the overall system too (see fig. 2).

„Chemical companies can build on their unique strengths

to help make renewable hydrogen competitive

and play an important role in Europe’s decarbonization progress.”

There is significant potential for end-to-end optimization, especially in the reduction of conversion losses, which occur during the generation of renewable hydrogen from water using climate-neutral electricity, followed by the compression, storage, transportation and eventual conversion of hydrogen back into electricity. Considering additional conversions that might be needed — for example, the conversion of hydrogen to ammonia and back for easier transportation — the need for efficiency becomes even more pressing.

Some of these conversion losses are already being addressed by installing clusters of hydrogen production and decarbonization or “hydrogen valleys” around industrial parks to minimize grid and distribution losses, integrating energy and material flows in Verbund-like structures. Hydrogen production can also be optimized through better membranes, electrodes and process stabilization.

As it stands, the EU’s hydrogen strategy calls for an additional 80 GW of renewable hydrogen generation capacity, and the production of 10 million tons of hydrogen by 2030 — backed by €25 billion to €30 billion in stimulus funding. However questions remain over how to provide internationally competitive energy in the EU, how to deal with imports and exports including online marketplaces, and how to safeguard competition in hydrogen production, transport and distribution.

Business Models for Chemical Companies

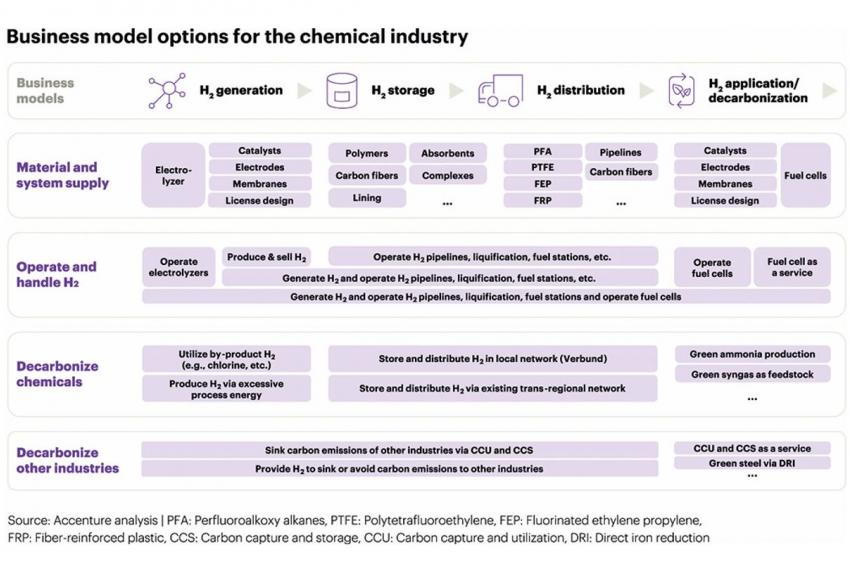

Ultimately, however, this chemical represents a huge opportunity. When it comes to decarbonization, hydrogen is clearly a potential solution molecule, with clear political will, production targets and public funding committed to build a market for it. For chemical companies there are several possible business models they could adopt to capitalize on this opportunity:

Supplying materials and system components, including electrolyzers, membranes or electrodes for electrolyzers, and linings for hydrogen pipes.

Operating hydrogen-production assets, and marketing, selling and/or distributing hydrogen.

Decarbonizing chemical processes — by utilizing hydrogen by-products in chlorine production or by shifting to green ammonia, for example.

Decarbonizing other industries — this could involve supplying hydrogen and process technology to sink CO2 emissions or for the direct reduction of iron.

Considering the volume of emissions produced by other industries, the latter model is by far the most lucrative, yet, to establish new and competitive chemical and physical processes for customer industries, innovative approaches will need to be taken.

Engagement in the Hydrogen Market is Key

To take advantage of the opportunity hydrogen presents, chemical firms must engage in the emerging hydrogen market now, setting up specific pilots — whether that’s in electrolysis or decarbonized processes —, develop an appropriate partner and ecosystem network and, most crucially, adapt the R&D portfolios and investment plans needed to capture a share of the hydrogen opportunity. If they embark on this journey today, chemical companies can build on their unique strengths to help make renewable hydrogen competitive and play an important role in Europe’s decarbonization progress.

References can be requested from the author.

Author: Bernd Elser, Managing Director, Global Industry Sector Lead Chemicals, Accenture, Frankfurt/Main, Germany